This post was originally published on this site

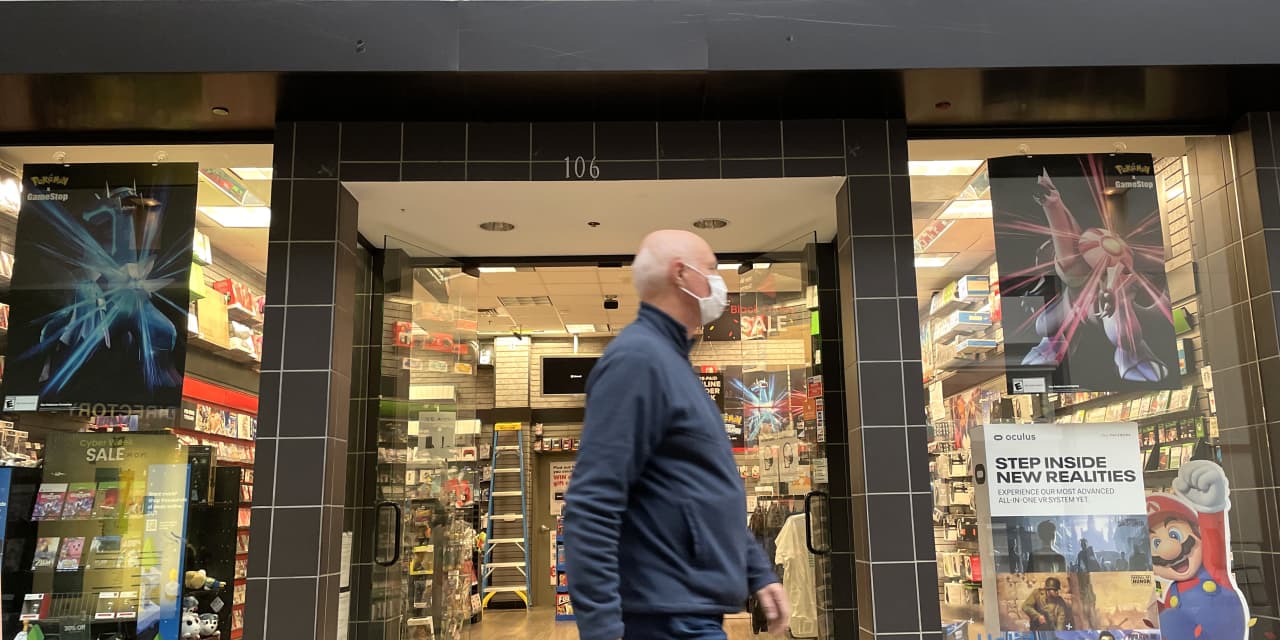

GameStop Corp. could get a sales boost this year from big videogame releases like “The Legend of Zelda: Tears of the Kingdom” and “Hogwarts Legacy.” But when the gaming retailer reports first-quarter results on Wednesday after the market close, profit could still prove hard to come by.

The results for GameStop

GME,

will arrive three months after the company put up a surprise profit in the holiday season, the retail chain’s first quarter in the black in two years. Continuing outperformance could depend on sales of popular games like Warner Bros. Discovery’s

WBD,

billion-dollar blockbuster “Hogwarts Legacy,” which launched during GameStop’s first quarter, and “Tears of the Kingdom,” which went on sale in May.

Wedbush analyst Michael Pachter, in a research note on Friday, wrote that recent store checks found that customers were lining up outside GameStop stores to buy the new “Zelda” game when it debuted last month for the Nintendo Switch. The game sold more than 10 million copies within its first three days of availability, Nintendo Co Ltd.

7974,

said last month, making it the fastest-selling Nintendo game ever in the Americas.

That game alone, Pachter said, “could conceivably drive north of $75 million of new software sales for GameStop” in its second quarter. And it is just one of a string of hot new releases. Stifel analysts on Sunday wrote that the slate of game releases over the first half of the year “boasts at least one game the last 4 consecutive months that has shifted at least 5 million units during the first few weeks in release, providing additional confidence behind our original forecast for ‘strong’ full game sales in ’23.”

Nielsen data indicated that for May, “Tears of the Kingdom” was the top console or PC game that U.S. consumers “plan to buy next,” the Stifel analysts wrote. Other top choices include “Hogwarts Legacy,” as well as “Diablo IV,” which Activision Blizzard Inc.

ATVI,

fully released Tuesday, and “Street Fighter 6,” which launched last week.

Still, Pachter noted that despite GameStop’s cost-cutting efforts and the benefit of holiday-season momentum, its operating margin in the fourth quarter was just above 2%, a sign that the company still had a lot more work to do. And he said broader trends — namely the migration toward online and mobile gaming and shopping, as well as subscription software — remained challenges.

“Cost cuts have recently improved [earnings per share],” Pachter said, “but it is unrealistic to expect breakeven or better quarterly results until the holiday quarter.”

GameStop has only produced three profitable quarters since mid-2019, and all three were holiday periods. For the first quarter, Pachter said he expected a slight sales dip from a year ago. That decline, he said, would follow “robust growth for PS5 hardware and collectibles momentum offset by softness for Nintendo’s Switch and a challenging comp for Microsoft’s

MSFT,

Xbox.”

In-depth: There is a ‘new normal’ in the videogame industry, and Wall Street is still adapting

Still, any detailed remarks from executives on future expectations, or color on demand trends, is unlikely during GameStop’s earnings call. Since the retailer found itself on the meme-stock roller coaster in 2021, executives have become more tight-lipped during those calls, forgoing Q&A sessions with Wall Street analysts and keeping calls short.

While GameStop shares have faded from the atmosphere-busting gains seen at the dawn of the meme-stock era two years ago, they’re still above anything seen in 2019 and 2020, with a market capitalization of roughly $7.4 billion as of Tuesday. The stock is down 24% over the past 12 months, however.

“GameStop shares trade at a level that fails to consider its many challenges ahead,” Pachter said in his note, adding that he was keeping his underperform rating on the stock.