This post was originally published on this site

With about a month left before borrowers start receiving their first student-loan bill in years, roughly 4 million are enrolled in a new repayment plan the Biden administration has touted as a “game changer.”

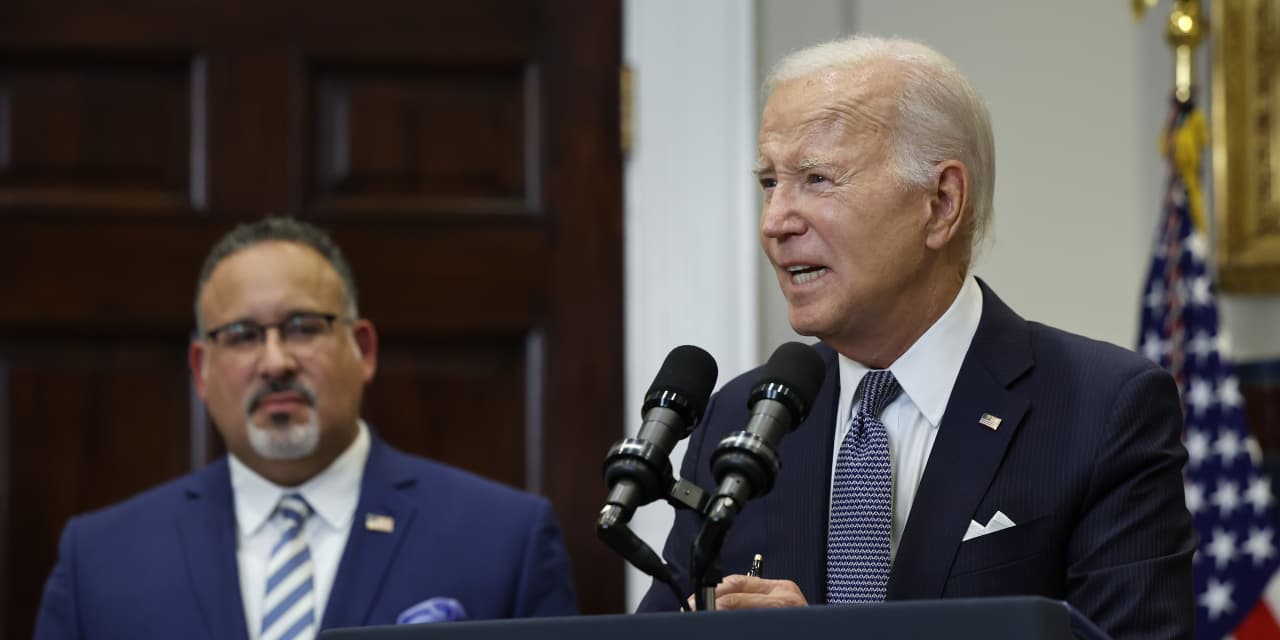

Officials’ announcement Tuesday provided the first look at data surrounding the SAVE plan, which the Biden administration officially launched last month. It comes as student loan- borrower advocates are watching the return to student-loan payments for the first time in three years this fall closely for signs of financial and logistical stress from borrowers. At the same time that advocates worry borrowers may struggle to access affordable student-loan payments, congressional Republicans have vowed to introduce legislation that would get rid of the SAVE plan.

SAVE is the latest version of income-driven repayment, a type of student loan payment plan that allows borrowers to repay the debt as a percentage of their income and have the remainder canceled after at least 20 years of payments in most cases. Borrowers typically use one of these plans if they can’t afford the monthly payment required to pay off their debt in 10 years.

Under the SAVE plan, borrowers have more income protected before payments kick in, and in some cases can devote a smaller share of their income towards the payments each month and stay current on their loans, among other benefits. Some of the benefits of the plan kick in when borrowers in October when student-loan payments resume. Others don’t take effect until July 2024.

“We know that student-loan bills are challenging for a lot of families and we want to do everything we can to make sure that borrowers take advantage of the benefits of a federal student loan,” James Kvaal, the deputy undersecretary of education, said on a conference call with reporters.

