This post was originally published on this site

A trade that blew up in the market’s face nearly six years ago, saddling investors with billions of dollars of losses, is making a comeback in 2023.

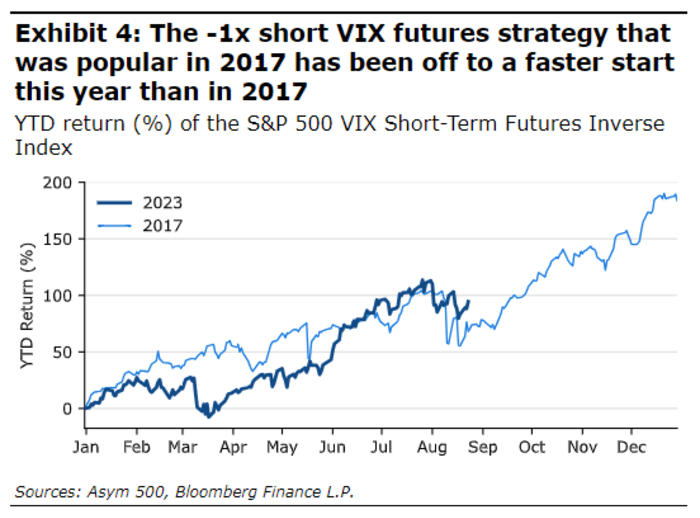

The so-called short volatility trade has become a moneymaker for systematic funds in 2023, according to data compiled by Rocky Fishman, founder of Asym 500, a research shop that provides research on the equity derivatives market.

Fishman estimated that one popular version of the strategy where traders bet against short-term futures tied to the Cboe Volatility Index

VIX,

better known as the Vix or Wall Street’s “fear gauge,” has returned nearly 100% since the start of the year, far surpassing the return on the S&P 500 index

SPX,

which has risen 17% year-to-date through Tuesday’s close, according to FactSet data.

ASYM 500

Relatively placid markets in 2023 have been a boon for traders betting that implied volatility as measured by the Vix will fall. The Vix uses S&P 500-linked options to gauge how volatile investors expect markets to be over the coming month.

Investment analysts who focus on the equity derivatives market said the trade is one way to generate returns in a sideways market. Traders can bet on the direction of the Vix using call or put options, or by buying or shorting futures contracts linked to the index.

Implied volatility as measured by the Vix tends to rise more quickly when the S&P 500 falls.

Another reason it has worked so well in 2023 is that the Vix has been trading below its long-term average for most of the year, with a few notable exceptions. Going back to the early 1990s when the volatility gauge was first launched, the Vix’s average level has been roughly 19.5, according to Joe Ferrara, an investment strategist at Gateway Investment Advisors.

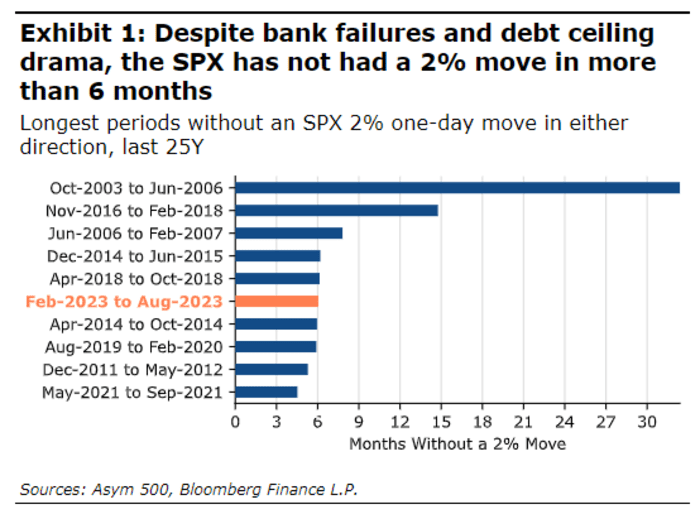

More than six months have passed since the S&P 500 has recorded a daily swing of 2% in either direction, one of the longest such stretches over the past 25 years. This has helped keep realized volatility subdued which feeds through to implied volatility by boosting investors’ confidence that markets will remain quiescent.

