This post was originally published on this site

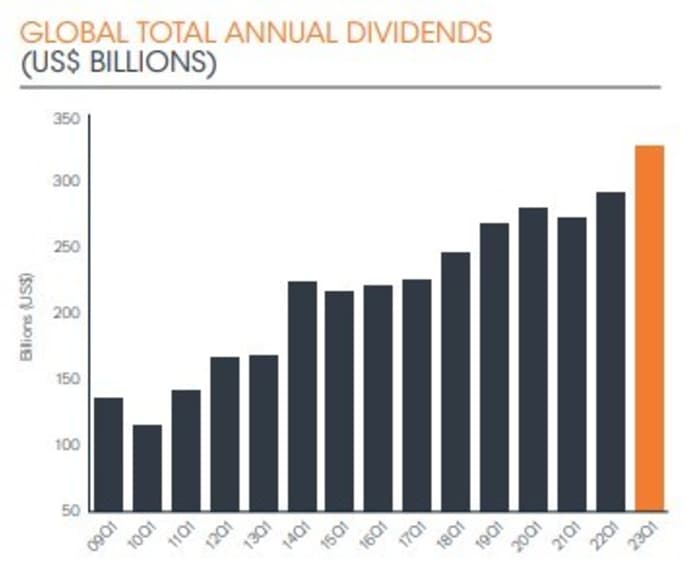

Dividends paid out by the world’s biggest public companies jumped 12% to a record $326.7 billion in the first quarter of 2023, with a large chunk of the increase delivered by bumper distributions from U.S. stocks.

However, a large proportion of the headline surge in payouts came from special dividends, leaving underlying growth at just 3%, according to research from Janus Henderson, the London-based asset manager.

Source: Janus Henderson

“The strong dividend growth we have seen in Q1 [first quarter] 2023 is all the more impressive considering the challenges the global economy faced in 2022, such as high inflation, rising interest rates, geopolitical conflict and continuing COVID lockdowns,” said Ben Lofthouse, head of global equity income at Janus Henderson.

“Profits were nonetheless strong last year, and this has supported further dividend growth,” he added.

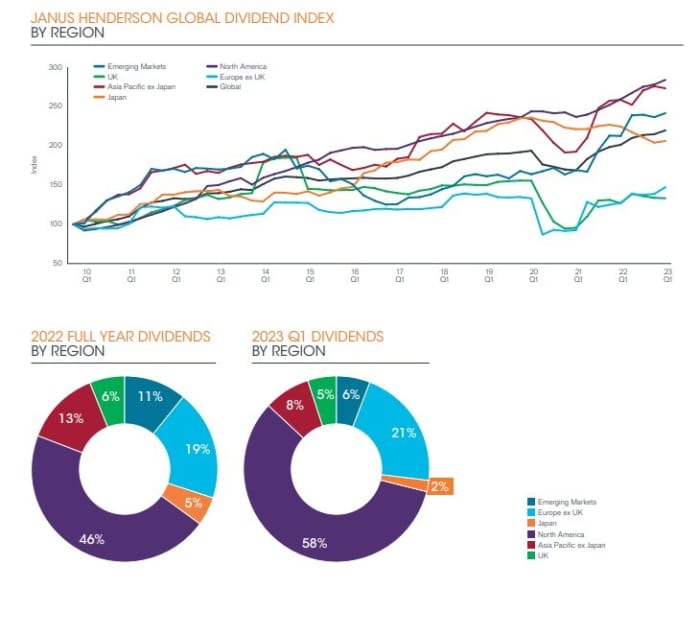

Janus Henderson analyzed 1,200 of the world’s largest companies by market value. It found that 95% of those grew their dividends or kept them steady, though within the cohort a sharp decline in mining sector payouts, driven by falling commodity prices, was counteracted by growth from financials and energy.

Source: Janus Henderson

Falling mining dividends will continue to be the biggest drag on overall dividend growth in 2023, said Janus Henderson, though it still sees payouts increasing to $1.64 trillion, up 5.2% on a headline basis it predicted.

One-off special dividends surged to $28.8 billion, the second biggest on record, with Ford

F,

and Volkswagen

VOW3,

accounting for almost a third, meaning headline payouts from the vehicles sector were ten times larger year-on-year as a result. One-off special dividends also made a significant impact in the transport, oil and software sectors, said Janus Henderson.

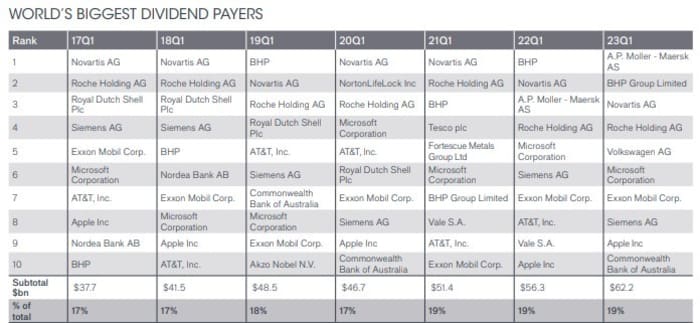

U.S. payouts, including “exceptionally large one-off special dividends” rose 8.3% to a record $153/4 billion, driven mainly by the real estate, technology and healthcare sectors. Microsoft

MSFT,

and Apple

AAPL,

were in the top ten of dividend payers in the first quarter.

Total dividends in Europe hit $60.3bn, with Denmark, Germany and Switzerland accounting for three quarters of the total paid.

Source: Janus Henderson

“Combined with the exceptionally large one-off special dividends we have seen in the first quarter, we have upgraded our forecast for 2023, although it is worth reiterating that we expect growth to be markedly slower for the rest of 2023 than over the last two years,” said Lofthouse.

“The world economy is slowing as inflation, higher interest rates and tighter financial conditions increasingly impact demand, and almost all the easy gains from the post-pandemic bounce back have now been made. Happily, dividends are typically less volatile than earnings over time, however,” he concluded.