This post was originally published on this site

The U.S. dollar isn’t about to lose its global leadership position despite challenges such as China’s increasing importance to the world economy, according to Wells Fargo Investment Institute.

“We do not foresee a meaningful risk of the greenback losing its status as the world’s primary reserve currency,” strategists at Wells Fargo Investment Institute said in a Sept. 7 note. “In our view, the U.S. dollar’s deep-seated advantages — including the rule of law, transparency, and a highly liquid financial market — make a global shift away from the U.S. dollar extremely difficult.”

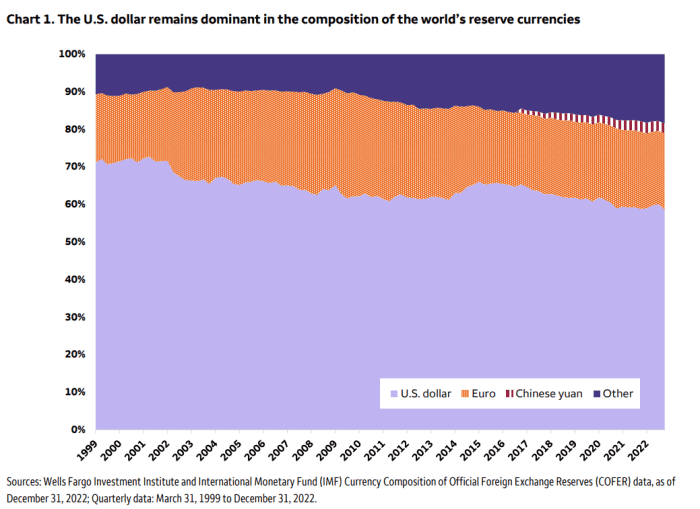

While “de-dollarization” is sometimes talked about as a theme, the greenback has for decades endured threats to its status as the main currency for international trade and investment, according to the note. The U.S. dollar dominates, with the Chinese yuan

USDCNH,

USDCNY,

representing a “consistently small share of global currency reserves” despite it being “most often cited as the primary threat” and China’s rank as the world’s second biggest economy, the analysts said.

WELLS FARGO INVESTMENT INSTITUTE NOTE DATED SEPT. 7, 2023

“The euro is currently the only serious contender for the U.S. dollar’s role,” the Wells Fargo strategists said, “as it possesses a deep, regional financial market and many of the other prerequisites for an international currency.”

The U.S. dollar is integral to “global financial plumbing,” with the greenback involving 90% of the more than $7.5 trillion in foreign exchange trades each day, according to the note, which cites data from the Bank for International Settlements.

Read: A rising U.S. dollar is ringing alarm bells overseas. Should stock-market investors worry?

“Only the U.S. dollar checks all the boxes for the key global currency, dating back to the 1960s, and, in our view, extending well into the future,” the analysts said.

They pointed to the “depth and liquidity” of financial markets in the U.S., the dollar’s visibility in financial transactions globally, its backing by “a single, identifiable national authority,” its role as a perceived “haven asset” in crisis times, and “greater flexibility in managing credit to accommodate non-inflationary — and deflationary — demands of global trade and investment.”

Meanwhile, the U.S. dollar’s latest challenges include “China’s growing importance to the global economy, now top-ranked in foreign trade and moving aggressively to shore up support for the yuan’s international role,” according to the Wells Fargo note.

Geopolitical tensions are speeding up efforts “to diversify out of the U.S. currency by China and other targets of U.S. economic sanctions,” said the strategists. “One outgrowth of that response has been a recent agreement among Saudi Arabia, China, and Russia to price some oil transactions in Chinese yuan.”

Yet the U.S. dollar remains “indispensable for running the world’s financial plumbing” even if other currencies have become more useful compared with decades ago, according to the note.

The analysts said that advances in technology supporting the rise of cryptocurrencies and central bank digital currencies have “erroneously” prompted talk of “a new front against the U.S. dollar’s international status.”

Wells Fargo Investment Institute favors allocating most of a portfolio’s long-term capital to stocks and fixed income denominated in U.S. dollars, as well as some diversification in international financial markets and exposure to commodities, according to the report.

“For portfolios allocated in these ways, we prefer to avoid adjustments triggered by speculation that the U.S. dollar may be in danger of losing its premier reserve currency status at the hands of some new challenger that lacks the qualifications and the staying power,” the strategists said.

Read: China’s onshore yuan weakens to 16-year low versus dollar as sentiment darkens

Also see: China ETFs fall sharply as they lag global stocks in 2023

The ICE U.S. Dollar Index

DXY,

a measure of the greenback against a basket of six major currencies, was little changed on Friday but is up around 1.4% so far this year, according to FactSet data, at last check.

“Threats to the U.S. dollar’s key-currency status are decades old and have included the 1971 collapse of the gold-exchange standard and the advent of floating exchange rates, fears of global banking collapse in 2008, and worries about U.S. policy miscues,” the Wells Fargo strategists said. “None has removed the dollar from its leadership position.”