This post was originally published on this site

In 2018, Luvleen Sidhu, founder of BankMobile, sat on the floor of the New York Stock Exchange and told Cheddar, a news site geared towards millennials, that she wanted millions, including college students, to open accounts at her online financial services company.

“[It’s] not because the numbers matter,” Sidhu said of the company’s aim. “It’s because we have a social mission here and we’re hoping to help these students.”

The 2018 appearance was one of many times when Sidhu, who was 28 years old when she founded the company, according to Forbes, described BankMobile in lofty terms. In a 2014 press release announcing that BankMobile, then a division of Customers Bank, had appointed her as its chief strategy officer, Sidhu said BankMobile’s products would offer a solution for millennials, including her friends and peers, who were feeling overburdened by debt. “We are beginning what we consider a revolution that will disrupt the traditional banking landscape,” she said.

Today, the company’s promise to upend the banking industry is faltering. BankMobile is now known as BM Technologies, or BMTX

BMTX,

The company isn’t a bank. Instead, it’s a financial technology company that partners with banks to provide accounts and other financial services. Its stock has tumbled by nearly 50% in the past year and BMTX announced in January that it would lay off about 25% of its staff amid broader cost-cutting measures and the reorganization of its executive suite. The market valuation of the company is $36.9 million.

Sidhu’s talk of her company’s social mission is also being questioned by regulators and consumer advocates who are concerned about its approach to college students. The company signs those students up through partnerships with schools.

For years, regulators have scrutinized these partnerships broadly, arguing that by introducing financial products to students through colleges and universities, they put a vulnerable group of consumers at risk of being preyed upon. As part of a required annual report to Congress monitoring these deals, the Consumer Financial Protection Bureau found that hundreds of thousands of students who opened BMTX college-sponsored accounts “are paying fees they might not be subject to if they opened different accounts.”

The report said the way university partners first present these types of accounts to students sometimes does “not appear to meet the standards” set forth by the Department of Education regulations surrounding campus banking products. This month the CFPB confirmed that the BMTX website featured in its report provided an example of the concerning language.

These rules require that college-sponsored bank accounts offered to students as part of the financial aid disbursement process, like those provided by BankMobile, be consistent with students’ best financial interests.

Though not a household name, BMTX distributes government funds critical to hundreds of thousands of students who use the money to pay for rent, food and other bills. Advocates say the company, which held roughly 70% of the college-sponsored bank accounts on the nation’s campuses, in the sample the CFPB reviewed, isn’t scrutinized closely enough by regulators charged with upholding the Department of Education’s campus banking rules and other consumer protection regulations. In its securities filings, BMTX wrote that “there is limited enforcement and interpretive history,” of the rules that govern the company’s products on college campuses.

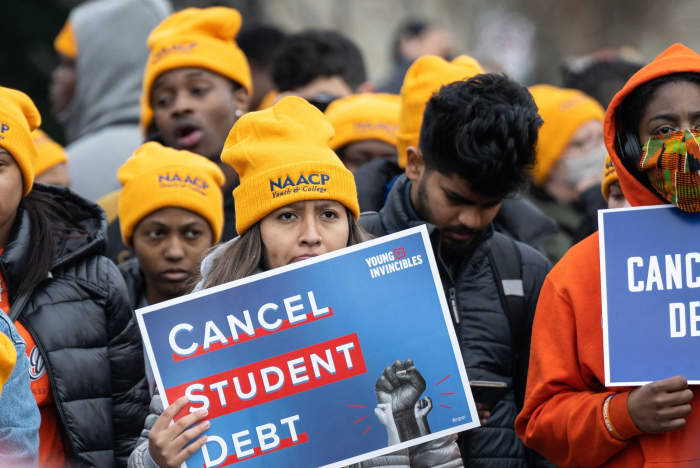

BMTX is one of many third parties students encounter throughout the college-finance system. Advocates, regulators and some lawmakers have warned that the federal student loan program’s reliance on for-profit entities has made it harder for students and borrowers to pay for college and repay student debt.

