This post was originally published on this site

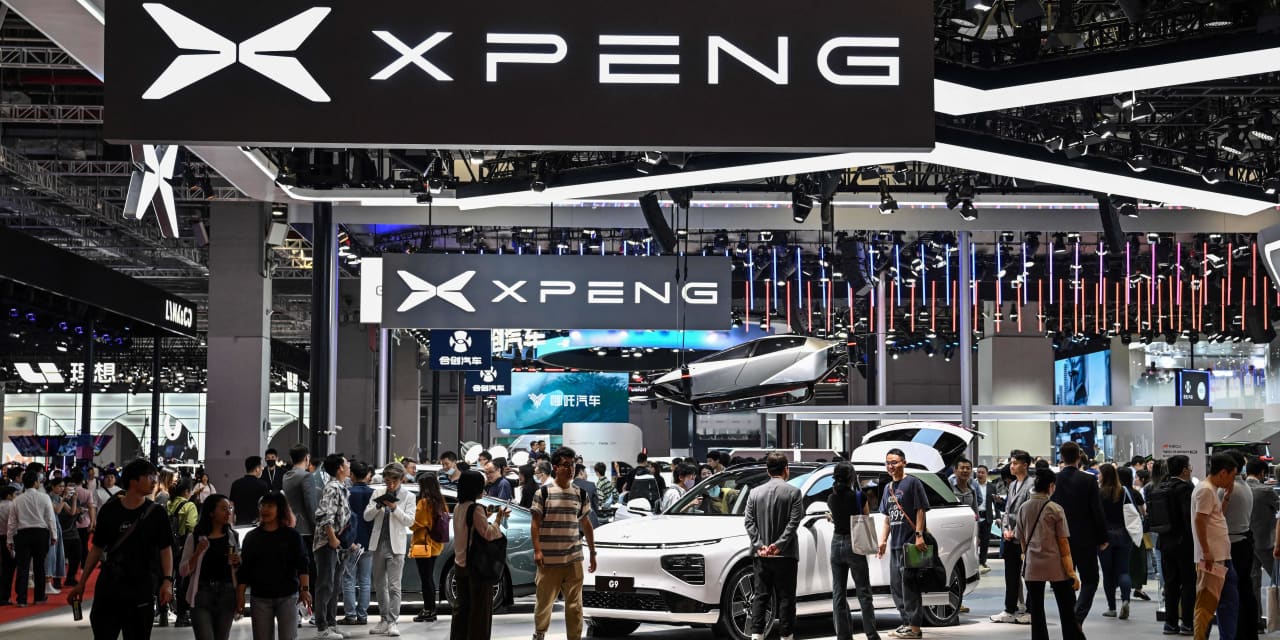

China-related exchange-traded funds surged on Monday, after a private sector survey pointed to resilient factory activity, and Chinese electric-vehicle makers reported solid delivery numbers for the month and quarter ending June 30, driving shares of Nio, XPeng and Li Auto higher.

The Invesco Golden Dragon China ETF

PGJ,

which tracks the American depositary shares of companies based in China, rose 2.2%, while the KraneShares CSI China Internet ETF

KWEB,

which offers exposure to Chinese software and information technology stocks, traded 2.4% higher. The iShares MSCI China ETF

MCHI,

and the SPDR S&P China ETF

GXC,

each surged 1.6%, according to FactSet data.

In China, the Caixin manufacturing purchasing managers index slipped to 50.5 in June from 50.9 in the previous month, but was above the 50 mark, which separates activity expansion from contraction, for the fifth month in a row, according to data released by Caixin Media Co. and S&P Global.

Economists expected the reading to hit 50.2 for June, according to a Reuters poll.

See: Nio, XPeng stocks surge after EV delivery data

Meanwhile, shares of China-based EV makers jumped after XPeng, Nio and Li Auto reported strong June deliveries that showed big jumps from May. Shares of Li Auto Inc.

LI,

rallied 3.4% toward an over one-year high, while XPeng Inc.

XPEV,

was up 4.2% and Nio Inc.

NIO,

advanced 3.5%.

The jump came after Tesla Inc.

TSLA,

Sunday reported that it delivered a record number of vehicles in the second quarter, beating market estimates after the electric-car maker increased discounts and incentives. The EV maker is also expected to achieve record sales yet again in China, its second-largest market after North America. Shares of Tesla jumped 6.9%.

China’s blue-chip indexes advanced on Monday with the CSI 300

000300,

up 1.3% and the Hong Kong’s Hang Seng Index

HSI,

adding 2.1% after the country’s central bank said Friday it would implement “prudent” monetary policy in a “precise and forceful manner” to support the country’s sluggish economic recovery from the COVID-19 pandemic.

The People’s Bank of China, or PBOC, also vowed to step up efforts to stabilize the yuan, which slipped to near eight-month lows against the dollar last week. The yuan

USDCNY,

traded at 7.25 per dollar on Monday.

China gets the new quarter underway after Chinses equities massively underperformed the U.S. stocks in the first half of the year. The CSI 300 index has risen a modest 0.5% so far in 2023, and the Hang Seng has dropped by 2.4% year to date, according to FactSet data.

That compares to a 32% jump for the Wall Street’s tech-heavy Nasdaq Composite

COMP,

which posted its best opening six-months in four decades on Friday, and a 16% advance for the large-cap index S&P 500

SPX,

according to Dow Jones Market Data.