This post was originally published on this site

Better Therapeutics Inc. shares surged in the extended session Monday after the digital therapeutics company got Food and Drug Administration approval for its smartphone-based behavioral diabetes therapy.

Shares of Better Therapeutics

BTTX,

rose 27% after hours — after surging as much as 48% — following a 19.6% fall in the regular session to close at 90 cents with 5.3 million shares exchanged, compared with a 52-week average daily volume of about 309,000 on the Nasdaq.

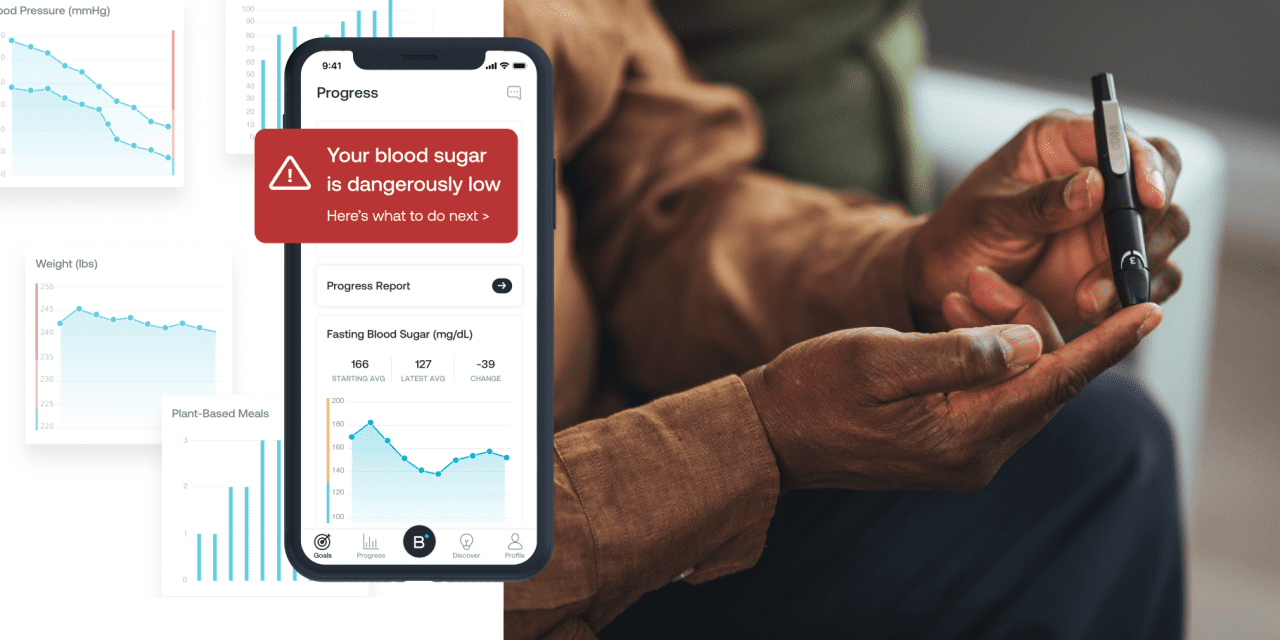

The FDA approved the San Francisco-based company’s AspyreRx prescription digital therapeutic, or PDT, to “provide cognitive behavioral therapy to patients 18 years or older with Type 2 diabetes,” the first PDT to provide such a therapy for a nutritional indication.

Ahead of a company conference call scheduled for 8:30 a.m. Eastern on Tuesday, TD Cowen analyst Charles Rhyee, who has an outperform rating on the stock, said the approval is not only a big deal for Better Therapeutics but for PDTs as a whole.

“We see this as a big milestone for both Better Therapeutics and the PDT class, as it is Better Therapeutics’ first approved PDT and the first PDT approved to deliver nutritional cognitive behavioral therapy,” Rhyee said in a note late Monday.

“Moving forward, we believe the next challenge is in driving adoption and gaining payor coverage,” the TD Cowen analyst added. “We note that while PDTs have real mechanisms of action and have displayed the ability to enact real physiological change in patients, adoption of PDTs has remained a challenge across the space.”

Rhyee said he expects the company will need to secure funding before commercial launch, projecting only enough runway cash through the third quarter. Better Therapeutics said it plans to launch AspyreRx in the fourth quarter.

Of the four analysts who cover Better Therapeutics, three have buy-grade ratings and one has a hold, along with an average target price of $7, according to FactSet data.