For years advocates, regulators and lawmakers have been concerned about the role of for-profit entities in the student loan system. (Photo by ANDREW CABALLERO-REYNOLDS/AFP via Getty Images)

andrew caballero-reynolds/Agence France-Presse/Getty Images

Sidhu and her company are on the ground floor of the financial lives of college students. Universities pay the company to help them disburse financial-aid money students receive in excess of tuition. As part of these deals, BMTX has the opportunity to present students with one of the company’s bank accounts as an option for depositing that money.

“There just seems to be this huge mismatch between how important of a role this company plays and how competent the company appears to be,” said Ben Kaufman, the director of research and investigations at the Student Borrower Protection Center, an advocacy group, referring to the company’s ongoing challenges, including its restructuring and stock-price decline.

Sidhu declined an interview request, but in written responses to questions from MarketWatch, a BMTX spokesperson defended the company’s practices and said the company complies with the Department of Education’s regulations surrounding its products.

“BM Technologies is on a mission to provide affordable, transparent, consumer friendly banking to millions of Americans, and our student checking account offering supports this mission,” the spokesperson wrote. The company “remains committed and dedicated to offering an affordable student checking account.”

***

About a year after BankMobile launched its app, Sidhu described how her company was going to disrupt the banking industry by growing more quickly and aggressively than traditional financial services firms.

“We need to stop thinking in terms of 10% and start thinking about 10x,” said Sidhu from the stage at the Financial Brand Forum, a gathering of bank marketing executives. “The moonshot that we had at BankMobile is that we wanted to acquire at least 10 times more customers a day than an average traditional bank.”

One key to doing that was to partner with universities to disburse financial-aid refunds, Sidhu and other company officials have said over the years. By taking over that process, the company solved a “pain-point” for schools across the country, said Sidhu, appearing on screen at a business summit last year.

“We get to ask these students that are receiving these funds, ‘do they want to ACH to an existing bank account?’” Sidhu said, using the industry term for a bank transfer, “or do they want to open a very compelling, competitively positioned, student-focused BankMobile checking account?”

In speaking elsewhere with investors and the media, BMTX leaders have made clear that part of their strategy is to use their partnerships with colleges and universities to cheaply lure customers who have the potential to use their bank products for decades to come.

In a 2022 investor presentation, BMTX touted its access to roughly one in three college students each with the potential to become a “customer for life.” Sidhu has said the company pays “less than $10” to acquire customers, compared with up to $1,500 for other banks and fintech companies, according to Chardan, an investment bank. BMTX offers banking products to customers other than students, but the student accounts offer a consistent source of revenue. Sidhu has called the university partnerships “a beautiful business” that “chugs along so well.”

This “extraordinary customer acquisition model” as Sidhu has described it, is part of a years-long trend of colleges and financial institutions partnering. But in the past regulators, including at the CFPB, have described these relationships differently calling them an “unholy alliance,” that they say could put students at risk.

“There is an assumption that if they are putting their stamp on it that it is not a bad deal for most people,” Dalié Jiménez, a professor at the University of California, Irvine School of Law, said of colleges. “It could be a bad deal in the way that the CFPB described,” she said, referring to the CFPB’s findings that BM Technologies’ campus accounts may not meet the standards of the Department of Education’s rules and that students using the accounts could be paying fees they might not face with other products. “It could also be a bad deal because the school chose a company that is actually not competitive,” she added.

For years, state attorneys general and federal regulators have tried to put guardrails on deals between colleges and financial institutions that market student loans, credit cards, and now, bank accounts. Despite the scrutiny, companies and schools are still eager to partner.

“These bank relationships are extremely lucrative,” said Ed Mierzwinski, senior director of the federal consumer program at PIRG, a consumer advocacy organization. “The money comes from student pockets mostly — although it also comes from the colleges in many cases that pay fees,” to BMTX for managing the student refund process.

BMTX works with colleges across the country to disburse financial aid refunds. (Photo by Robyn Beck / AFP) (Photo by ROBYN BECK/AFP via Getty Images)

robyn beck/Agence France-Presse/Getty Images

BM Technologies established a “robust compliance management, monitoring and oversight program,” even though Department of Education regulations do not require the company to establish the program, the BMTX spokesperson wrote in response to a question from MarketWatch about regulators’ concerns surrounding the impact on students of partnerships between financial institutions and schools.

