This post was originally published on this site

The Social Security COLA for 2024 is likely to be just as high as it was in prior years.

It’s important to point this out in order to counter the alarmist narrative that’s taking hold in some quarters that next year’s cost of living adjustment (COLA) will be much lower than in prior years. Retirees and others living on a fixed income are naturally upset.

To be sure, we won’t know the exact COLA until October 12, which is when the September CPI level will be reported. 2024’s COLA will equal the percentage difference between September’s level and where the CPI stood in September 2022, 12 months prior.

Even though we can only speculate at this point, a number of written articles have appeared with scary headlines such as “The Social Security COLA for 2024 could be 2.7%, down from 8.7%.”

But these analyses and headlines focus on the COLA’s absolute rather than relative level. And though 2024’s COLA almost certainly will be lower than 2023’s, in absolute terms, inflation also will be a lot lower. And it’s the relation between those two that tells us whether retirees’ purchasing power will be preserved or eroded.

Failure to focus on that relation is an error that economists refer to as “inflation illusion.” To illustrate, consider that the Social Security COLA in calendar 1980 was 14.3%. If you didn’t remember that inflation at that time was running in the double digits, you’d be envious of how good that year’s Social Security recipients had it. In fact, those recipients most likely lost purchasing power in 1980, as the Consumer Price index’s trailing 12-month inflation got as high as 14.6% during that calendar year.

Whether the 2024 COLA will be higher or lower than next year’s actual inflation will be a function of whether inflation is trending up or down later this year and next. When the CPI’s 12-month rate of change is trending upwards, then a given year’s COLA will be lower than actual inflation, since that adjustment would have been set the prior October when the rate was lower.

In contrast, a given year’s COLA will more than compensate for inflation in a given year if the CPI’s 12-month rate of change is trending down. And that appears to be the case currently. So there’s a good chance that the CPI’s trailing 12-month rate of change this October will be higher than what inflation actually turns out to be in 2024.

Of course, we won’t know until the end of next year whether the 2024 Social Security COLA will be higher or lower than the year’s actual inflation. But our best guess at this point is that 2024 will be one of those years in which the COLA will be slightly higher than actual inflation. So, rather than complaining, retirees should—tentatively—be hopeful.

I’ve received numerous angry emails in prior years when I’ve made similar points about the importance of judging the Social Security COLA in relative rather than absolute terms. Many of you have related genuine hardships caused by trying to pay your bills with what you receive from Social Security, arguing that those hardships prove my analysis is wrong.

But let me be clear: I’m not taking a position on whether Social Security benefits are in and of themselves adequate. I’m solely focusing on whether Social Security’s inflation adjustment is adequate. Those are two separate things.

Consumer Price Index for the Elderly

While I’m on the subject, let me address a related subject: Does the Social Security Administration (SSA) use the correct measure of inflation when calculating its COLA? Many argue that it does not, on the grounds that the elderly’s cost of living rises faster than it does for the rest of us. In theory that argument makes a lot of sense.

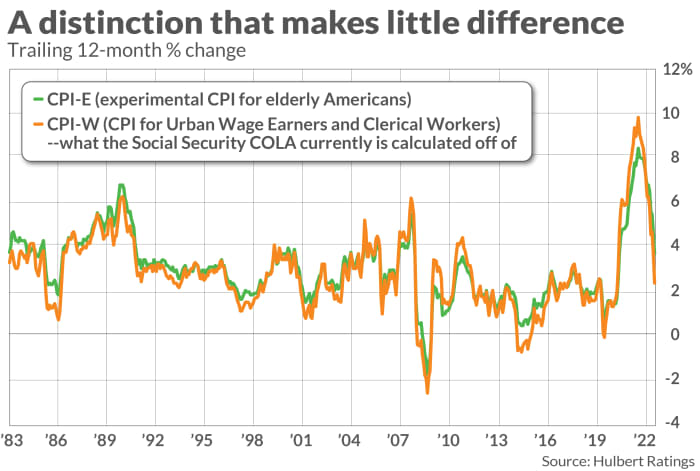

In practice, however, it makes little difference. We know because the SSA, since 1982, has calculated a separate “Consumer Price Index for The Elderly,” or CPI-E, which takes into account the distinct spending habits of the typical elderly person. As you can see from the accompanying chart, its 12-month rate of change is often virtually indistinguishable from the “Consumer Price Index for All Urban Wage Earners and Clerical Workers,” or CPI-W—which is what the SSA uses to calculate its annual COLAs.

The bottom line? In adjusting retirement benefits by inflation, the SSA is not trying to fix all inadequacies in how Social Security is administered. It has a much more narrow goal, which is to fairly adjust those benefits by actual inflation. Its success or failure should be judged on that basis alone.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com