This post was originally published on this site

The Federal Reserve’s inflation fight has been particularly brutal for anyone not already a U.S. homeowner before interest rates and mortgage rates rose to 15-year highs.

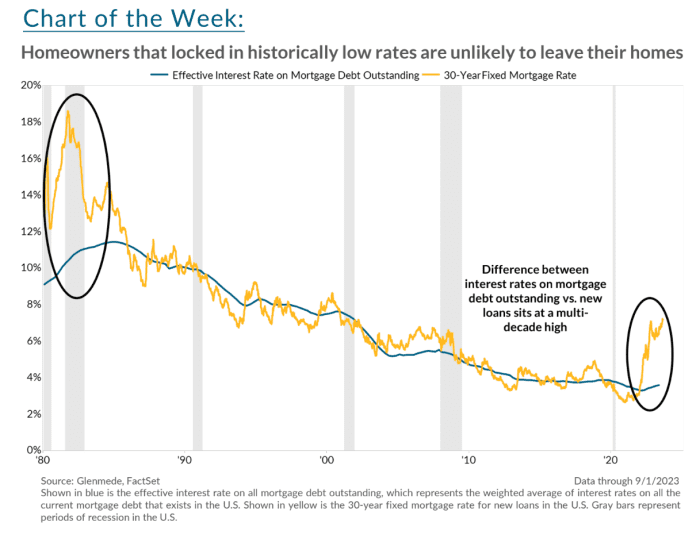

With mortgage rates around 7.2% to kick off the post–Labor Day period, the difference between the rates on a new 30-year home loan and on all outstanding U.S. mortgage debt (see chart) has not been so wide since the 1980s.

It’s the 1980s again in the U.S. housing market.

Glenmede, FactSet

“Generally, climbing interest rates curb demand and cause housing prices to fall,” Glenmede’s investment strategy team wrote, in a Tuesday client note, but not this time.

Instead, U.S. homes remain in critically low supply after more than a decade of underbuilding, and with most homeowners who already refinanced at low pre-pandemic rates being “reluctant to leave their homes,” wrote Jason Pride, chief of investment strategy and research, and his Glenmede team.

Also, while homes prices have come off their prepandemic highs, they still were fetching $416,000 in the second quarter, based on median sales prices, above $358,700 in the fourth quarter of 2020, according to U.S. Census and HUD data.

“Until the supply gap is filled by new construction, home prices and building activity are unlikely to decline as meaningfully as they normally would given the headwind from rising rates,” the Glenmede team said.

Read: Housing affordability is now at its worst level since 1984, Black Knight says

The Glenmede team, however, does expect more pressure on consumers in the coming months, particularly as student-loan payments resume in October and if the Fed keeps interest rates high for a while, as increasingly expected. The benchmark 10-year Treasury yield

BX:TMUBMUSD10Y,

which underpins the U.S. economy, was back on the climb at 4.26% Tuesday.

Meanwhile, shares of home-vacation rental platform Airbnb Inc.

ABNB,

rose 7.2% on Tuesday, after the Labor Day weekend, and 66.4% higher on the year so far, according to FactSet.

Don’t miss: New York City cracks down on Airbnb and other short-term-rental listings

Shares of Invitation Homes Inc.

INVH,

which grew out of the last decade’s home-loan foreclosure crisis to become a single-family-rental giant, were up 14.3% on the year, according to FactSet.

Dallas Tanner, CEO of Invitation Homes, said he expected “the rising costs and the burden of homeownership” to continue to benefit his company, in a July earnings call. The company recently bought a portfolio of about 1,900 homes and has been snapping up newly constructed homes. Companies can borrow on Wall Street at much lower rates than individuals.

Stocks closed lower Tuesday, with the Dow Jones Industrial Average

DJIA

off 0.5%, and the S&P 500 index

SPX

0.4% lower and the Nasdaq Composite Index

COMP

down 0.1%, according to FactSet.