This post was originally published on this site

The stock-market rally is no longer just about megacap technology names.

A wider swath of stocks have joined the S&P 500

SPX,

upswing after the so-called Magnificent Seven — Apple

AAPL,

Amazon

AMZN,

Alphabet

GOOG,

Microsoft

MSFT,

Meta

META,

Nvidia

NVDA,

and Tesla

TSLA,

— single-handedly propelled the large-cap index into a bull market in early June, with the gauge now up more than 28% from its low notched last October and rising to new highs since April 2022, according to Dow Jones Market Data.

Hopes that the U.S. economy could pull off a soft landing and avoid a recession despite the Federal Reserve’s aggressive interest-rate hikes, as well as receding inflation pressures and expectations for the end of the Fed’s monetary tightening campaign, have underpinned a notable expansion in market breadth over the past two months, according Adam Turnquist, chief technical strategist at LPL Financial.

The S&P 500 Equal Weighted Index

SP500EW,

which lagged behind the market-cap-weighted S&P 500 index for most of the year, has now kicked back into gear and staged an impressive comeback in July. The equal-weighted index and the S&P 500 each advanced 3.1% this month, according to FactSet data.

The equal weighting eliminates the distortion of the megacap components and significantly changes several sector weightings in the S&P 500, including technology, which drops from around 29% on the SPX to only 13% on the equal-weighted index, said Turnquist in a Friday note. Meanwhile, the industrials sector has the biggest increase in weight, jumping from 9% on the SPX to 16% on the equal-weighted index.

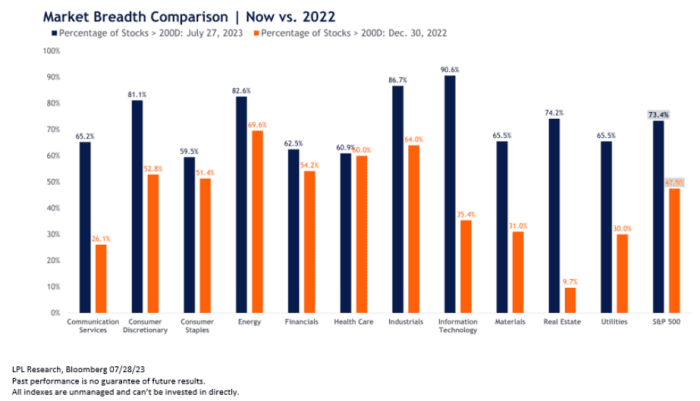

Another way to quantify and compare market breadth is to look at the percentage of stocks on an index trading above their longer-term 200-day moving average (dma), Turnquist said. In general, if a stock is trading above its 200 dma, it is considered to be in an uptrend, and if the price is below the 200 dma, it is considered in a downtrend. Furthermore, a higher percentage of stocks above their 200 dma implies buying pressure is more widespread — suggesting the market’s advance is likely sustainable.

The chart below shows that 73% of stocks within the S&P 500 are trading above their 200 dma as of July 27, which compares to only 48% at the end of 2022. Moreover, the composition of breadth leadership has turned increasingly bullish. The highest sector readings include technology, industrials, energy, and consumer discretionary.

“So not only is breadth on the index robust, but cyclical stocks are also leading,” said Turnquist.

SOURCE: LPL RESEARCH, BLOOMBERG

Wall Street often views broadening participation in the stock-market rally as a measure of health and a constructive sign of the sustainability of the bull market.

Jimmy Lee, founder and chief executive officer of The Wealth Consulting Group said he is seeing “a lot of money” flowing into areas that are not the Magnificent Seven such as stocks in the industrials, financials, materials, energy and even real-estate sectors.

The S&P 500’s industrials sector

SP500.20,

climbed 2.9% in July, while the financials sector

SP500.40,

advanced over 4.7% this month. The S&P 500’s energy sector

SP500.10,

which had been the biggest laggard when the rest of the markets exited the bear market in June, jumped 7.3% month to date after the U.S. oil benchmark

CL.1,

CL00,

closed above $80 a barrel for the first time since April.

Meanwhile, the tech-heavy S&P 500’s communication-services sector

SP500.50,

rose 6.7% in July, while the consumer-discretionary sector

SP500.25,

gained 2.4% and the information-technology sector

SP500.45,

was up 2.6%, according to FactSet data.

Stephen Hoedt, managing director of equity and fixed income research at Key Private Bank, told MarketWatch in an interview that he doesn’t see “any reason to get bearish here with the fundamentals that are underlying,” which gives investors reason to rotate toward the more cyclical areas such as energy, financials and industrials, while broadening the market away from just being concentrated in the megacap technology names.

“The growth has been a surprise this year for everyone, so that’s what the market got wrong coming into this year. When I look at growth, nominal GDP growth translates directly into earnings and we’ve seen earnings continue to surprise on the upside,” Hoedt said.

Hoedt pointed to the direction of the 12-month forward earnings estimate for the S&P 500 as an important indicator. “As long as the direction of the 12-month forward earnings number for the S&P 500 is going up, it’s really, really difficult to be bearish on the stock market,” he said. “It seems to me that we may start to see another inflection higher in forward earnings revisions that take into account this stronger growth environment that we’re in.”

However, the broadening of the stock-market rally and the bullish sentiment were also driving some on Wall Street to believe stocks are overbought and due for a correction.

Lee said there’s still too much pessimism out there and too much concern that some investors haven’t chased the market yet. “In the second half of this year, when the Fed does stop raising rates and if the economy stays out of recession, you can see major money — trillions of dollars moving from the money market into equities and other risk assets,” he told MarketWatch in a phone interview on Friday.

“When that happens, it’s probably going to push valuations even further. So I would imagine when that happens is when you can expect more of a correction to occur, but I think that we still have more room to go before that happens.”

U.S. stocks ended higher on Monday, finishing up July on a positive note. Three major stock indexes rallied this month, with the S&P 500 up 3.1% and booking its fifth monthly gain. The tech-heavy Nasdaq Composite

COMP,

gained 4.1% month to date, while the Dow Jones Industrial Average

DJIA,

advanced 3.4%, according to Dow Jones Market Data.