This post was originally published on this site

JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. kick off second-quarter earnings season Friday after one of the choppiest three-month periods for the banking sector since the global financial crisis.

Bank of America Corp.

BAC,

and Morgan Stanley

MS,

will provide their second-quarter updates on July 18, followed by Goldman Sachs Group Inc.

GS,

on July 19.

While Silicon Valley Bank and Signature Bank failed in the first quarter, the second quarter saw the collapse of First Republic Bank and stock-price swoons by regional banks, even as larger banks booked some deposit inflows.

For this reason, FDIC Chair Martin Gruenberg said the banking system would have to await second-quarter results to gauge the full impact of the bank failures.

Also read: Bank stocks drop as FDIC flags challenges and strengths in quarterly report

This body blow to banks came against a backdrop of higher interest rates by the U.S. Federal Reserve in an attempt to cool the economy and tame inflation.

As bigger banks compete for deposits, their profit margins on loans have come under pressure and eaten into their projected earnings. While higher interest rates allow banks to charge more for loans, their cost of capital has also increased. The higher cost of borrowing has also dampened loan activity by consumers and businesses.

On the plus side, employment levels have held up better than expected in a sign that banks could benefit from robust spending and overall economic activity.

Also in the mix is a changing regulatory environment, with banks on the hook for potential increases in capital requirement to meet the international Basel III guidelines as part of a regulatory changes by Michael Barr, vice chair of supervision for the Fed.

See: Fed’s Michael Barr proposes new capital requirements for banks with $100 billion or more in assets

It’s no surprise that profit expectations for banks have been coming down, as banks tinker with plans to repurchase shares after the Fed’s annual regulatory stress tests results.

More: As bank earnings season begins, these 20 have had the largest cuts to estimates

CFRA Research analyst Kenneth Leon said Bank of America, JPMorgan Chase

JPM,

and Wells Fargo

WFC,

“have the best chance” to deliver higher second-quarter profits compared to year-ago levels, but “this will be harder” for Citigroup

C,

because of its asset sales.

Meanwhile, an investment-banking rebound may be in the cards after a trough in the second quarter, “with an expected upturn ahead” for Goldman Sachs and Morgan Stanley, Leon said.

“Large U.S. banks may see mixed second-quarter revenue comps,” Leon said.

Wall Street will also pay close attention to second-quarter earnings updates from some of the banks that saw their stock prices slide sharply after First Republic Bank was acquired by JPMorgan Chase in early May.

Some of those names include PacWest Bancorp

PACW,

Western Alliance Bancorp

WAL,

and Zions Bancorp

ZION,

JPMorgan Chase profit expectations increase

JPMorgan Chase now holds the distinction of the strongest stock price performance among the major banks in 2023 as of June 30, as well as more bullish profit expectations from analysts.

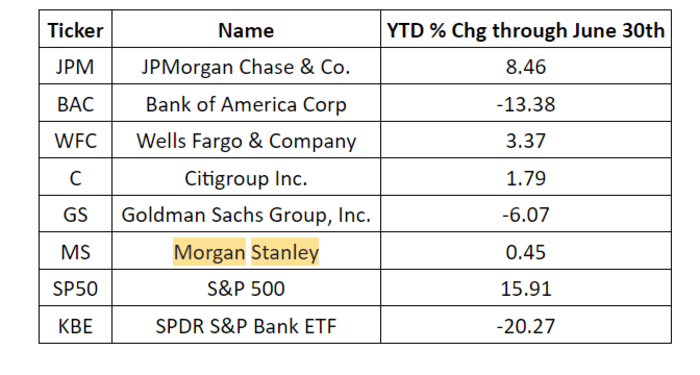

Between Jan. 1 and June 30, JPMorgan stock was up more than any other megabank, with a rise of 8.46% (see chart below).

Dow Jones Market Data

Analysts currently expect JPMorgan Chase to earn $3.94 a share on revenue of $39.32 billion, according to estimates compiled by FactSet. At the beginning of the second quarter, analysts had expected earnings of $3.27 a share for JPMorgan Chase.

Meanwhile, JPMorgan Chase CEO Jamie Dimon has remained visible on the lecture circuit and has been toying with the idea of public office at some point, while assuring investors he plans to stay on at the bank for the time being.

Dimon has also been pulled into some of the litigation surrounding deceased pedophile Jeffrey Epstein, with the bank being sued by the U.S. Virgin Islands for its alleged role in Epstein’s financial dealings.

During the past quarter, JPMorgan settled with victims of Epstein in a separate suit and pursued its own legal action against Jes Staley, who led the bank’s wealth unit and did business with Epstein.

Bank of America expectations dip slightly

As the second-largest U.S. bank after JPMorgan Chase, Bank of America has benefited from its large exposure to a wide swath of the U.S. economy as well as its massive credit-card business as a window into the American consumer.

As CEO Brian Moynihan continues to call for a mild recession, profit expectations for the bank have cooled somewhat.

Analysts now expect Bank of America to report earnings of 84 cents a share, down from a forecast of 86 cents a share on March 31. Analysts also expect the bank to report revenue of about $25.05 billion.

Bank of America has had the worst year-to-date performance among the major banks, with a drop of 13.38% as of June 30.

Wells Fargo profit on tap amid lower forecasts

Analysts currently expect Wells Fargo to report second-quarter earnings of $1.17 a share on revenue of $20.12 billion, according to estimates compiled by FactSet.

At the start of the quarter, analysts expected Wells Fargo to earn $1.20 a share.

During the quarter, Wells Fargo marked another milestone in regulatory efforts to lift its $1.93 trillion asset cap the Fed placed on it in 2018.

Also read: FDIC set to levy big banks to pay for $15.8 billion bailout of Silicon Valley, Signature Banks

Goldman Sachs CEO remains under pressure

Goldman Sachs in on deck to report a second-quarter profit of $5.31 a share and revenue of $10.9 billion.

At the start of the quarter, analysts expected Goldman Sachs to earn $7.84 a share.

CEO David Solomon has been in the hot seat, with a fresh Justice Department inquiry into Goldman’s role as both a banker and securities acquirer of Silicon Valley Bank in the period leading up to SVB’s collapse.

In addition, the Wall Street Journal has reported about criticism of Solomon from some of the firm’s partners and its former CEO, Lloyd Blankfein.

Morgan Stanley succession takes center stage

Analysts expect Morgan Stanley to report second-quarter earnings of $1.28 a share on revenue of $13.17 billion.

Expectations for Morgan Stanley have fallen from $1.79 a share on March 31 amid a slowdown in second-quarter deal-making.

Meanwhile, CEO succession at Morgan Stanley remains a major focal point for Wall Street after James Gorman said in May he plans to retire in 2024.

Citigroup earnings come as bank sells off overseas retail units

Citigroup is on tap to report second-quarter earnings of $1.35 a share on revenue of about $19.4 billion.

The bank’s earnings forecast for the quarter stood at $1.56 a share on March 31.

During the quarter, Citigroup said it would pursue an initial public offering of its Banco Nacional de México business in 2025 as it sheds its overseas retail banking units.

CEO Jane Fraser took to the bully pulpit in March to talk about the strength of the U.S. banking system in the face of the bankruptcies of Silicon Valley Bank and Signature Bank in an appearance at the Economic Club of Washington.

Last August, Citigroup said its plan to scale back its consumer banking operation in Russia would cost about $170 million, mostly over the next 18 months.