This post was originally published on this site

Apple Inc. has amassed upwards of $10 billion in deposits for its savings account since launching the product with Goldman Sachs Group Inc. in April, the company announced Wednesday.

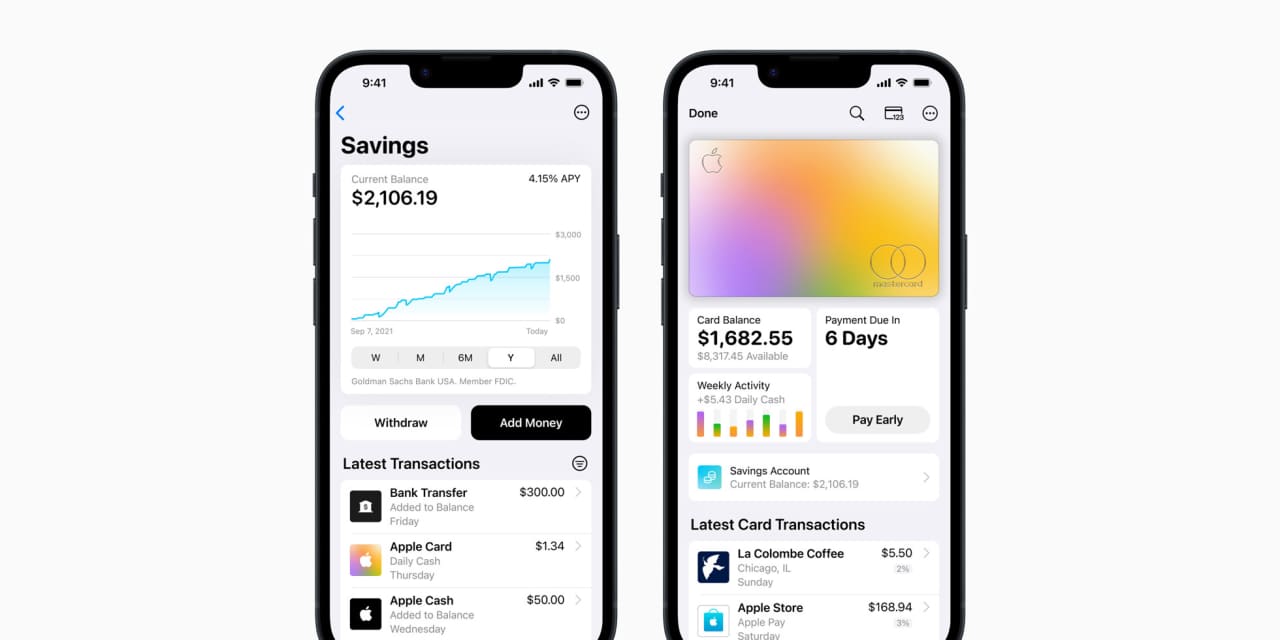

The savings account, which is offered by Goldman

GS,

lets holders of the co-branded Apple Card credit card stash their rewards while earning interest. The account has a 4.15% annual percentage yield.

Apple

AAPL,

said in a Wednesday release that 97% of cardholders using the savings account have opted to have their Daily Cash cash-back rewards automatically sent to their account. Users can also deposit funds through linked bank accounts or through their balances of Apple Cash, which is the company’s peer-to-peer offering.

Read: Apple’s new savings account is more bad news for banks, Moody’s says

The Wall Street Journal has reported that Goldman is seeking to exit its partnership with Apple as part of a broader departure from consumer businesses. Apple didn’t immediately respond to MarketWatch’s request for comment on that relationship.

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” Liz Martin, Goldman Sachs’s head of enterprise partnerships, said in Wednesday’s press release.

Apple has gradually been making inroads in financial services. Beyond offering the Apple Card and savings account alongside Goldman, the company has a buy-now-pay-later offering that lets customers make purchases in installments. The consumer-electronics giant also runs the popular Apple Pay service that has been gaining traction and lets people send money to friends through Apple Cash.

See more: Apple appears to be making rapid inroads in buy-now-pay-later