This post was originally published on this site

Neuberger Berman, an asset manager with eight decades under its belt, is on the lookout for cracks in credit markets from the Federal Reserve’s rate-hiking campaign.

Erik Knutzen, chief investment officer of multi asset, worries that several factors could be a tipping point for the economy, from an economic slowdown in China to U.S. consumers finally becoming exhausted by higher rates.

Yet Knutzen expects the high-yield, or junk bond, market to serve as the “canary in the coal mine” for broader market volatility, acting as “perhaps the most visible threat, and therefore one we think could be priced in sooner than later.”

The Bloomberg U.S. High Yield Bond Index has returned 6.4% through the end of August, producing one of the year’s highest gains in fixed income, helped along by a “resilient U.S. economy coupled with still-available financial liquidity,” according to the Wells Fargo Investment Institute.

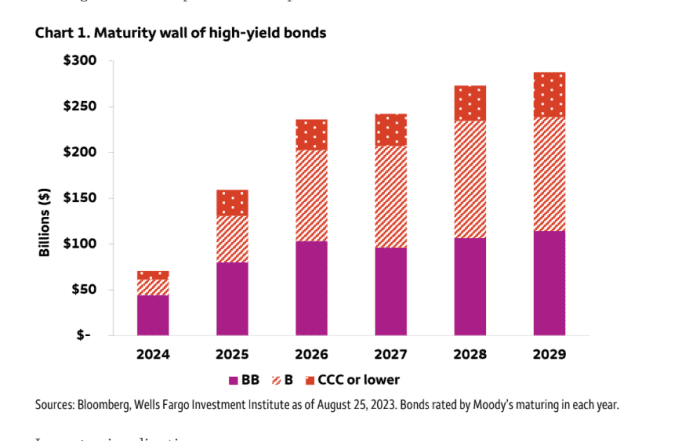

But Knutzen worries that as the high-yield maturity wall draws closer, “the first policy rate cuts get priced further and further out, raising the threat of expensive refinancings.”

The 10-year Treasury yield’s

BX: TMUBMUSD10Y

climb to a multidecade high in August of almost 4.4% left many major U.S. corporations in early September hesitant to borrow beyond 10 years.

Starting next year, some $700 billion of high-yield bonds are set to mature through the end of 2027, with a big slice of the refinancing need coming from companies with riskier credit ratings below the top BB ratings bracket.

The junk-bond maturity wall.

Bloomberg, Wells Fargo Investment Institute, Moody’s Investors Service

The two big U.S. exchange-traded funds linked to junk bonds are the SPDR Bloomberg High Yield Bond ETF

JNK

and the iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

both up 1.8% and 1.5% on the year through Monday, respectively, while offering dividend yields of more than 5.8%, according to FactSet.

Of note, fixed-income strategists at the Wells Fargo Investment Institute also said they see risks emerging in junk bonds for companies rated B and below, particularly with spread in the sector trading less than 400 basis points above the risk-free Treasury rate since July. Spreads are the premium that investors are paid on bonds to help compensate for default risks.

Top corporate executives appear hopeful that the Federal Reserve will cut rates sooner than later. Fed Chairman Jerome Powell said in Jackson Hole, Wyo., in August that the central bank is prepared to keep its policy rate restrictive for a while to get inflation down to its 2% target.

To that end, Neuberger Berman, which has roughly $443 billion in managed assets, sees several sources of volatility lurking through year’s end, and has a “defensive inclination” in equity and credit, favoring high-quality companies with plenty of free cash flow, high cash balances and less expensive long-term debt.

U.S. stocks booked gains on Monday after a week of losses, with the S&P 500 index

SPX

and Nasdaq Composite Index

COMP

scoring their best daily percentage gains in about two weeks. The Dow Jones Industrial Average

DJIA

advanced 0.3%.