This post was originally published on this site

After electronic skirmishing in which the bears held sway Friday, the S&P 500

SPX

is opening near a seven-week trough. Wall Street’s equity benchmark is down 10 of the last 13 sessions with a number of suspects getting the blame.

Worries about China’s economy, seasonal softness, higher energy prices and surging bond yields have all apparently provided an excuse for profit taking, particularly in some of the more richly-valued heavyweight tech stocks.

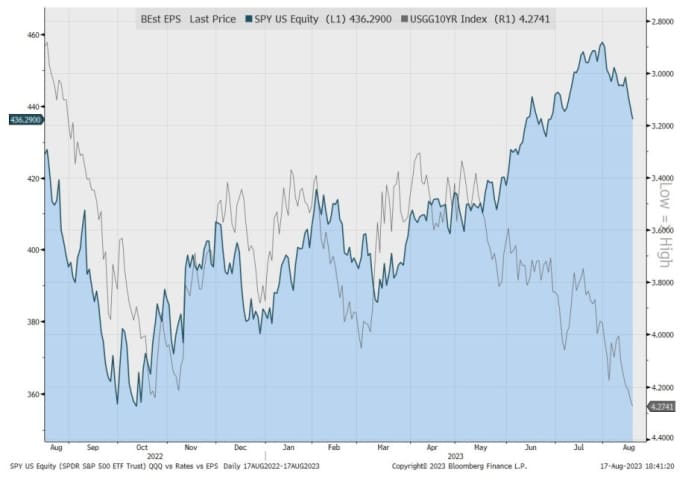

This is just the latest vacillation that Michael Kantrowitz, chief investment strategist at Piper Sandler, says is part of the market’s trend of swinging up and down since early 2022 mostly on changes in market multiples, or price to earnings ratios, as opposed to fundamental cyclical concerns.

“In the most simplistic sense, P/Es are just…[a] figure that represent emotional views of investors. While many variables factor into valuation, over the short run, it’s investors’ perception of risks that dominate,” says Kantrowitz in a note to clients published late Thursday.

Price-to-earnings ratios have vacillated, far more than earnings expectations.

Source: Piper Sandler

And he is of the view that right now it is the moves in bond yields that are driving that emotion.

Taking October 2022 as a guide, he notes that stocks began to rally when views and data on inflation began to cool down, overcoming any concerns about macroeconomic weakness and falling earnings. Investors believed the Fed was done raising rates and that the economy would have a soft landing: thus good news drove stocks higher.

“Recall, the market got off to a great start this year largely due to views that bonds yields had peaked, especially after the March bank issues,” he says.

Today’s scenario is a bit different. The move to 15-year highs for 10-year bond yields is not solely because of inflation concerns, but a number of reasons including the relaxing of Japan’s yield curve control that has perhaps enticed some funds home. U.S. budget deficit worries may also be a factor, alongside positive economic surprises, and hawkish Fedspeak.

Stocks have dropped as the 10-year yield has climbed.

Source: Piper Sandler

So what happens next?

Well, if bond yields can stabilize for what Kantrowitz calls good reasons, such as lower inflation, then we could see a rally in riskier assets. Should yields decline for bad reasons, like weaker macroeconomic data, especially relating to jobs, then risk-on assets may underperform and the supposedly haven large cap growth stocks may lead.

A further rise in yields would hurt small caps, value stocks, cyclical-sensitive assets and those with high betas, Kantrowitz warns.

However, he says that though higher rates pose a risk to stocks, they alone will not push the market down for a sustained period of time.

“At some point, equity weakness might be viewed as super bearish for the macro outlook and investors will return to the safety of bonds and policy makers will try to talk down yields … which could help to stabilize the situation,” says Kantrowitz.

But for now, he stresses: “The thing about P/E-driven markets is that they can change on a dime – if the perception of risks changes, the markets do as well.”

Markets

U.S. stock indices

SPX

COMP

are lower at the open as benchmark Treasury yields

BX:TMUBMUSD10Y

ease from recent multi-year highs. The dollar

DXY

is steady, while oil prices

CL.1,

are a touch weaker and gold

GC00,

gains.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

Traders may need to be on their toes as an estimated $2.2 trillion of stock options are due to expire on Friday.

Deere & Co.

DE,

is among those at the tail-end of the earnings season to release results before the opening bell. Shares in the farm equipment maker are a touch lower after its 2023 guidance beat analyst estimates.

Shares of Farfetch Ltd.

FTCH,

are slumping more than 40% in Friday’s premarket after the luxury fashion company reported sales below analysts forecasts.

Shares of Applied Materials Inc.

AMAT,

gave up early premarket gains which came after the chip industry equipment supplier reported earnings and forecast an outlook that topped Wall Street expectations.

China Evergrande, the heavily indebted group that is China’s second biggest developer, filed for bankruptcy late on Thursday.

And in related news, China’s central bank on Friday stepped in to support the yuan amid concerns about the health of the world’s second biggest economy.

Bitcoin

BTCUSD,

was trading near $26,000 after a sharp fall on Thursday following reports Elon Musk’s SpaceX had dumped its holding in the crypto currency.

Best of the web

Will the rest of the world feel China’s deflation pain?

The ghost fleet helping Russia evade sanctions and pursue its war in Ukraine.

Buyers of Bored Ape NFTs sue after digital apes turn out to be bad investment.

The chart

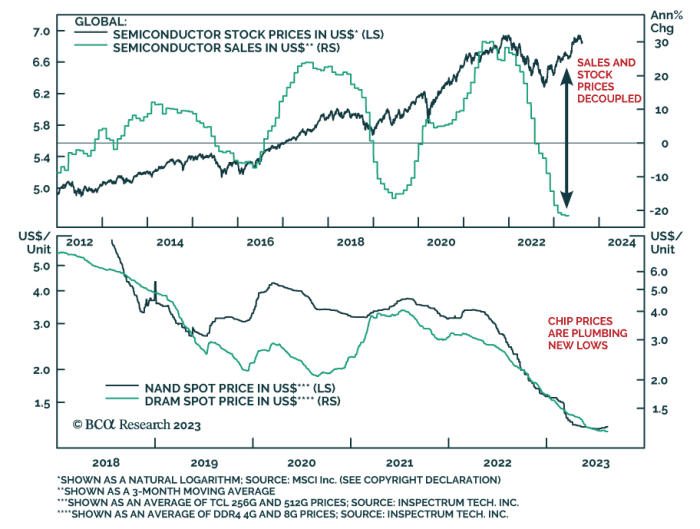

BCA Research has downgraded the semiconductor sector to underweight, and the charts below help explain why. Chip prices are falling pushing sales drastically lower, but share prices have done well.

Source: BCA Research

“Demand for AI chips remains strong, but it does little good to most chip companies except Nvidia and AMD. TSMC said that AI chips account for only 6% of its sales,” says BCA. “The industry trades at 28.5x forward earnings, which is the 99th percentile relative to 10 years of history. The BCA Valuations and Technical indicators signal that the industry is both overvalued and overbought relative to the S&P 500. “

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

TTOO, |

T2 Biosystems |

|

NVDA, |

Nvidia |

|

NIO, |

NIO |

|

APE, |

AMC Entertainment preferred |

|

MULN, |

Mullen Automotive |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

EBET, |

EBET |

Random reads

Not so ‘Bonnie’ Prince Charlie revealed.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton