This post was originally published on this site

The Nasdaq-100, the best performing of the major U.S. equity indexes year-to-date, just capped off its worst two-week stretch since December, according to Dow Jones Market Data.

On Friday, the tech-heavy index capped off a two-week pullback of 4.6% when it finished 100.77 points, or 0.7%, lower at 15,028. That’s the biggest such loss since Dec. 23, when the index capped off a pullback of 5%, Dow Jones Market Data showed.

It’s only the latest concerning factoid to confirm that high-flying technology stocks are seeing their market-beating momentum deflate.

On Wednesday, the popular Nasdaq-100-tracking Invesco QQQ Trust Series 1

QQQ

exchange traded-fund, closed below its 50-day moving average for the first time since March 10, FactSet data showed. The index has now finished below its moving average for three consecutive sessions, another indication, according to technical analysts, that its 2023 gains may continue to fade.

A handful of the most valuable megacap technology stocks comprise roughly 40% of the Nasdaq-100’s value. And weakness among several of these names, which have played a critical role in the U.S. market’s 2023 rebound, is fueling concerns that the market might be headed for a bigger, and perhaps broader, selloff.

Among the so-called “Magnificent Seven” stock-market leaders, Apple Inc.

AAPL,

Nvidia Corp.

NVDA,

Microsoft Corp.

MSFT,

and Tesla Inc.

TSLA,

all finished the week below their 50-day moving averages.

Other signs that the technology selloff could be accelerate lurk under the market’s hood, analysts said.

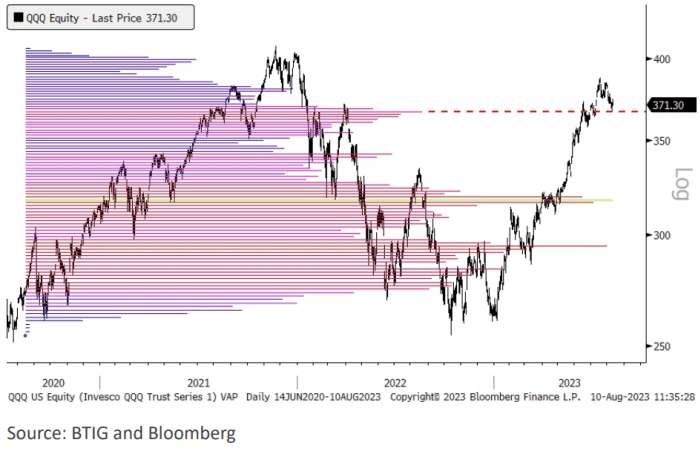

In a research note shared with clients and the media on Thursday, Jonathan Krinsky, the top technical analyst at BTIG, said that QQQ and several other popular tech-heavy ETFs are nearing a “volume pocket” that could see them move even lower, in a hurry.

An analysis of volume-at-price data over the past three years shows a sustained break below $368 for QQQ would leave it vulnerable to a more rapid selloff based on historical volume-at-price, a tool used by stock analysts to parse where levels of support and resistance might emerge for a given security.

Volume-at-price measures trading volume for a given security at a range of price points over a given period. Krinsky looked back at the last three years in his analysis.

“Support and resistance is based on prior price memory,” Krinsky said during a phone interview with MarketWatch. “Within that range, there is not as much price memory from participants. That is when you can get the faster price moves,” he added.

BTIG

Krinsky noted that QQQ rallied by roughly 16% over six weeks from late April to mid-June, raising the likelihood that a reversal could happen just as swiftly, if not faster. QQQ is up 37.5% year to date as of Friday’s close, according to FactSet.

Analysts have blamed the pullback on several factors, including crowded investor positioning, overly rich valuations for the best-performing stocks, rising Treasury yields and corporate earnings that failed to meet a high bar set by investors.

Rising Treasury yields have helped to heap more pressure on stocks, especially the highflying technology names that are particularly sensitive to interest rates.

The big question now is whether a further unraveling of Big Tech’s advance will take the broader market down with it, or whether other corners of the market will help to pick up the slack.

See: Here are 4 of the biggest changes to the Nasdaq 100 from Monday’s special rebalancing

James St. Aubin, chief investment officer at Sierra Investment Management, said it looks like traders have been content to rotate into other areas of the market that aren’t quite as richly valued as the Big Tech names.

The leaders are fading, but the laggards are coming up right behind them,” St. Aubin said during a phone interview with MarketWatch. “If money was flowing out across the board and going into cash and bonds, that would be a bit more concerning.”

U.S. stocks eked out a gain on Thursday after blowing most of their early gains. The market initially rallied after the release of July inflation data that largely matched economists’ expectations. But San Francisco Fed President Mary Daly said later that the Fed still has more work to do to tame inflation, sending Treasury yields higher and provoking a swift turnaround for equities.

The S&P 500

SPX

finished Friday in the red, falling 4.78 points, or 0.1%, to 4,464.05 and logging a second-straight weekly decline. The Nasdaq Composite

COMP,

which includes a broader universe of stocks than the Nasdaq-100, shed 93.14 points, or 0.7%, to 13,644.85.

The Dow Jones Industrial Average

DJIA

was a lone bright spot, rising 105.25 points, or 0.3%, to 35,281.40.

The 10-year Treasury yield

BX:TMUBMUSD10Y

jumped to 4.156% on Friday to settle at its highest level in a week, Dow Jones Market Data show.