This post was originally published on this site

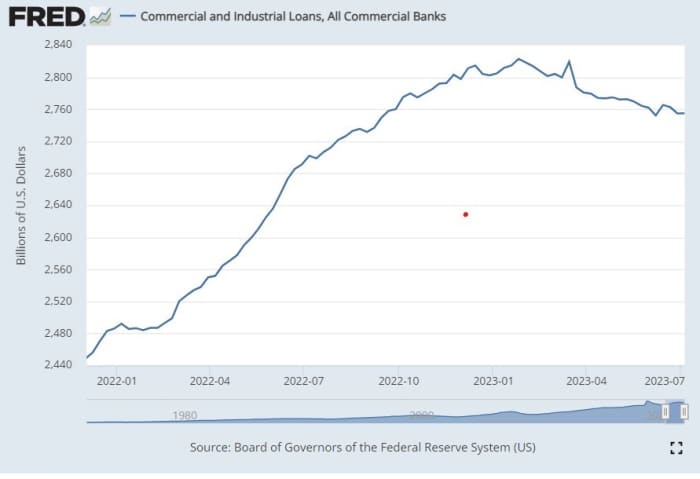

The numbers: Commercial and industrial loans — a key economic driver — held roughly steady in the week ending July 5, the Federal Reserve said Friday. Loans rose $200 million to $2.754 trillion, the central bank said.

Bank lending has been slowly decelerating, falling for three straight months. C&I loans hit a peak of $2.82 trillion in mid-March, right before the collapse of Silicon Valley Bank.

Uncredited

Key details: Total bank deposits rose by $24.9 million to $17.367 trillion in the same week. Deposits have been shrinking slowly. They peaked at $18. 21 billion in mid-April.

Big picture: In the wake of the collapse of Silicon Valley Bank in March, economists have been watching the data carefully for signs of a credit crunch, as banks have weak balance sheets as a result of the Fed’s swift increases in interest rates since March 2022.

San Francisco Fed President Mary Daly said Monday she hadn’t seen credit tightening that is in excess of normal.

“I do think, from research literature, that this takes a while to show itself, and so I think we are still looking into the fall before we would have a declarative statement to make about the extent of credit tightening and the impact on the economy,” Daly said.

Market reaction: Stocks

DJIA,

SPX,

finished the week higher on Friday. The yield on the 10-year Treasury note

TMUBMUSD10Y,

rose to 3.83%.