This post was originally published on this site

The new month has gotten off to a decent start for stocks, with the S&P 500

SPX,

once again poking above the 4,200 level.

Futures suggest it may extend gains Friday after chances of an imminent U.S. default were finally removed.

But whether 4,200 can now morph from ceiling to support may depend on the nonfarm payrolls data providing confirmation the Federal Reserve won’t raise interest rates this month.

Unfortunately, even that may not be enough to help the rally continue, reckons Adam Turnquist, chief technical strategist for LPL Financial.

Technical and seasonal factors mean investors should focus on the potential for a “June Swoon,” he said in a note published midweek.

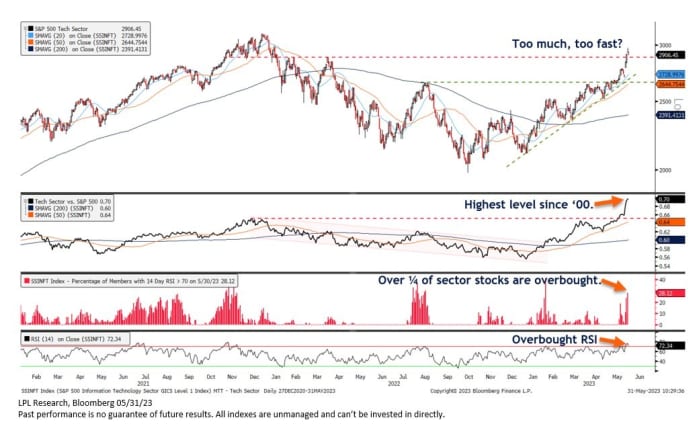

While a debt-ceiling deal in Washington could be a catalyst for the S&P 500 to break significantly above 4,200, the overbought conditions in the technology sector and mega-caps — the primary drivers of this year’s advance — may make it hard for the market to consolidate above that hurdle in the near term, especially without a broader participation of stocks, says Turnquist.

The tech sector’s relative strength index, a momentum gauge, shows just how overbought it is, alongside about 25% of tech stocks, Turnquist notes.

To emphasize this, the second from top chart in the graphic below shows how the ratio of the tech sector relative to the S&P 500 is in rarified territory.

Source: LPL Financial

“While overbought conditions provide validation of the sector’s uptrend, and overbought does not mean over, odds for a shorter-term consolidation and/or pullback appear to be growing,” says Turnquist.

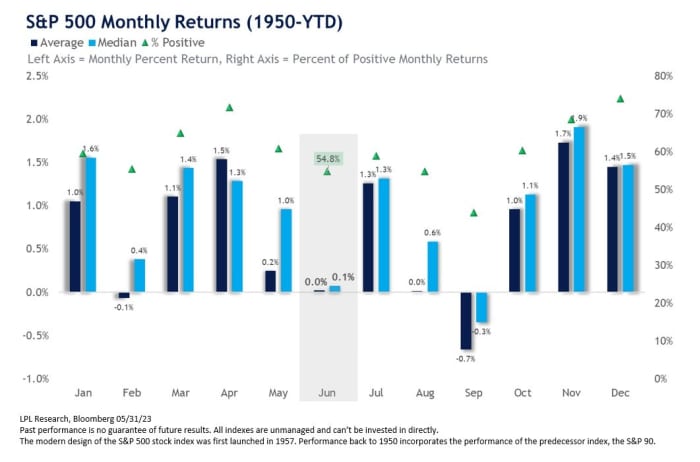

And while people like to repeat the mantra ‘Sell in May and go away’, it’s actually June that historically has provided poor returns during the late spring/summer. The S&P 500 has delivered average and median gains during June of 0.0% and 0.1% respectively. It’s the fourth worst performing month since 1950.

Source: LPL Financial

Turnquist adds: “While the overall average June return is underwhelming, when the S&P 500 does trade higher during the month, the average return has been 2.5%. In contrast, when the S&P 500 trades lower during the month, the average June return has historically been -3.0%.”

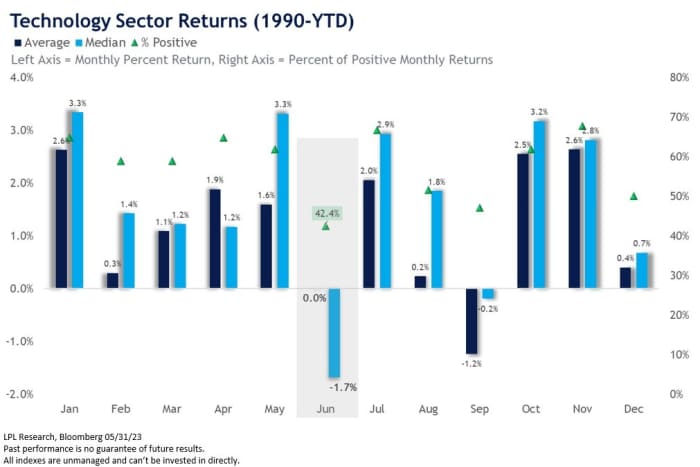

Unfortunately the seasonal set-up for tech is even worse, with the sector generating since 1990 average and median returns of 0.0% and minus 1.7% respectively. That’s the second worst month, with positive returns only 42.4% of the time, according to Turnquist.

