This post was originally published on this site

Futures are firmer again on Friday. And, yet again, the S&P 500

SPX,

is eyeing the top of the range — 3,800 to 4,200 –with which it has been flirting for several months.

Worries about the debt-ceiling deadline may constrain the bulls, but they are nevertheless gaining succor from a mostly supportive first-quarter earnings season and a further cooling of inflation that may allow the Federal Reserve to loosen policy soon.

Bears may point to intermittent bursts of banking angst as a reason for caution. But according to Jitesh Kumar and Vincent Cassot, derivative strategists at Societe Generale, the turmoil in that corner of the financial sector, which began in March, has in fact not only reduced broader stock market volatility, but also helped lift the benchmark index.

“The S&P 500 is about 2.5% higher than in early March, and VIX

VIX,

is back below the 20 level,” write Kumar and Cassot in a note to clients.

There are three reasons for this. First, and very importantly, it does appear that the regional banking problems have not spread.

“The regulators swiftly stepped in to guarantee deposits and stem the damage from the bank failures. As a result, the losses have been largely contained within the financial sector, which was already much smaller than pre-Lehman crisis levels,” say Kumar and Cassot.

Source: SocGen.

Secondly, the bond markets have reacted to the turmoil by pushing yields lower on expectations that the banking problems nevertheless will crimp credit and reduce the need for the Fed to keep interest rates higher for longer.

Since the regional banking flare-up, the U.S. 2-year Treasury yield

TMUBMUSD02Y,

has moved from more than 5% to around 4% and the U.S. 10-year yield

TMUBMUSD10Y,

has fallen from more than 4% to around 3.5%, they note.

“Meanwhile, the terminal rate for the Fed has been reduced from 5.7% in early March to [about] 5.1% now. This repricing is consistent with the view of our U.S. economist Stephen Gallagher who thinks that the resulting restrictiveness of bank lending should account for 50-75bp of Fed funds’ equivalent tightening,” say Kumar and Cassot.

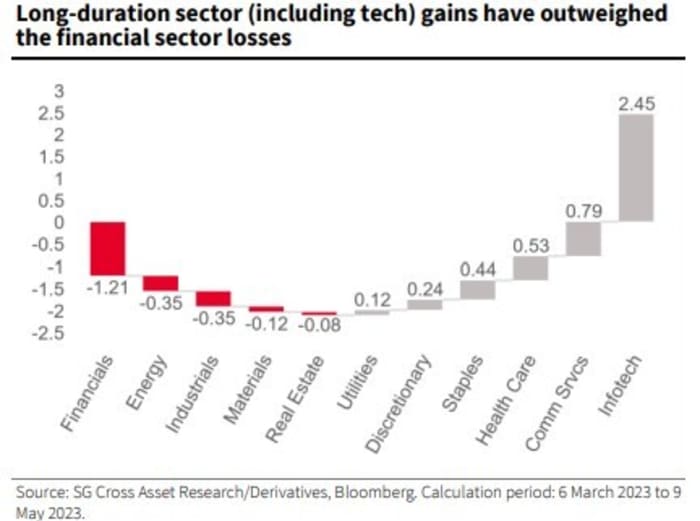

And thirdly, this repricing of bond yields has benefited what they term ‘long-duration sectors,’ including technology, which commands a particularly hefty weighting in the S&P 500 compared to the small regional banking sector.

Indeed, Kumar and Cassot calculate that the financial sector over this period is responsible for a loss of 1.21% in the S&P 500, but technology has provided a 2.45% gain.

Source: SocGen.