How are you preparing for the return of student-loan payments? We want to hear from you. Email: jberman@marketwatch.com.

Officials launched SAVE after years of complaints surrounding income-driven repayment. The new plan addresses some concerns from advocates and borrowers. For example, under SAVE borrowers whose income-tied payments are too low to cover the interest on their debt will have the remaining interest paid for by the government. That means they won’t see their balances grow, even as they make payments, a perennial problem under previous versions of income-driven repayment.

Borrowers had also complained that even income-tied payments weren’t affordable under previous plans. Borrowers enrolled in SAVE won’t see payments kick in until they’re making at least 225% of the poverty line, up from 150% in previous plans. In addition, starting in July 2024, borrowers with only debt from undergraduate schooling will pay 5% of their monthly income, down from 10% in previous plans. Borrowers with debt from both graduate and undergraduate schooling will pay a weighted average of somewhere between 5% and 10%.

Finally, borrowers whose original principal was less than $12,000 will have their debt canceled after 10 years of payments. In other versions of income-driven repayment, borrowers have to pay for at least 20 years before their debt is forgiven.

Concerns about income-driven repayment remain

Despite the changes, some of borrowers’ and advocates’ concerns about income-driven repayment remain. For one, not all borrowers have access to SAVE. Borrowers with Parent PLUS loans, or the federal loans parents can use to pay for their children’s schooling, generally aren’t eligible for SAVE. That’s even though this debt has posed major challenges for many of these borrowers.

In addition, borrowers who are in default on their loans aren’t automatically eligible for SAVE. Under a program called Fresh Start, the Department of Education brought defaulted borrowers current on their student loans. Borrowers have a year from the resumption of student loan payments to take action to stay out of default and take advantage of programs like SAVE. But if they don’t, they’ll fall back into default once the grace period ends.

Kvaal said Tuesday that the Department of Education hasn’t released any data on how many borrowers receiving the benefits of Fresh Start have signed up for SAVE or another repayment program that would allow them to stay out of default once the grace period ends. Borrowers who default on their debt can face some of the worst consequences of the student-loan system, including having their wages and Social Security benefits garnished.

Advocates also remain concerned that borrowers could still face logistical challenges to enrolling in SAVE. For years, they’ve said that servicers — the contractors the government hires to manage the student-loan portfolio — haven’t provided borrowers with enough or the right information to ensure they’re getting access to the benefits of the federal student loan program.

The challenges borrowers face reaching their servicers may be particularly acute during this period. Servicers have cut staff and customer service hours and they’ll be facing unprecedented call volumes as borrowers seek advice in advance of their first bill.

‘Who is the message reaching?’

The more than 4 million borrowers enrolled in SAVE represent about 9% of federal student-loan borrowers overall. In addition, the bulk of those borrowers are people who were automatically moved over from an income-driven repayment plan, REPAYE, that is sunsetting with the launch of SAVE, Kvaal told reporters.

Roughly 3.3 million borrowers were enrolled in REPAYE, according to the most recent data from the Department of Education, indicating that about 700,000 of the 4 million borrowers enrolled in SAVE signed up and weren’t transferred automatically. The agency said nearly 1 million borrowers have applied for SAVE through its website since the soft launch of the SAVE plan on July 30.

“The thing that is important to know is the breakdown of who is getting enrolled,” said Persis Yu, deputy executive director and managing counsel at the Student Borrower Protection Center, an advocacy group. “Who is the message reaching?”

Yu said she’s particularly concerned about whether low-income borrowers, who could benefit the most from SAVE because they might qualify for a $0 monthly payment and have the interest that isn’t covered by the payment waived, are aware of the option.

Advocates have been long concerned that borrowers who can’t take time away from work or caregiving to fill out paperwork or call their servicer may struggle to access the benefits of the student-loan program.

“A lot of the problems that we’ve seen in the past are going to appear here,” Yu said. “My fear is that it’s going to be worse because the call centers are all understaffed and they have a lot more volume than they are going to need to contend with.”