Source: LPL Financial

Still, Turnquist finishes on a more positive note: “The good news is that if there is mean reversion, it would likely be toward the sector’s uptrend and provide a potential pullback opportunity for investors seeking a better entry point into tech. The LPL Research Strategic and Tactical Asset Allocation Committee maintains a neutral recommendation on the technology sector and is waiting for a better entry point.”

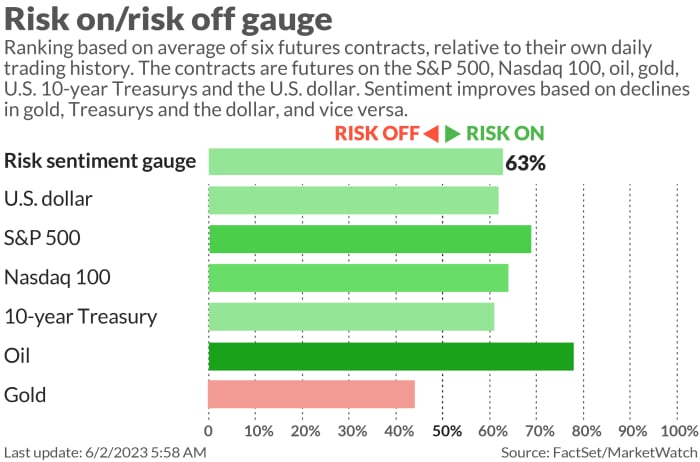

Markets

U.S. stock index futures

ES00,

NQ00,

are firmer and benchmark Treasury yields

TMUBMUSD10Y,

are nudging higher as a risk-on mood prevails. The dollar index

DXY,

is softer, helping oil

CL.1,

rally and gold

GC00,

advance.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

The big data-point Friday is the nonfarm payrolls report for May. Economists expect a net 188,000 positions to have been created, down from 253,000 in April. The unemployment rate is forecast to rise from 3.4% to 3.5% and month-on-month hourly wage growth to fall from 0.5% to 0.3%.

Confirmation that the U.S. debt default is definitely off the table — until the next time — helped spark a broad global risk-on mood. A notable beneficiary was the Hang Seng in Hong Kong

HSI,

which after flirting with bear market territory this week, bounced 4% Friday.

Oil prices

CL.1,

were firmer ahead of the OPEC+ meeting over the weekend. Most analysts expect the cartel to leave production targets unchanged.

MongoDB Inc. shares

MDB,

are more than 25% higher in premarket trading Friday after the database-software company blew away expectations with its earnings and forecast delivered after Thursday’s closing bell.

Shares of Lululemon Athletica Inc.

LULU,

are jumping nearly 15% after the retailer forecast full-year sales and profit above expectations and as strong gains in China’s reopened economy helped boost first-quarter results.

SentinelOne Inc.

S,

shares are plummeting more than 30% after executives cut their annual forecast and announced layoffs.

Best of the web

When markets melt down, these traders cash in.

Hedge funds at war for top traders dangle $120 million payouts.

Five globally successful Chinese companies you’ve never heard of.

The chart

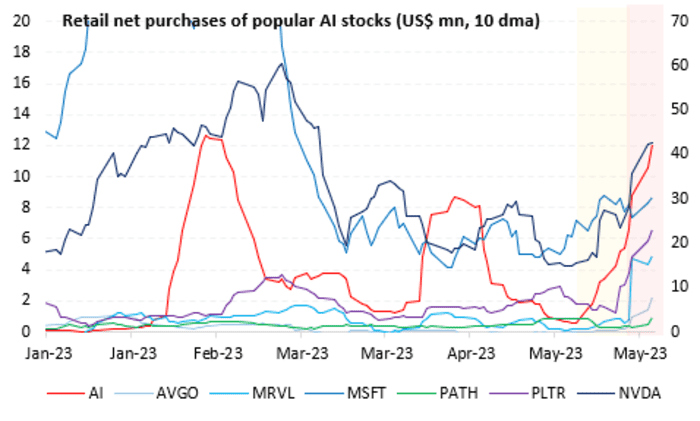

Last week we noted that retail investors had yet to meaningfully pile in to AI-themed stocks, meaning the rally may gain further propulsion when they do. Well, the chart below from Vanda Research shows that those traders are indeed now putting more of their money to work in the sector.

Source: Vanda Research

“FOMO looks to be kicking in. After weeks of stagnant flows, retail traders are starting to chase the tech rally by expanding their purchases across a wider array of AI-sensitive stocks…large-cap names were the initial targets, but now individual traders are shifting to other companies like

PLTR,

MRVL,

and

PATH,

” said Vanda.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

BUD, |

Anheuser-Busch InBev ADR |

|

PLTR, |

Palantir |

|

AI, |

C3.ai |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

AMZN, |

Amazon.com |

Random reads

Jack Russell ‘too polite to bark’ spends 14 hours down well.

14-year-old wins National Spelling Bee with ‘psammophile’.

How to hire a pop star for your private party.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton