This post was originally published on this site

Shares of XPeng Inc. took a hit Friday, after J.P. Morgan recommended investors sell ahead of earnings, as there is very little scope for a positive margin surprise given the “survival competition” seen in China’s auto market.

Analyst Nick Lai cut his rating on the China-based electric-vehicle maker to underweight from neutral. While the price target was raised to $10.00 from $7.50, the new target still implies 33.5% downside from Thursday’s closing price of $15.04.

“Our reservation is that we see ‘survival’ competition in the auto market now which is ultimately a competition on the balance sheet and who has more cash to burn,” Lai wrote in a note to clients.

The stock

XPEV,

fell 1.3% in premarket trading. It had soared 62.6% over the past three months through Thursday, while shares of rival Nio Inc.

NIO,

have rallied 23.9% and the S&P 500 index

SPX,

has gained 9.7%.

Lai said he expects second-quarter gross profit margin (GPM) to remain weak due to operation deleveraging and a weak product mix, and sees second-half GPM below current Wall Street forecasts.

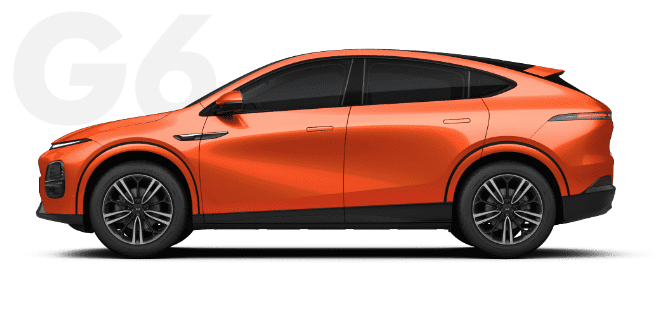

And while pricing of the newly introduced G6 coupe sport-utility vehicle (SUV) is attractive, which should provide a volume bump in the second half of the year, Lai’s full-year volume estimate of 133,000 vehicles is still shy of management’s target of 150,000 EVs.

“We believe the share price will potentially see a pull back into result season and don’t expect delivery of satisfactory margin in 2H23, hence our UW rating and profit-taking call,” Lai wrote, especially given how strong the stock has been in recent months.

XPeng is projected to report second-quarter results in late August. Last year, the report was released on Aug. 23.

Separately, Lai kept his neutral rating on Nio’s stock, while raising the price target to $9.00 from $8.50. The stock gained 1.1% ahead of Friday’s open.