This post was originally published on this site

Is it time for a millionaire money makeover?

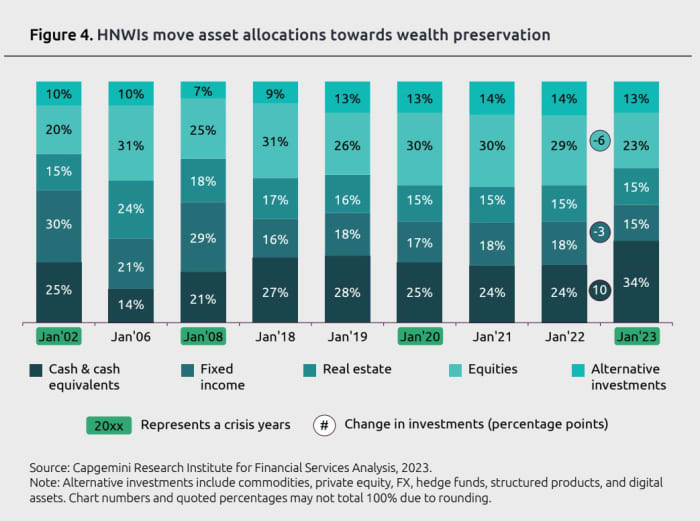

This past year has clearly been tough on investors — from clock-watchers to high-net-worth individuals — and the latter have shown a dramatic change in behavior. Falling stock prices, rising interest rates, an uncertain economic outlook and the constant drumbeat of recession have led high-net-worth individuals (HNWI) to change their investing habits: they’re keeping their money in cash and cash equivalents at the highest rate in more than a decade.

The Capgemini Research Institute, a global think tank, tracks the behavior of HNWI around the world, and analyzes the asset allocation from the most conservative individual investor to the most aggressive. In its latest annual report, the number of the world’s HNWI has fallen to 21.7 million in 2022 from 22.5 million in 2021, largely due to a fall in stock prices, the latest report found. (Other sources have higher estimates for the world’s HNWI population.)

Here’s a breakdown of the numbers: HNWI individuals stored 34% of their wealth in cash and cash equivalents in 2022, up 10 percentage points from 24% during the prior year, according to Capgemini’s annual wealth report, which was released this month. It’s also 20 percentage points lower than the 14% stored in cash and cash equivalents in 2006, a couple of years before the Great Recession. What’s more, cash is expected to remain high — along with interest rates.

“We’ve never seen this before — banks are sitting on tons of cash, sitting idle, waiting for the right opportunity,” Elias Ghanem, global head of Capgemini Research Institute for financial services, told MarketWatch. “The amount of money held in cash has never been so high, and the jump year-over-year has never been so high. They’re putting their money into short-term cash allocation, checking accounts, savings accounts, and CDs.”

Holding off on investing in equities

These habits appear to be reflected by retail investors who don’t have millions of dollars to invest (or burn). “Some of our clients are hesitant to invest cash in this environment and, more often than I can remember in the last few decades, are asking for T-bill and CD ladders while they wait,” Lorraine Ell, chief executive and senior financial adviser of Better Money Decisions, a financial advisory firm near Albuquerque, N.M.

“We don’t recommend waiting, but this is a time when clients are requesting to hold off investing in equities, probably a result of high interest rates for holding cash and cash equivalents and uncertainty about interest rates and recession and their impact on markets,” she added. Flows into exchange-traded funds this year have gone into defensive equities and bonds — and not more aggressive equities, she added.

Indeed, total ETF flows so far this year suggest “investors’ diminished appetite for risk,” a June report by State Street Global Advisors concluded. ETFs took in $44 billion in May, in line with the 5-year average of $44 billion, but below the 3-year average of $54 billion. But only 47% of ETFs had inflows — 15 percentage points below the historical median,” it said. “Equities were 17 percentage points below their historical median (44% versus 61%).”

