This post was originally published on this site

The soaring S&P 500 index will probably fail to reach a record peak by the end of the year, according to Stifel’s chief equity strategist Barry Bannister.

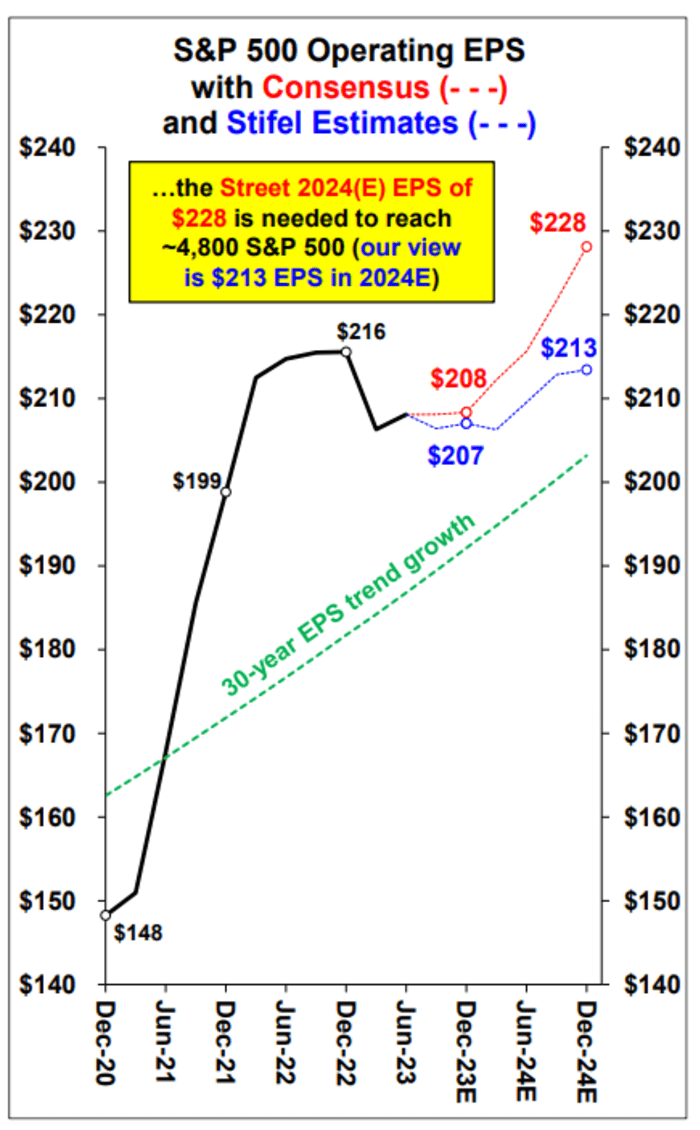

“A new high by year-end 2023 is exceptionally unlikely,” Bannister said in a note Tuesday. While equity strategists that he considers “uber-bulls” anticipate the index could hit a record price of around 4,800 by then, Bannister said that level is “still out of reach.”

The U.S. stock market has jumped this year in a so far resilient economy, even as the Federal Reserve continued lifting interest rates, albeit at a slower pace, to fight still elevated inflation. But the S&P 500 would require “very favorable” earnings per share and financial conditions, which are unlikely, to climb back to its prior all-time high, according to Bannister.

The S&P 500 has already soared 17.1% this year through Tuesday, leaving it just 6.2% off its record close of 4,796.56 in early January 2022, according to Dow Jones Market Data.

Major U.S. stock benchmarks closed lower Tuesday, as investors resumed trading after returning from the three-day weekend celebrating Labor Day. The S&P 500

SPX

fell 0.4% to end at 4,496.83, while the Dow Jones Industrial Average

DJIA

dropped 0.6% and the technology-heavy Nasdaq Composite

COMP

shed 0.1%, FactSet data show.

Bannister is expecting the S&P 500 to end the year at 4,400. That compares with a median year-end target of 4,350, he said, citing a Bloomberg survey of U.S. sell-side equity strategists.

To reach 4,800, the S&P 500 needs a financial conditions index “near generational lows,” he said. “We doubt the Fed wants that.”

The Fed has been tightening monetary policy since early 2022, in a bid to bring down inflation that remains above its 2% target.

“The other issue is EPS, and the Street looks high to us,” Bannister said of Wall Street’s expectations for the S&P 500’s earnings per share.

STIFEL NOTE DATED SEPT. 5 2023

The “slowdown” in cyclical economic data in 2023, seen with a lag after the Fed’s rate hikes, “should restrain 2024 EPS growth for technology,” according to Bannister. “Hyperpositive late-2023 views are unlikely to come to pass, regardless of whether ‘New Era’ AI bot thinking disagrees with us,” he wrote.

This year’s artificial-intelligence craze has helped fuel the S&P 500’s rally, while some investors anticipate a potential soft landing for the economy after the Fed slowed its rate hikes in 2023 against the backdrop of easing inflation.

Meanwhile, the S&P 500’s equity risk premium is now 3%, a level Bannister described as neither low nor high “but perhaps a sign of a return to normality in a fully priced market.”

“The first half S&P 500 relief rally is over,” said Bannister. The “second half will just be flat.”