This post was originally published on this site

Trillions of dollars worth of bonds and loans deemed higher-risk by credit firms are set to come due before the end of 2025, creating a “maturity wall” that could potentially inject more panic into markets, according to a report by a team of global credit strategists at Morgan Stanley.

Approaching deadlines could ratchet up the pressure on many borrowers seen as less creditworthy, especially as big banks become more choosy about extending credit during an era of higher interest rates. Plus, as more time passes without securing refinancing, pressure on bond prices could intensify.

See: Fed Data on Banks Show Tighter Loan Standards. What It Means for Interest Rates.

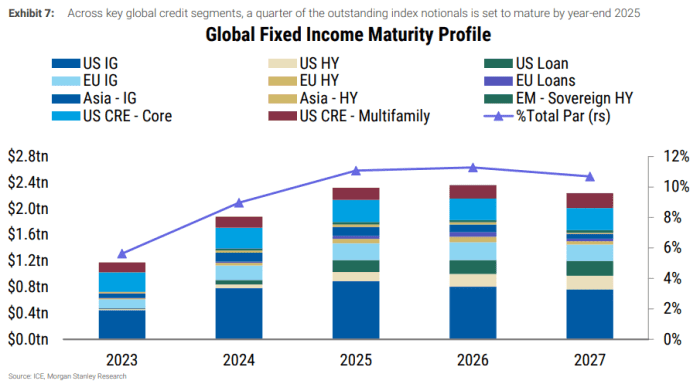

Morgan Stanley strategists said $5.3 trillion of public bonds and institutional loans from U.S., European and emerging-market borrowers are set to mature through the end of 2025, creating a “maturity wall” that could exacerbate concerns about rising interest rates and banks’ unwillingness to underwrite more risky debt.

That figure is equivalent to 26% of the value of bonds included in indexes that track investment-grade and high-yield bonds, along with leveraged loans and other credit products.

Even those borrowers that do manage to roll over their debt could face problems sustaining it going forward, with interest rates soaring since early 2022 as central banks, including the Federal Reserve, have confronted the worst wave of inflation in decades.

“As banks solve for a higher cost of capital, credit conditions are set to tighten at a time when maturity walls in debt markets are also coming into focus,” according to a note penned by a group of 14 Morgan Stanley credit analysts.

While investment grade corporate borrowers could be insulated from potential difficulties related to refinancing maturing bonds, borrowers who relied on high-yield bonds and leveraged loans, bank loans made to companies that already have heavy debt burdens, could struggle.

MORGAN STANLEY

Investment banks underwrite bonds and typically sell them on to asset managers, insurance companies and other customers, while sometimes holding slices of the risk on their books. Higher interest rates increase the debt burden shouldered by companies, making it more difficult for some borrowers to sustainably service their debts.

Perhaps the most pressing risk stems from lower-quality commercial real estate borrowers in the U.S. Their lenders are primarily smaller and medium-size banks, which are already overexposed to these types of borrowers, the Morgan Stanley team said.

MORGAN STANLEY

Looming “maturity walls” will impact distinct corners of the credit markets differently. For example, refinancing needs are already “front and center” for U.S. commercial real estate, the Morgan Stanley team said. This means imminent default risks for lower-rated borrowers likely has been worked into the price of those bonds.

See: The $1 trillion ‘wall of worry’ for commercial real estate that spirals through 2027

One way to trade woes in commercial real estate, they said, would be to bet against AAA-rated commercial mortgage-backed securities as a hedge that would pay off if credit spreads surge, sending prices of even high-quality bonds tumbling. In bond trading, a spread is the difference between the yield of a given bond and its benchmark risk-free security, typically a Treasury note. Bond yields move inversely to bond prices, rising as prices fall.

Leveraged loans and high-yield, or “junk,” bonds in the U.S. could be more vulnerable to a selloff as time passes, since the market for issuing fresh high-yield debt has dried up over the past year, potentially making it more difficult for these borrowers to roll over their bonds and loans.

“…This runway is getting shorter given little progress made over the past year,” the Morgan Stanley team said about high-yield U.S. credit.

Related: A $1.8 trillion wall of corporate debt coming due could cost jobs, Goldman warns

Investors have been increasingly focused on bond markets lately, with some market strategists blaming rising 10-year and 30-year Treasury yields for a pullback in the S&P 500

SPX

and Nasdaq Composite

COMP.

Both indexes fell for the second week in a row Friday, the longest streak of losses for the highflying Nasdaq since December.

U.S. stocks bounced back on Monday, with the S&P 500

SPX,

Nasdaq and Dow Jones Industrial Average

DJIA

finishing higher after a stretch of losses. Meanwhile, the yield on the 10-year Treasury note

BX:TMUBMUSD10Y

rose nearly 3 basis points to 4.193%, while the yield on the 30-year bond

BX:TMUBMUSD30Y

rose nearly 2 basis points to 4.288%. Yields on both are nearing their highs of 2023.