This post was originally published on this site

For more than two years, bitcoin and stocks often traded in tandem with each other but maybe no longer.

The correlation between bitcoin

BTCUSD,

and the S&P 500 index

SPX,

has fallen to close to zero, according to a Tuesday note by Dan Morehead, founder and managing partner at Pantera Capital.

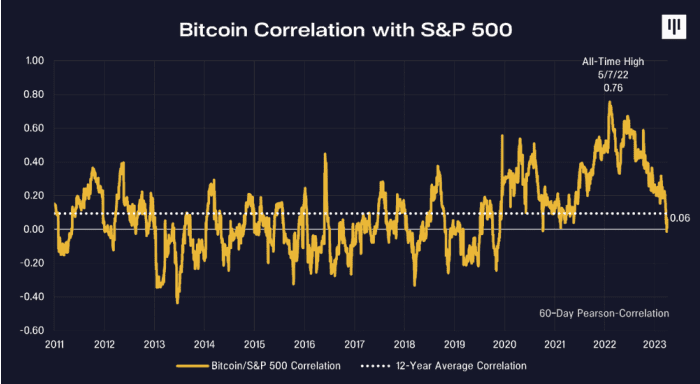

For most of cryptocurrencies’ history, the assets were not correlated with U.S. stocks, noted Morehead. During the first nine years of the existence of bitcoin, which was created in 2009, correlation between the crypto and the S&P 500 was 0.03.

Panteral Capital

However, the correlation between the two assets started to rise starting 2020, and peaked at 0.76 in May last year.

Part of the reasons was market participation from “all of the excessively-leveraged centralized entities,” according to Morehead.

A fall in the correlation between bitcoin and stocks is bullish for crypto assets, noted Morehead. “When you find a new asset class with incredibly high historical returns and essentially no correlation with typical assets – that’s the dream investment.”

“As blockchain is in no way connected to interest rates, it should have a very low correlation to the main asset classes (stocks, bonds, real estate), which are all tightly driven by rates,” wrote Morehead.

Bitcoin has rallied over 80% so far this year, after posting an over 60% decline last year, according to CoinDesk data. The S&P 500 rallied 15% year-to-date, while the index lost over 18% in 2022, according to FactSet data.