This post was originally published on this site

It doesn’t take long when travelling in Ireland to appreciate the virtues of contrarian analysis. That’s because it’s hard to find traces of the economy that was nearly given up for dead during the 2008 Global Financial Crisis (GFC). Fifteen years later there are lines outside most stores, and not just in areas frequented by tourists. Restaurants require reservations and pubs are packed.

How times change. Ireland’s economy was in such bad shape 15 years ago, saddled with seemingly insurmountable levels of sovereign debt, that the country was added to that group of four southern European countries whose economies were already basket cases — Portugal, Italy, Greece and Spain.

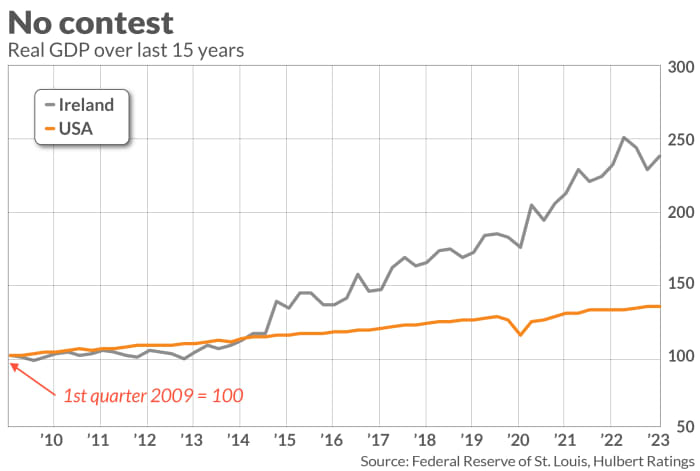

There’s more than just anecdotal evidence of Ireland’s turnaround. Unemployment is the lowest it’s been since the early 2000s. Since the first quarter of 2009, the country’s real GDP has grown at an annualized pace of 6.3%. In comparison, U.S. GDP growth has been anemic, as you can see from the accompanying chart.

Ireland’s stunning growth in recent years came in the wake of many bad years leading up to and including the GFC. But that’s precisely the point that contrarians make: Bad times don’t last forever, just as trees don’t grow to the sky.

This reversion-to-the-mean story implies that Ireland’s economy won’t grow as fast in coming years as it has since 2009. The average (mean) inflation-adjusted growth rate for Eurozone economies over the past three decades has been 1.5% annualized. Reversion to the mean suggests that the yearly growth rate of Ireland’s economy over the next 15 years will be closer to that rate than 6.4% annualized.

That doesn’t mean Ireland’s economy will grow more slowly in coming years than the U.S. economy. U.S. GDP growth since the GFC has been slightly below its long-term average, but not by enough for a reversion-to-the-mean prediction of a much higher growth rate in coming years. Contrarians are therefore inclined to predict that both economies will grow at similar inflation-adjusted growth rates over the next decade or so.

Factors in the Irish market’s favor

Two other reversion-to-the-mean factors will work in the Irish stock market’s favor in coming years, both in its own right and relative to the U.S. market. One is the Ireland market’s P/E ratio, which has remained stubbornly low since the GFC, in contrast to the S&P 500

SPX.

This is one reason why the S&P 500 has outperformed the Irish stock market since 2009, despite the U.S. having a much slower economic growth rate.

Consider that both country’s P/Es were non-existent at the end of the GFC, with trailing 12-month EPS negative in both cases. Today, the MSCI All Ireland Capped Index sports a P/E of 12.6, barely half the 23.6 P/E of the S&P 500. If the U.S. stock market were trading with the same P/E ratio today as Ireland’s, the S&P 500 would currently be below 2,400.

The U.S. market’s long-term average trailing 12-month earnings P/E ratio, based on data for the U.S. stock market back to 1871, is 16.0. On the assumption that Ireland’s P/E ratio in coming years will be closer to that mean than its current 12.6, it’s a good bet that the country’s equities will produce impressive performance even if its economic growth slows from its blistering pace since the GFC. Just the opposite is implied for the U.S. market.

Another reversion-to-the-mean factor in Ireland’s favor in coming years, at least to a U.S.-dollar-based investor, is a weaker dollar

DX00,

The opposite has been true over the past 15 years, as the euro

EURUSD,

has lost 20% of its value against the dollar, creating significant headwinds for a U.S. investor in Irish equities. Reversion to the mean suggests that the euro’s value will not continue to decline at anything close to its rate over the past 15 years, staying even with the dollar or possibly rising. If so, those headwinds may turn into tailwinds.

The bottom line? In order for U.S. equities to outperform Irish equities in U.S. dollar terms, not only will the dollar have to continue to strengthen against the euro, but the gap between the two countries’ P/E ratios will have to widen even further. Contrarians are inclined in both cases to believe the trend will be in the opposite direction.

If you are persuaded by these arguments, perhaps the easiest way to invest in the Irish equity market is via an ETF. The U.S.-based Irish stock market ETF with the most assets under management is the iShares MSCI Ireland ETF

EIRL,

with an expense ratio of 0.50%.

If you’re interested in individual stocks, the table below lists Irish-headquartered companies whose stocks are currently recommended for purchase by at least one of the investment newsletters whose performances my auditing firms tracks.

| Stock | # newsletters recommending |

| Medtronic PLC (MDT) | 3 |

| Seagate Technology Holdings PLC (STX) | 2 |

| AerCap Holdings NV (AER) | 1 |

| Cimpress PLC (CMPR) | 1 |

| Eaton Corp PLC (ETN) | 1 |

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: A rising U.S. dollar is ringing alarm bells overseas. Should stock-market investors worry?

Also read: China ETFs fall sharply as they lag global stocks in 2023