“BMTX provides this additional service to help ensure our college and university partners meet their regulatory obligations,” the spokesperson wrote. The spokesperson added that every two years schools are required to ensure that the fees associated with the BMTX account offered to students are “consistent with or below” market rates. The Department of Education “does not outline a procedure for conducting Due Diligence,” the spokesperson wrote, but BMTX has established its own due diligence procedure and it requires its clients to participate in the process.

As part of its report released last year, the CFPB listed the financial institutions with college-sponsored accounts in their sample where students paid the highest average annual fees during the 2020-2021 academic year. BMTX ranked second on that list. Because so many students work with BMTX, the company made the most from those fees — $12.6 million — of any of the partner financial institutions reviewed by the CFPB.

Cait Brooner was one of the students funneled towards BMTX through a partnership with her school. She first heard about the company from Tulsa Community College, when she enrolled there in 2019. The college is one of 363 across the country that had a relationship with BMTX, according to the sample of campus accounts the CFPB reviewed.

Brooner said she felt the college steered her toward using BMTX to receive her refunds. TCC’s webpage about refunds links to a page on BMTX’s website indicating that banks “typically” take “1-2 business days” from when a school sends the funds to BM Technologies to credit the money to a student’s existing account. By contrast, students who open a BankMobile Vibe account can expect to have the money deposited “the same business day” BMTX receives it from the school, the website says.

“When I would ask people at the bursar’s office or the financial aid office for more information about this company, they were super palms up, flippant, had no answer for me besides ‘just go to the website,’” she said. “You’re basically working with this company or you’re getting nothing and you’re screwed and it’s really aggravating.”

In response to a MarketWatch’s question about Brooner’s situation, the BMTX spokesperson wrote that various materials provided to students explain students’ choices for receiving their financial aid refund “in detail, and in a fact based and neutral manner.” The spokesperson added, “in fact, we explicitly state within refund selection that you are not required to open a BankMobile Vibe checking account.”

Anytime financial aid funds were loaded onto her BankMobile card, Brooner would take steps to move the money to her PayPal

PYPL,

account or another bank account, but found the process could take several days. For Brooner, who held multiple jobs while at TCC, including doing alterations at David’s Bridal and clerical work at her college, getting access to her money quickly and seamlessly was crucial.

“Some semesters I was so broke it was literally teetering on them,” Brooner said of the company’s role in her financial life at the time. She grew so frustrated with BMTX that she eventually canceled her account.

Nicole Burgin, a spokesperson for Brooner’s former college, TCC, said the school couldn’t speak to the details surrounding Brooner’s experience, “but we believe it is an isolated situation.” BM Technologies processed just under 24,500 disbursements on behalf of TCC during the 2022-2023 academic year and 8% opted to receive their refund in a BankMobile account, compared to 81% who used an existing bank account, according to Burgin. The other 11% received a paper check, Burgin wrote.

“TCC follows the U.S. Department of Education guidelines and policies when it comes to the disbursement of federal student aid and subsequent refunds to students,” Burgin wrote. “In adhering to a requirement of the U.S. Department of Education, TCC evaluates the BankMobile contract annually with regards to costs, features and how they compare to other banking institutions for fees and services.”

Like Brooner, Krystal Baez first heard of BMTX through her school, Prince George’s Community College. Baez said she was hesitant to sign up, but thought “it’s through the school so it would be fine.” The idea that it might take her an extra day or two to get her financial-aid refund if she used an existing bank account also sold her on trying out the company.

“I was like, ‘cool, perfect, I’ll do that if I could get it same day,’” she said. But in reality, “it was just a headache.”

Baez, 31, said she never received her bank card from BMTX, so when her refund money hit her account it was difficult to access. The company would give her a temporary card she could use through her phone, but it expired after two weeks. Baez, a single mom, needed the funds to pay her rent and other bills. So Baez said she called the company multiple times to get them to send her a new card.

The BMTX spokesperson said the company “attempted to send a debit card on three occasions,” to Baez, “to no avail.” Baez said company representatives told her they were sending her a new card multiple times, but she never received it, “and they basically just blamed it on the Post Office.”