Given the economic backdrop and how many Americans are living paycheck to paycheck, there is one big problem for those who would like to stash their cash: they don’t have the cash to begin with. In fact, only 48% of U.S. adults say they have enough emergency savings to cover at least three months’ worth of expenses, a recent Bankrate survey found. That percentage has remained virtually unchanged since it was 49% in 2022 and when inflation was at a 40-year high.

HNWI individuals stored 34% of their wealth in cash and cash equivalents in 2022, up 10 percentage points from 24% during the prior year.

Source: Capgemini Research Institute

And for those who do have money to invest? The year got off to a promising start with a stock-market rally, but it recently appeared to run out of steam. The S&P 500

SPX,

has rallied more than 14% so far in 2023 and is up nearly 15% over the last 12 months. The rally has been concentrated, however, in megacap tech stocks, leaving much of the market behind. An equal-weight measure of the S&P 500 is up just 4.4% so far this year and 8.8% over the last 12 months, according to FactSet.

“We don’t think the rally is over, but it may be difficult” for that earlier rally to continue in the weeks ahead “with liquidity coming out of the system,” Michael Arone, managing director of State Street Global Advisors, told MarketWatch in a phone interview earlier this week. So much for FOMO — “fear of missing out” — by those investors sitting on the sidelines.

Global stocks reported their worst performance since the 2008 financial crisis with nearly $18 trillion wiped out in 2022, the Capgemini report said. Only 23% of their investible wealth was held in equities, down 6 percentage points from 29% in 2021. Real estate appeared to be another relatively safe haven with a 15% allocation, a percentage that has not changed since 2020. Ditto alternative investments, which hovered at 13% to 14% for the last four years.

Searching for a middle ground

“When cash was yielding zero, purely from an investment perspective, clients had little incentive to hold cash,” Andrew Schuler, investment managing director at PNC Private Bank, told MarketWatch. “Now, given recession fears and the substantial rise in rates, many clients are more comfortable holding cash yielding around 5% instead of taking risks in the markets.”

But he said that comes with a downside. “We do tell our clients that the risk you don’t see is the loss of purchasing power,” he added. “When inflation is running 4%-5%, your real yield is close to breaking even. This is unlikely to achieve the investment results the clients’ longer-term goals and objectives require.”

“It doesn’t have to be all-or-nothing decisions,” Schuler said. “Sure, you can hold a higher cash reserve, but that doesn’t mean you should be all cash or all invested — there is a middle ground using higher yields to your advantage as part of your asset allocation. We always recommend that clients maintain sufficient cash to satisfy current lifestyle needs and other known expenses.”

Wealth preservation is the No. 1 focus

Nearly 70% of HNWI individuals cited “wealth preservation” as their No. 1 focus. “I’ve been presenting this report to banks across the globe,” Ghanem said. “All of them are confirming what I’ve told you.”

Capgemini considers high-net-worth individuals anyone with investible assets of $1 million and above, excluding their primary residence, and divides these HNWI millionaires into several categories: “millionaires next door” with $1 million to $5 million in investible assets, midtier millionaires with $5 million to $30 million, ultra-HNWI with $30 million or more. Their net worth fell to $83 trillion at the end of 2022 from $86 trillion in 2021, Capgemini’s report found.

Some regions were hit harder than others. “Difficult macroeconomic conditions led to bearish global markets and significant declines in indices across regions. Following suit, globally, HNWI wealth and population totals dropped by 3.6% and 3.3%, respectively, as compared to the prior year,” the report added. “While still the wealth leader, North America registered 2022’s steepest declines, with total HNWI wealth falling by 7.4% and population by 6.9%.”

“This is where people are today,” Ghanem said. “High-net-worth individuals are taking a wait-and-see approach, ready to make the next investment when the right opportunity presents itself.” Many cash investors are looking at 5%-plus interest. But he remains optimistic about equities in the long term. “Everyone is saying, ‘Something positive will happen, and I want to be able to act fast on it,’” he added. “They’re saving their assets to do the job.”