This post was originally published on this site

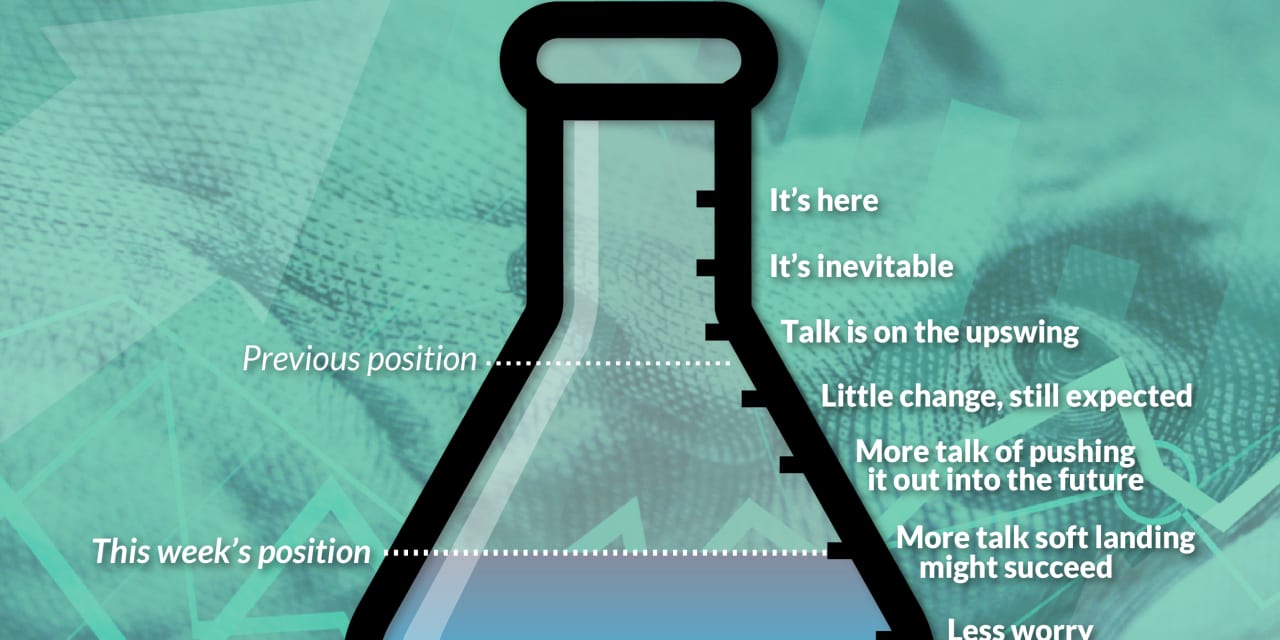

Fears of a U.S. recession fears eased this week after the government reported that consumer price inflation cooled sharply in June.

With inflation coming down, economists saw a greater chance the Federal Reserve might not have to “slam on the brakes” to get price pressure under control.

“It’s a Goldilocks economy, I mean, strong economic growth… and I don’t see any reappearance of inflationary trends, I see stability,” said Wharton Professor Jeremy Siegal.

On Friday, the University of Michigan reported consumer sentiment jumped in July by the most of any month since late 2005.

“Easing concerns about a recession, which received a ton of headlines in the media for most of the year, may have helped push sentiment and expectations higher. Google Trend searches for recession have fallen,” said Ryan Sweet, chief U.S. economist at Oxford Economics.

Other economists think this talk of avoiding a recession is wishful thinking.

Torsten Slok, chief economist at Apollo Global Management, said the economy is going to get hit soon from delayed effects of the rapid rise in interest rates engineered by the Fed over the past year and a half.

“The transmission mechanism of monetary policy takes time, and the drag on growth from lagged Fed hikes over the coming year will be significant, and that is why a recession is a more likely outcome than a soft landing, no matter what happens to inflation,” Slock said.

See also: Inflation in the U.S. has cooled off significantly. Great. Here’s what’s not so great.

Commentary on recession this week

- Phil Camporeale, portfolio manager at JP Morgan Asset Management, said his recession probability has dropped to 25% from 40% in March. “We are pretty highly convicted we’re in a soft landing,” Camporeale said. He said recession talk was all the rage in March. “Even the Fed got faked out. There a lot of people saying that by July the Fed could be easing,” he said.

- “I think there is an increasing possibility of a soft landing. But it is too early to declare that as a done deal. There are some sectors that are weak that have historically spilled over into the broader economy. And if we are fortunate enough to have a soft landing, it would be the second or third out of 11 or 12 attempts,” said former Fed Vice Chair Roger Ferguson.

- New York Fed President John Williams said that the U.S. economy won’t hit its weakest point until 2024. In an interview with the Financial Times, William said he though the slower growth would start in the July-September quarter and continue into March. Williams said he doesn’t have a recession in his baseline forecast. “I have pretty slow growth,” he said.