Eventually, Baez said, the company told her she could wire the money to another bank account or they could send her a new card again — both fixes that she says she was told would require paying a fee. “All of their solutions was a fee and I was like, ‘that’s crazy, this was your problem to begin with.’”

Ultimately, Baez grew so frustrated with BMTX that she closed her account. But the ordeal made her question the company’s relationship with her college. “You guys are looking for young students to sign up who will do whatever,” she said of BMTX. “You’re just preying on college students who don’t know anything.”

What’s more, the efficiency promised through BMTX never materialized. “If I would have just let them deposit in my bank account,” she said of her school, “I would have had access to my funds faster.”

Sonji Joyner, a spokesperson for Prince George’s Community College, wrote in an email that the school’s student accounts department has received “positive feedback” from students about its financial aid disbursement process.

“The comments from the CFPB are concerning and we value our students opinions and concerns,” Joyner wrote. “If any of our students are having any issues we will work diligently to find a solution.”

***

BM Technologies began as BankMobile, a digital bank Luvleen Sidhu and her father, Jay Sidhu, founded in 2014 inside Customers Bank

CUBI,

a regional bank with over $21 billion of assets, where Jay Sidhu was CEO. Luvleen Sidhu began working on BankMobile after graduating from Harvard University and Wharton Business School with stints at investment management firm Neuberger Berman and consulting giant Booz & Company, according to securities filings.

It was partially Jay Sidhu’s previous experience launching an online bank that pushed BankMobile toward working with universities. Sidhu, a longtime banking executive, had tried to start a branchless bank before as the CEO of Sovereign Bank, but the venture shut down after struggling to draw customers, he told the Wall Street Journal in 2015.

To solve that problem for BankMobile, the elder Sidhu told the Wall Street Journal he hoped to build off a relationship between Customers Bank and Higher One, a firm that partnered with universities to provide students with their financial-aid refunds. By the time the Sidhus launched the BankMobile app in 2015, Customers had access to 1.2 million student checking accounts and ATMs at 800 universities through the partnership. The elder Sidhu told the Wall Street Journal at the time that he hoped some of those students would stay with BankMobile after graduation.

But Higher One hadn’t served students well, according to regulators. In 2012, Higher One agreed to pay $11 million over claims it overcharged students on fees. At the time, the company neither admitted nor denied liability. Its student checking account included fees like a 50-cent charge for accountholders to use their PIN instead of a signature at a store, a $50 fee if a student had an overdrawn account for more than 45 days and a $10 monthly fee if a student stopped using the account for six months.

In 2015, the Federal Reserve ordered Higher One to pay about $24 million in restitution to about 570,000 students over claims the company misled students. The FDIC also ordered Higher One and a bank partner to pay about $31 million to 900,000 consumers over similar claims. The regulators also each fined the company $2.23 million.

Marc Sheinbaum, the chief executive officer of the company at the time the fines were announced, provided a statement to multiple media outlets saying the company had already completed changes that would allow its products and services to comply with a significant portion of the issues raised. “After joining Higher One in 2014, I charged our team to set new standards for transparency and compliance,” Sheinbaum said.

Rohit Chopra who, at the time had recently stepped down from his job as the student-loan ombudsman at the CFPB, said the enforcement action, “put the nail in the coffin of their broken business model.” “Schools should think twice before partnering with companies that recklessly violate the rights of their students,” Chopra said at the time. He’s now the CFPB’s director.

In 2015, Rohit Chopra criticized practices in the campus banking industry. He is now the CFPB’s director. (Photo by Anna Moneymaker/Getty Images)

Anna Moneymaker/Getty Images

In launching rules aimed at cracking down on these partnerships, the Department of Education cited legal action against Higher One. The regulations, which took effect in 2016, are known as the cash-management rules and they require that campus bank accounts offered through the financial aid disbursement process be consistent with students’ best financial interest.

The “heightened scrutiny” on Higher One’s practices in the college banking space is what pushed the company to sell that part of the business, according to a securities filing. Customers Bank, at the time BankMobile’s parent company, bought it. Now, companies that want to distribute financial-aid funds and introduce a college-sponsored account as part of the business have to abide by stricter rules than those just offering college-sponsored accounts on their own. But by acquiring Higher One, BankMobile was able to become the largest player in that highly-regulated market essentially overnight.

