This post was originally published on this site

U.S. investors are pricing in too much optimism in the stock market as this year’s rally feeds into their views on the economic growth, which is set to be weaker than expected, according to Michael Wilson, Morgan Stanley’s chief investment officer.

“At current prices, markets are now expecting a meaningful re-acceleration in growth that we think is unlikely this year, especially for the consumer, which aligns with our economists’ forecast for slowing PCE growth,” said Wilson in a Tuesday research note.

Wilson and his team said while it is typical for investors to “swing back and forth” between soft and hard landing outcomes when the Federal Reserve is nearing the end of its interest-rate hiking cycle, there is some skepticism about a soft landing, meaning the economy can avoid a recession, while this scenario is becoming a widely assumed outcome for the economy.

The Personal Consumption Expenditures (PCE) index slowed considerably in the second quarter of 2023 and appears to be getting weaker based on recent commentary from numerous retailers and the recent rise in delinquencies, said Wilson. Morgan Stanley economists are now forecasting real PCE growth to fall into negative territory in the fourth quarter with nominal PCE growing just 1.3%.

The inflation measure that’s watched closely by the central bank edged higher in July but grew at a monthly rate that’s in line with the forecast by a Wall Street Journal poll of economists. The cost of goods and services rose a mild 0.2% in July, the government said Thursday. Year over year, the measure showed inflation rose 3.3%, compared with 3% in June.

“Potentially softer September and October data is not priced into many stocks and expectations, in our view,” Wilson said.

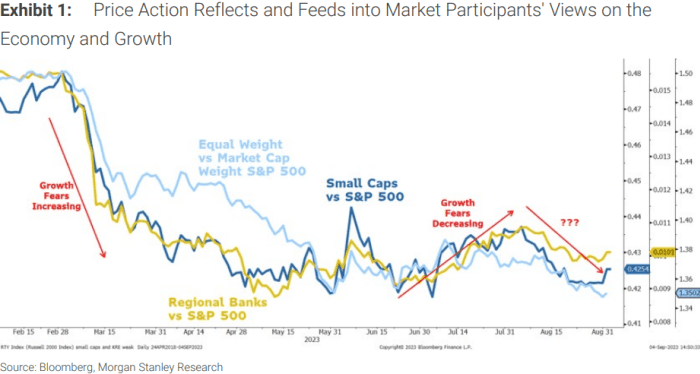

Meanwhile, investors’ sentiment can be influenced by stock prices more than usual as excitement around artificial intelligence (AI) also played a role which morphed from “a very narrow list of beneficiaries” to the broader U.S. stock market in June and early July, giving way to a rally in small caps and other economically sensitive parts of the market such as financials, materials and industrials sectors.

However, those rallies were stymied right at their early February highs and then rolled over sharply with both small caps and cyclicals underperforming (see chart below), Wilson and his team noted.

SOURCE: BLOOMBERG, MORGAN STANLEY

The Russell 2000

RUT

has risen 7% year to date, while the S&P 500 financials sector

XX:SP500.40

was nearly flat and the industrials sector

XX:SP500.20

has gained 8.5% so far this year. These compare with a 34% year-to-date advance for the Nasdaq Composite

COMP

and a 17.1% gain for the S&P 500

SPX,

according to FactSet data.

“These failed rallies may now produce some doubt in the minds of market participants looking for a broadening out of the stock rally, and consequently, a soft landing or the growth re-acceleration that is now priced into many areas of the market,” Wilson said.

See: S&P 500 ‘exceptionally’ unlikely to climb this year to record peak, says Stifel’s Barry Bannister

“The rally in some of the major averages over the last few weeks may have investors feeling a bit better again but given the underlying weakness in breadth and in some of the more cyclical parts of the market, we think that optimism should be faded,” said Wilson and his team.

U.S. stocks ended lower on Tuesday after posting strong weekly gains on Friday. The S&P 500 lost 0.4%, while the Dow Jones Industrial Average

DJIA

was down 0.6% and the Nasdaq Composite finished 0.1% lower.