This post was originally published on this site

Intel Corp.’s shares scored their best week in 14 years Friday, after one analyst said the chip maker still has a “material AI opportunity” amid rivals Advanced Micro Devices Inc. and Nvidia Corp.

On Friday, Intel

INTC,

shares rose 1.5% to finish at $36.37, for a weekly gain of 16.1%, their best week since the one ending July 17, 2009, when shares rose 17.1% after the chip maker reported a better-than-expected quarter and outlook, according to FactSet data.

On Friday, Morgan Stanley analyst Joseph Moore had increased his target price on Intel to $38 from $31, while maintaining his equal weight rating on the stock.

Read: AMD, Nvidia face ‘tight’ budgets from cloud-service providers even as AI grows

“Intel does have material AI opportunity, but due to larger legacy server business also has more meaningful headwinds as cloud budgets adjust to higher levels of AI spending,” Moore said. “We see the principal near-term opportunities from Habana Labs/Gaudi, specialty silicon that the company acquired a couple of years ago, that could drive material revenue in inference next year [and training down the road].”

“But for AI to drive stronger growth overall, we will need a recovery in servers spending to drive revenues back to a profitable level,” Moore noted. Intel was savaged in both data-center and CPUs as chips flipped from short supply during the COVID pandemic to a glut about a year ago.

Read: Open-source AI: AMD looks to Hugging Face and Meta spinoff PyTorch to take on Nvidia

Year-to-date, Intel shares have risen 37.6%, compared with a 45.1% rally on the PHLX Semiconductor Index

SOX,

a 14.9% gain on the S&P 500 index

SPX,

a 30.8% surge on the Nasdaq Composite Index

COMP,

and a 3.8% rise on the Dow Jones Industrial Average

DJIA,

Those gains pale in comparison to those of Nvidia

NVDA,

with a nearly 200% share price gain on the year, and AMD

AMD,

with shares up 85.4% on the year. Those are followed up by Marvell Technology Inc.

MRVL,

with a 65% gain, and Broadcom Inc.’s

AVGO,

55.3% gain.

Moore also switched his “top pick” designation to Nvidia from AMD, and also raised his price target on Marvell to $68 from $55. AMD shares finished down 3.4% at $120.08 Friday, while Nvidia shares rose 0.1% to close at $426.92, and Marvell shares finished down 1.5 at $61.12.

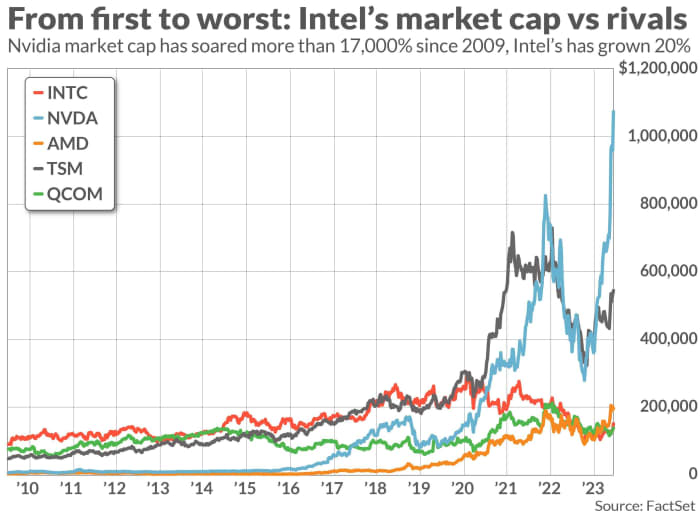

Market caps over the past 14 years (in millions)

Back in 2009, Intel commanded a $109 billion market cap, with Qualcomm Inc.

QCOM,

being the next largest chip maker at a $78 billion valuation. Third-party fab Taiwan Semiconductor Manufacturing Co.

TSM,

had a cap of around $52 billion, while Nvidia was valued at $6.7 billion, and AMD was a $2.8 billion company.

At the beginning of 2020, on the other hand, Intel was a $261 billion chip maker, having slipped behind TSMC’s $303 billion cap. Nvidia was trailing close at $145 billion, and would overtake Intel in mid-2020, after Intel reported delays in its next generation of chips. Qualcomm was at $78 billion and AMD was a $51 billion contender at the time.

Currently, Nvidia rules the pack having recently become the first chip maker to join the $1 trillion club when it comes to market capitalization.