This post was originally published on this site

Friday could be a historic day for the U.S. options market, according to a derivatives strategist at Goldman Sachs Group.

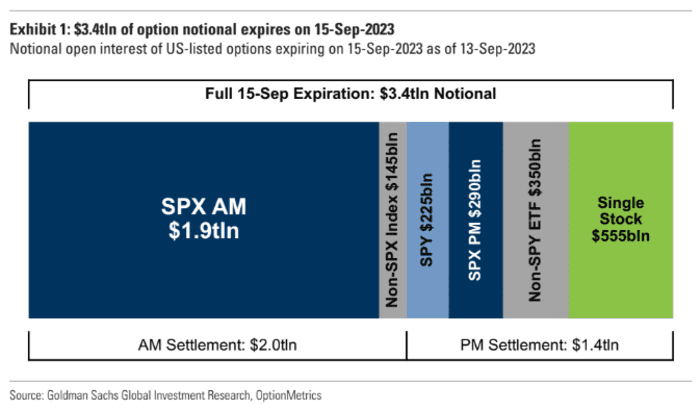

As trading in U.S. stock options, especially extremely short-dated zero day to expiration options, continues to boom, contracts attached to $3.4 trillion worth of U.S. stocks, exchange-traded funds and equity indexes like the S&P 500 are set to expire Friday during September’s expiry for monthly and quarterly options, according to the latest figures from John Marshall, head of derivatives research at the investment bank that were accurate as of midweek.

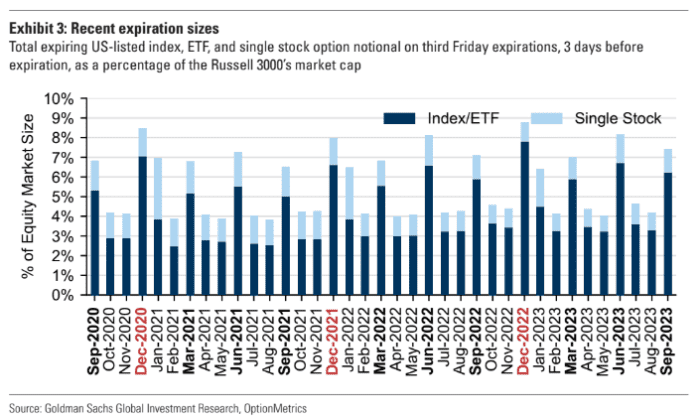

That is on track to be the largest September expiry on record, raising the possibility that markets could finish the week on a volatile note.

In a breakdown of notional value due to expire, Goldman showed that nearly $2 trillion of S&P 500 index options are due to expire Friday morning, while single-stock options with a notional value of $555 billion will expire later in the day, along with a host of other contracts.

In options-market parlance, notional value refers to the value of the underlying securities or indexes controlled by the option. Typically, index options are settled in cash, while options on single stocks and ETFs are settled in shares.

GOLDMAN SACHS

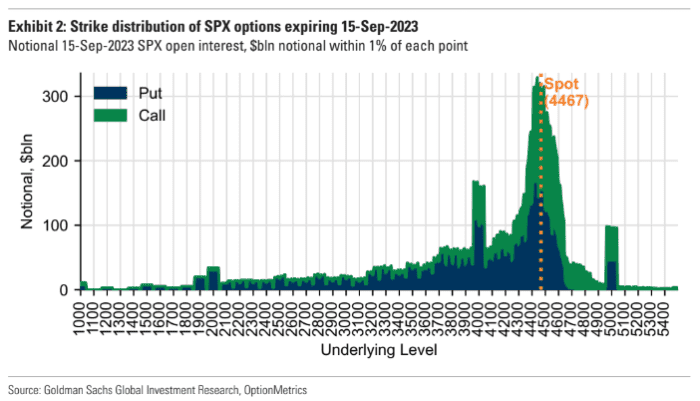

Since U.S. stocks have seesawed over the past couple of weeks, a large share of options expiring on Friday are very close to being in the money, which could further exacerbate market volatility, Marshall said. It is considered conventional wisdom on Wall Street that quarterly options expiry days often coincide with choppy markets.

“Given the rangebound nature of the equity market over the past several weeks, a

high proportion of the open interest is in options with strike prices that are near the

current spot level,” he said.

GOLDMAN SACHS

Friday’s expiration is set to be the sixth-largest monthly expiration on record, in addition to being the largest September.

GOLDMAN SACHS

Such high open interest is surprising, Marshall said, given that stock-market volatility remains relatively subdued. Meanwhile, trading volume in short-dated options with less than 24 hours until expiration has increased, Marshall noted, and now comprises 49% of activity in S&P 500 index options.

Growth in trading of index and ETF-linked options has helped drive the surge in open interest ahead of September’s marquee event, Marshall added.

Another derivatives analyst, Nomura’s Charlie McElligott, warned clients to brace for potential volatility, since 10 of the past 11 September op-ex days saw the S&P 500 finish lower, with a median return of -0.5%. Historical data also show that the week after September op-ex is typically rocky for stocks. September is, on average, the worst month of the year for the S&P 500’s performance.

McElligott also noted that an unusually large amount of exposure on options dealers books is set to evaporate on Friday, potentially leading to more volatility as traders open new positions to replace options set to expire. Large quarterly option expiration events often correspond with near-term market weakness, according to Nomura’s analysis.