ASYM 500

While the Vix has trended lower for most of 2023, there have been a few occasions where it jerked higher, creating opportunities for investors to profit by betting that it would quickly revert lower. On March 13, the first trading session following the collapse of Silicon Valley Bank, the Vix rose as high as 30 intraday, according to FactSet data.

During May, the Vix twice broke above 20 as Congress struggled to strike a deal to raise the federal debt ceiling. On Aug. 18, it nearly hit 19 at the end of a three-week streak of losses for the S&P 500. During each instance, the Vix quickly erased its bump as markets recovered.

“Every time we go through a period where the market sees heightened risk ahead, but the market doesn’t move in a violent way, it improves the case for selling volatility.”

To be sure, the short volatility trade can be extremely risky for investors who use too much leverage, or neglect to hedge their positions.

Many investors learned this lesson the hard way on Feb. 5, 2018, a day that Wall Street traders nicknamed “Volmageddon.” On that day, the Vix more than doubled from roughly 20 to 40, according to FactSet data. U.S. stocks plunged, causing the Dow Jones Industrial Average

DJIA

to finish 1,175 points lower, its worst closing point decline on record at the time.

The selloff was triggered by rising Treasury yields and fears that the U.S. economy might be overheating. It was exacerbated by short-volatility exchange-traded funds that had become too crowded. Many blew up as they attempted to close their short positions in Vix futures, triggering a marketwide meltdown that led to shares in Vix-linked ETFs being halted for volatility.

Investors in short-Vix products booked billions of dollars in losses that day, and at least one of the ETFs didn’t survive. Credit Suisse ultimately recalled its popular VelocityShares Daily Inverse Short-Term Exchange-Traded Note after its assets were almost entirely wiped out. Angry investors ultimately sued over the incident.

But the risks of something similar happening in 2023 are low, Fishman said, since the amount of money in short-volatility ETFs that need to close out their positions every day is far lower today than it was in early 2018.

The -1 Short Vix Futures ETF

SVIX

has $95.5 million in assets under management, according to FactSet data, while the ProShares Short Vix Short-Term Futures ETF has $255 million in assets, according to FactSet data. By comparison, funds tracking the strategy had billions under management ahead of Volmageddon. The ProShares ETF had $1.6 billion AUM at its peak just before Feb. 5, 2018.

Prior to “Volmageddon,” the short-volatility trade had been a huge moneymaker during 2017 as the Vix repeatedly tumbled into single-digit territory, among its lowest levels recorded since the gauge was launched in 1993.

Betting against Vix options or buying put options on the Vix aren’t the only options for investors looking to profit from the short-volatility trade. One option is selling covered calls against individual stocks held by an investor. This allows investors to book regular profits, squeezing more yield from shares in stocks they already own.

And should the market move against them, their losses would be capped because the worst that could happen is they would be forced to sell their shares.

Losses from betting against a Vix futures contract without some kind of hedge in place are, in theory, unlimited, since there is no limit on how much the value of a financial derivative or asset can rise. By comparison, when an investor is long a given stock or contract, it can only fall to zero.

Rising Treasury yields have boosted the price of equity options, which makes selling them more attractive for investors looking to pick up extra yield, Gateway’s Ferrara said during an interview with MarketWatch.

“There are meaningful gains to be had in a low-risk fashion with some of these call-writing strategies,” Ferrara said.

Investors have rushed to park money in ETFs that attempt to mimic this covered-call selling strategy. One example, the JPMorgan Equity Premium Income ETF

JEPI

has seen investors deposit more than $11 billion in the fund since the start of the year, FactSet data show.

U.S. stocks traded mostly higher on Wednesday, with the S&P 500 up 0.1% at 4,504. The Vix was falling as a result, off 0.9% at 14.32 in recent trade, its lowest level in nearly a month, FactSet data show.