This post was originally published on this site

Tilray Brands Inc.’s share price dropped in the extended session Thursday after the cannabis company filed a convertible note offering to buy back older ones before they convert to stock, a month after it announced an all-stock acquisition of rival Hexo Corp.

Shares of Tilray

TLRY,

TLRY,

fell about 20% after hours, following a 2.5% decline to close the regular session at $2.36. Meanwhile, the S&P 500 index

SPX,

finished Thursday up 0.9%. Should shares open Friday down that much and remain unchanged, however, it won’t be the stock’s first 20%-plus daily beating.

Since Tilray went public in July 2018, the stock has logged six sessions where it has closed down more than 20%, the last being the stock’s worst one-day performance ever, on Feb. 11, 2021, when shares plummeted 50% after U.S. reforms on the legal status of cannabis slowed.

Late Thursday, the company said it was issuing $150 million in senior convertible notes due in 2027, with underwriters Jefferies and B. of A. Securities getting a 30 -day option to offer an additional $22.5 million.

In a statement, the company said the offering will result in lower interest payments and have “fewer covenant restrictions than our non-convertible debt options due to the conversion option value,” and would be less dilutive than a secondary offering of stock.

Read: Up in smoke: $60 million marijuana startup co-owned by rapper was a Ponzi scheme, feds say

Based on Thursday’s closing price, $172.5 million represents about 73 million shares. Tilray has about 618 million shares outstanding. At the end of February, the company reported having $165 million in cash and cash equivalents, $89.4 million in long-term debt, and $223.1 million in “convertible debentures payable.”

The company said it was using a portion of the proceeds to buy back 5% convertible senior notes that come due in 2023, and 5.25% ones due in 2024, and the rest for general corporate purposes. At the same time, Tilray said that with “certain holders” of the 2023 and/or 2024 notes, it will buy back “a portion of such notes on terms to be negotiated with such holder.”

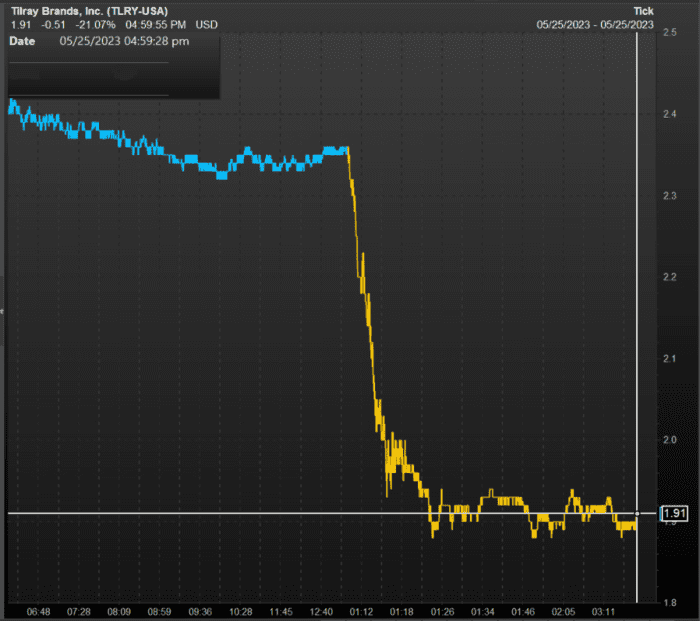

Tilray stock after hours (in yellow) Thursday following the announcement. FactSet

The offering comes a little more than a month after the company agreed to buy peer Hexo

HEXO,

On April 10, Tilray reported after the close of markets it swung to a loss for the February-ending quarter and offered to acquire Hexo in an all-stock, $56 million deal expected to close in June.

Tilray shares, which had closed April 10 up 5.4% before any of the announcements were made, closed down 8% the next session. Meanwhile, shares of Hexo had surged 30.2% on April 10 before the announcements, and dropped 26.8% during the April 11 session, according to FactSet data.

At Thursday’s close, Tilray shares were down 12.3% year to date, compared with an 8.1% gain on the S&P 500

SPX,

Hexo shares are up 15.8% for the year.