With his company in charge after the acquisition, Jay Sidhu vowed that his bank wouldn’t subject students to high fees. “With BankMobile, students can be confident this will never happen again,” he said of Higher One’s conduct in 2015 in a statement, according to BuzzFeed.

After a few years of searching for ways to spin BankMobile out of Customers, the Sidhus pushed BankMobile to the stock market by merging it with Megalith, a special purpose acquisition company, or SPAC, during the COVID-era SPAC boom. At the time, Jay Sidhu was executive chairman at Megalith, according to American Banker, meaning he was on both sides of the transaction. Months before the transaction was announced, Sam Sidhu, Luvleen Sidhu’s brother and Jay’s son, served as Megalith’s CEO.

Though BM Technologies is now a separate public company, it still has a banking partnership with Customers.

BMTX maintains “an arm’s length relationship with Customers Bank,” which is “clearly disclosed” in BMTX’s public filings, the BMTX spokesperson wrote in a response to questions from MarketWatch about the Sidhu family’s role in the company.

In 2021, the year BankMobile went public and renamed itself BM Technologies, Luvleen Sidhu received roughly $16.3 million in total compensation, securities filings show. About $16 million of Sidhu’s compensation package came in the form of stock, including 809,248 shares of restricted stock granted by Customers Bank as severance for her work at the company before BMTX merged with Megalith.

The company said the stock award value reported for Sidhu “does not represent compensation” to her “unless and until ultimately vested.” Part of the criteria for vesting is based on achieving “defined performance goals that are directly linked to Company strategy, growth model, financial objectives, and ultimately to continued value creation for our shareholders,” the company wrote.

In securities filings, BM Technologies described Sidhu as a “recognized leader in the industry,” detailing accolades including being selected as one of Innovative Finance’s “Women in FinTech Powerlist 2020,” one of PaymentSource’s “Most influential Women in Payments:Next,” and Lendit Finetech’s Fintech Woman of the Year twice. The filings also say she’s “been featured regularly in the media,” including in CNBC, Crain’s New York and American Banker.

But BMTX struggled to find success as a company independent from Customers. In 2021, the company took a stab at acquiring a bank, announcing its intent to merge with First Sound Bank, a Seattle-based community bank with nearly $175 million in assets. The deal fell apart in 2022. Both Sidhu and Marty Steele, the chief executive officer at First Sound Bank at the time cited the “prolonged” regulatory approval process in their announcements calling off the deal.

That same year, the CFPB released its annual report on campus banking, which scrutinized some of the company’s practices. The report zeroed in on the BMTX-hosted website where schools often direct students for information about receiving their refunds. On this site, the first option listed is for students to deposit their funds into an existing account. “Typically, it takes 1 – 2 business days for the receiving bank to credit the money to your account,” the site reads.

If students choose to deposit their refund money in a BankMobile Vibe checking account instead, the funds are “deposited the same business day” the company receives the money from their school, according to the site.

The webpage does not “appear to meet the standards put forth in ED regulations,” which require that payments to a pre-existing bank account be “as timely and no more onerous to the student,” than depositing the funds in a college-sponsored account, the CFPB wrote in its report last year. The CFPB said recently it couldn’t comment on “any supervisory or enforcement work we may or may not be undertaking as that information is confidential.”

The company is “in compliance with” the Department’s regulations, the BMTX spokesperson wrote in response to MarketWatch’s questions. The spokesperson added that the company provides materials to its partner schools to help them stay in compliance with those rules and that there are “no financial incentives” for the schools to push students towards BMTX accounts.

“As required, BMTX provides students with their electronic disbursement refund choices in a fact based and neutral manner,” the spokesperson wrote. “Specifically, when presenting options BMTX lists the pre-existing account as the first and most prominent option. BMTX factually explains to students when they will receive their funds for each option as this is a question that the majority of students want answered and is the company’s number one call driver, i.e., when will I receive my refund?”

The federal regulator also highlighted another BankMobile practice, allegedly marketing to students an account with a fee to deposit their financial aid refund. The CFPB contrasts this practice with the Department of Education’s intent for the cash management rules to ensure that students “do not incur unreasonable and uncommon financial account fees.” In materials provided to students by their universities, the company lists the option for students to deposit their money in a BankMobile Vibe checking account, which carries a $2.99 monthly fee, the report notes. Students can avoid the fee with $300-a-month in deposits — but financial-aid refunds don’t count towards that $300. At the time the CFPB report was published, BMTX also offered a no-fee checking account but the company didn’t present this option on the menu provided to students to choose where to deposit their financial aid refund, according to the report.

The BMTX spokesperson wrote that the company’s student checking account charges four “reasonable and common fees” that are all in compliance with the Department of Education’s regulations. BMTX doesn’t charge what the spokesperson described as “industry standard fees,” including a minimum balance fee, a fee to investigate fraudulent activity and a fee to speak with a customer service representative.

The BMTX spokesperson wrote that the company’s student checking account is “in alignment with or better than prevailing market terms in the industry truly making it a great option for students.” BMTX discloses the $2.99 fee to students before they decide where to deposit their refund and students are “required to review the fee schedule and agree separately to any fee charged prior to an account opening,” the spokesperson wrote.

In addition, the BMTX spokesperson wrote that the fee is “easily avoidable” by making at least $300 worth of qualifying deposits during a statement cycle. Financial aid refunds are excluded from that $300 minimum, but the spokesperson wrote that the qualifying deposit is “not difficult for student account holders to maintain.” The average age of the company’s student account holders is 30 and the median age is 26, the spokesperson wrote, indicating that “these individuals are not typically full-time dependent students and in fact quite the opposite, as many have either part or full-time employment and attend school part-time.” Roughly 60% of BMTX student account holders who are 25 years-old or older earn at least $10,000 per year or about $800 a month before taxes, the spokesperson wrote.

“Essentially, BMTX’s student account holders are older than the average student age, and they tend to make more income per year, making it highly probable that they are easily able to maintain the $300 qualifying deposit,” the BMTX spokesperson wrote.

***

In the years following its stock market listing BMTX’s business struggled. The collapsed merger with First Sound scuttled plans for the company to diversify its business line and build a lending platform, according to American Banker. The firm also faced challenges competing for depositors in a high interest rate environment. The company posted a tiny loss in 2022 on revenues of $83.6 million.

After the company went public and, later, amid BMTX’s financial challenges and scrutiny from the CFPB, Sidhu touted her achievements. She explained to Inc Magazine that going public through a SPAC was for “the players that actually have strong fundamentals.” Sidhu also spoke to Tearsheet, which covers the “modernization of money and commerce”, about her routine, highlighting her daily meditation practice and her efforts to “help propel women in finance.”

Less than a year later, in March 2023, during the regional banking crisis, trading in shares of Customers Bank, BMTX’s bank partner, was temporarily halted after the price plunged more than 20%. BMTX’s exposure, however brief, to the regional banking problems exacerbated consumer advocates’ concerns about the financial-aid system relying so heavily on one company to get money to students successfully. For its part, the government will make sure the financial-aid disbursement process runs smoothly, a Department of Education spokesperson wrote in an email.

Department of Education rules that took effect in 2016 aim to put guard rails on partnerships between financial institutions and colleges.

Getty Images

Now, the fate of BMTX’s student business is tied to a relatively small community bank in North Carolina. The company announced in March that it would be moving its student deposits from Customers to First Carolina Bank, which has $2.2 billion in assets.

Kaufman’s consumer-advocacy organization as well U.S. PIRG wrote state and federal regulators asking them to “intervene” in the proposed deal and “use your respectively broad authorities to initiate careful scrutiny of the past and present conduct,” of both entities.

To make their case, the authors warned that First Carolina may not be ready for the influx of accounts, which would grow their deposit base by nearly 25%. They also point to the findings in the CFPB report and write that BMTX hasn’t “indicated any intention to change its conduct.”

In response to questions from MarketWatch about the letter, Sidhu said that the company “respectfully” disagrees with the letter’s contentions and “would welcome an opportunity to engage in a dialogue to educate the authors of the letter about our business.”

“Our company and the coalition’s interests are aligned, empowering the student population, and ensuring that they have the financial tools to successfully participate in the financial system,” she said.