This post was originally published on this site

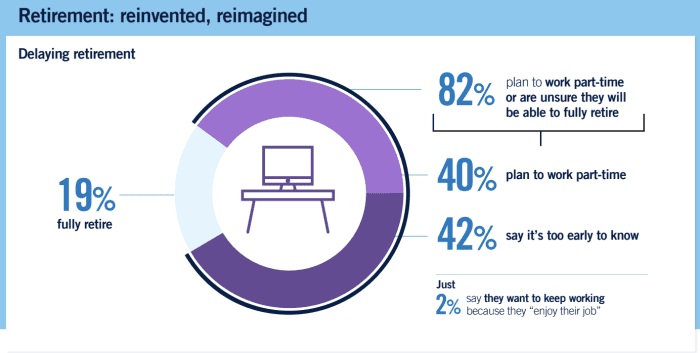

Members of Generation X may be getting close to retirement age, but they’re apparently not giving it too much thought. Only 19% of those in that cohort, who are now about 43 to 58 years old, think they will ever fully retire in the old-fashioned way that involves leaving their jobs and enjoying their golden years, according to a new survey from Prudential Financial.

So what are the other more than 80% planning to do? They are pretty evenly split between those who say they will keep working at least part-time basically forever and those who say they haven’t thought about retirement yet. Only 2% say they intend to keep working because they like what they do and want to keep at it.

“Do you even call that retirement? I don’t know if that actually qualifies,” says Rob Falzon, vice chair of Prudential Financial, who oversaw the survey.

Prudential Financial

But the fact that so many Gen Xers plan to keep working could be seen as good news for this group. If they work longer, they may eventually save more — and with other recent retirement surveys showing that most Americans don’t have enough money saved for retirement, it’s likely many of them will need to do just that.

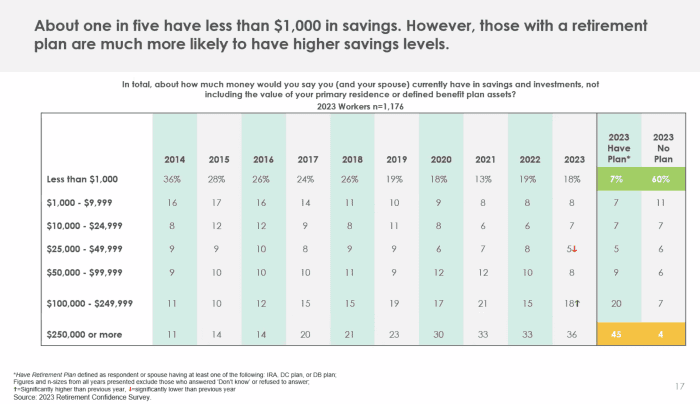

The 2023 Retirement Confidence Survey from the Employee Benefit Research Institute found that 1 in 5 Americans had less than $1,000 in savings and that retirement confidence had dropped by the most since 2008. Most of that drop is attributed to younger workers rather than older ones. But the Prudential survey found that 18% of Gen Xers had nothing at all saved for retirement, and 35% had less than $10,000.

On the other end of the spectrum, EBRI found that 36% have more than $250,000 saved, although that’s heavily skewed toward those who have access to workplace savings plans.

The lost generation

Generation X has had some bad luck when it comes to saving for retirement. It also often gets overlooked in data because it is much smaller than the enormous baby boomer generation that preceded it and the even more massive millennial generation that follows it.

“We have historically seen that older retirees are more confident. Millennials and Gen Xers are the least confident and the most concerned,” says Lisa Greenwald, chief executive of Greenwald Research, which worked on the EBRI report.

Most members of Generation X do not have access to pensions or other guaranteed income in retirement, yet they are also too old to have benefited from advances like automatic enrollment in workplace 401(k) plans and automatic increases in their contributions. Gen Xers also don’t expect to inherit much. Most of the massive $70 trillion wealth transfer that experts say is on the horizon is expected to flow from boomer parents to their millennial children.

Add to that the precarious future of Social Security, which is projected to run out of funds to pay full benefits when the oldest Gen Xers turn 69, and you have a potential disaster in the making.

“They received no education and have no concept of what amount of assets they would need on their own. They don’t know how to do that basic math,” says Falzon of Gen Xers. “By and large, they are not well prepared.”

EBRI

The time to plan for retirement is now

For those who have fallen behind, working longer is one way to bolster savings — and even for those who have never participated in a workplace 401(k) plan, if they keep working, they are likely to contribute to one at some point, according to EBRI. “The group we worry about the most are those who have access to a retirement plan but do not participate,” says Craig Copeland, EBRI’s director of wealth benefits research. “They’re having more issues with debt. But over the long run, working gives them continued access to saving, which makes them more likely to end up in the confidence bucket.”

Another bright spot for Generation X is homeownership. Falzon says this age group has a large amount of equity built up in their homes. So while they might be short on invested retirement savings, they could potentially make up some ground later on by tapping into the value of their homes — even if the Prudential survey found that most Gen Xers don’t plan to do that yet.

“Home equity is a primary savings route for older generations. I imagine Generation X has less than baby boomers right now, but it’s still meaningful numbers,” says Falzon. “So things are not as bad as you might think.”