This post was originally published on this site

Hello! This is markets reporter Isabel Wang bringing you this week’s ETF Wrap. In this week’s edition, we take a look at Japan ETFs, which saw significant inflows in the past month after the legendary billionaire investor Warren Buffett said that Berkshire Hathaway owns more stocks in Japan than in any other country outside of the U.S.

Please send tips, or feedback, to isabel.wang@marketwatch.com or to christine.idzelis@marketwatch.com. You can also follow me on Twitter at @Isabelxwang and find Christine at @CIdzelis.

Sign up here for our weekly ETF Wrap.

Japan’s stock market has waited more than three decades for its time to shine again.

U.S.-listed Japan exchange-traded funds saw big fund inflows since last Friday when a rally in the Japanese stock market pushed the Nikkei 225 Stock Average

NIK,

to its highest level in nearly 33 years.

The iShares MSCI Japan ETF

EWJ,

which tracks the MSCI index composed of Japanese equities, has seen inflows of nearly $544 million over the past month, with the flows in the week to Wednesday alone exceeding $418 million, according to FactSet data.

The iShares MSCI Japan ETF also was among the top 10 ETFs to capture the largest inflows in the past week, per FactSet data.

Many U.S. investors have been underweight Japan since the late-1980s when the country’s asset bubbles burst, with equities and property values plunging as a result of the Bank of Japan’s tightening of monetary policy. Japan’s economy stagnated for decades, as low inflation and lower consumer demand made the economy less attractive to foreign investors.

In 2010, China leapfrogged Japan to become the world’s second-largest economy, a title Japan had held for more than 40 years.

However, market analysts said things could be shifting again, including because of fresh optimism about Japan’s corporate governance reforms, signs that inflation and wages are finally on the rise, but also increasing volatility in U.S. financial markets and disappointment on China’s economic recovery. They said such factors have started to bring foreign investors back to the Japanese market in 2023.

There’s also Warren Buffett’s recent endorsement of Japanese stocks that’s helping lift the sentiment. Berkshire Hathaway

BRK.B,

BRK.A,

has raised the company’s existing stake in five Japanese trading firms in April. The 92-year-old billionaire investor said he was also considering other opportunities in Japan.

See:Japan’s stock market is smoking the S&P 500. Is it too late to jump in?

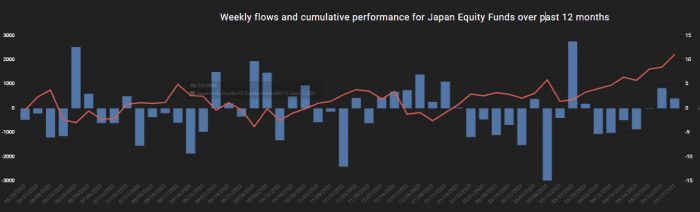

The Nikkei 225 has advanced 18% year-to-date this year, outpacing the S&P 500’s 8.1% rise, according to FactSet data. Despite the rally, flows to Japan equity funds “have actually been pretty choppy this year” with markets seeing more outflows than inflows since mid-January, said Cameron Brandt, director of research at EPFR.

Japan equity funds saw about $3.4 billion of outflows in April, while outflows over the first four months of 2023 totaled $7.6 billion, according to EPFR data shared with MarketWatch (see chart below). The blue line represents weekly fund flows since May 2022.

SOURCE: EPFR

Japan ETFs are showing a “slightly more positive” picture, but they are still far from, “Let’s jump on this train and ride it to the land of untrammeled positive returns,” said Brandt.

“Anyone who’s not just looking at this day-to-day is going to carry a healthy skepticism that this is the breakout trend, and probably act accordingly,” Brandt told MarketWatch via phone on Thursday. “You have history, and the fact that maintaining the kind of monetary policy that Japan does, when everyone else is doing something different, carries some fairly significant risks of its own.”

As the only major central bank in the world with a negative interest rate, Japan’s monetary policy remains ultra-accommodative, even though its headline inflation reached a four-decade high in February.

See:Why the Bank of Japan’s surprise policy twist rattled global markets

In 2016, the Bank of Japan fook its interest rate below zero and introduced a yield-curve control policy to lift inflation closer to its 2% target, in a bid to combat a long stretch of economic stagnation. Under the policy, the central bank has pledged to buy as many Japanese government bonds as needed to keep the 10-year yield within its target range.

The policy seemed successful until 2022, when the Federal Reserve and other major central banks started raising borrowing costs aggressively, creating an interest-rate gap that has led to a sharp depreciation of the Japanese yen. The yen traded at 140.07 per dollar

USDJPY,

on Thursday, its weakest level since last November, while the greenback has strengthened.

Foreign investors also may consider their level of comfort with currency risks, when taking exposure in Japanese stocks.

For those who want to try to limit such risk, currency-hedged instruments may help. The WisdomTree Japan Hedged Equity Fund

DXJ,

or iShares Currency Hedged MSCI Japan

HEWJ,

are designed to provide exposure to Japanese equities, while neutralizing exposure to fluctuations of the yen movements relative to the dollar. They could offer investors a “pure exposure to the stock-market return,” said Neena Mishra, director of ETF Research at Zacks Investment Research.

“These currency-hedged ETFs will do well when the yen is weakening against the dollar. On the flip side, they will underperform if the yen strengthens against the dollar,” Mishra said. “If the yen strengthens against the dollar, by investing in unhedged ETFs, you will get the currency return, plus the stock-market return.”

The iShares Currency Hedged MSCI Japan ETF is up nearly 7.8% in the past month, versus a gain of 2.5% for the unhedged iShares MSCI Japan ETF. However, unhedged-ETFs have seen larger inflows, with the iShares MSCI Japan ETF, gathering $544 million of capital in the past month. The iShares Currency Hedged MSCI Japan ETF lost over $40 million of flows, according to FactSet data.

“As far as currency hedging is concerned, and if you believe that the yen may continue to weaken, it makes sense to take the currency equation out of your investment,” Mishra told MarketWatch in a phone interview.

However, she warns that currency movements are cyclical, which means if investors want to invest over the longer term, the currency movements may cancel out themselves. “Maybe an unhedged ETF is better, particularly with investing for a few months or a year or two, then maybe just don’t take the currency risk and invest in a currency-hedged ETF,” she said.

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Top Performers | %Performance |

|

ARK Genomic Revolution ETF ARKG, |

5.2 |

|

VanEck Oil Services ETF OIH, |

3.3 |

|

United States Oil Fund LP USO, |

2.5 |

|

Global X Cybersecurity ETF BUG, |

2.5 |

|

iShares U.S. Oil & Gas Exploration & Production ETF IEO, |

2.2 |

| Source: FactSet data through Wednesday, May 24. Start date May 18. Excludes ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

| Bottom Performers | %Performance |

|

United States Natural Gas Fund L.P. UNG, |

-5.6 |

|

iShares U.S. Home Construction ETF ITB, |

-5.2 |

|

Global X Copper Miners ETF COPX, |

-5.2 |

|

VanEck Rare Earth/Strategic Metals ETF REMX, |

-4.4 |

|

IShares MSCI Global Metals & Mining Producers ETF PICK, |

-4.4 |

| Source: FactSet |

New ETFs

-

Global X ETFs on Thursday launched the Global X Carbon Credits Strategy ETF

NTRL,

,

which invests in a basket of carbon credit or allowance futures across geographies.