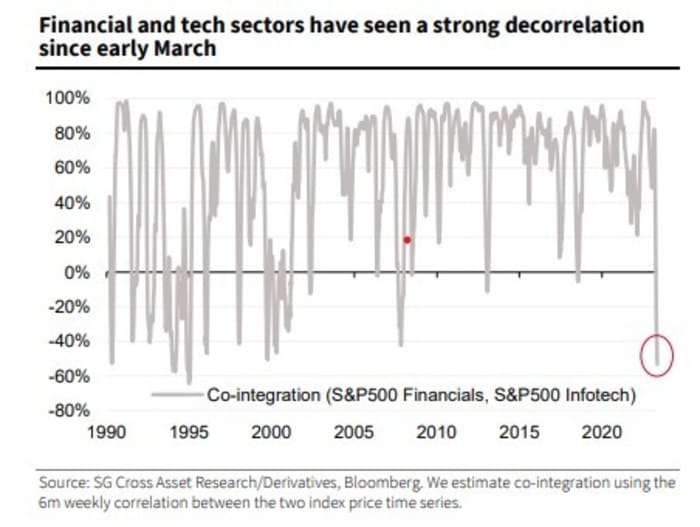

“Moreover, investor aversion to financials is exactly what seems to have driven the preference for the tech sector — as evidenced by the breakdown in cointegration between these sectors. In other words, these sectors have seen a very sharp divergence since the bank failures in early March,” they add.

To put it simply, what happens to the tech sector is more important for S&P 500

volatility -– either directly or indirectly via the interest rates channel, say Kumar and Cassot.

Source: SocGen.

In fact, such a sensitivity to interest rates is not limited to the technology sector, they say. “Over the past six months, 7 out of 11 sectors in the S&P 500 have recorded a negative correlation with 2-year Treasury yields, and these sectors account for around 70% of the weight of [the] S&P 500.”

There is, however, one area of the market for whom tighter credit conditions is a significant problem, small-cap companies and those with weak balance sheets that conduct financing in the loan markets.

“While large-cap companies can afford to wait for better conditions and rely on their cash piles to finance activities, smaller and weaker companies often do not have that luxury and are more likely to need to come to the market and pay higher costs/face tighter conditions,” say Kumar and Cassot.

That’s why during the recent bout of bond market volatility the small-cap Russell 2000 index

RUT,

significantly underperformed the megacap-dominated and higher-quality Nasdaq 100 index

NDX,

the team from SocGen note.

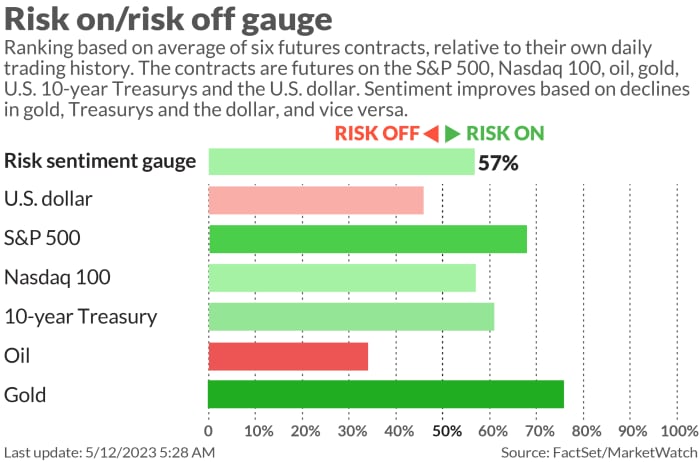

Markets

U.S. stock futures

ES00,

NQ00,

are firmer and Treasury yields

TMUBMUSD02Y,

TMUBMUSD30Y,

are higher. The dollar index

DXY,

is barely changed, while oil

CL.1,

and gold

GC00,

fall back.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

President Joe Biden’s Friday meeting on the debt ceiling with congressional leaders has been postponed until next week — but the market seems ok with this. For now.

U.S. economic data due on Friday include April import prices at 8:30 a.m. followed by the preliminary reading of May consumer sentiment at 10 a.m., both times Eastern.

Fed Governor Philip Jefferson will be part of a panel on Monetary Policy Strategy at Stanford University, starting at 7:45 p.m.

The first-quarter earnings season is mostly done, but Friday will see broker Charles Schwab

SCHW,

publish its results before the opening bell.

Tesla

TSLA,

shares are up 1% premarket. and adding to the previous session’s gains. as investors hope Elon Musk may be able to focus more on the EV company after finding someone to run Twitter.

Finally, punters who made a bet on shares of Getaround Inc.

GETR,

are being rewarded with a cool 113% surge after the car-sharing company said it plans to buy all of the assets of HyreCar Inc.

HYREQ,

which offers car rentals for gig-economy drivers, for $9.45 million.

Best of the web

$10,000 an hour bought inside line on China—and now risks jail.

Here’s where investors may turn to ‘hide’ as U.S. debt-ceiling deadline looms.

Life inside the South African gangs risking everything for copper.

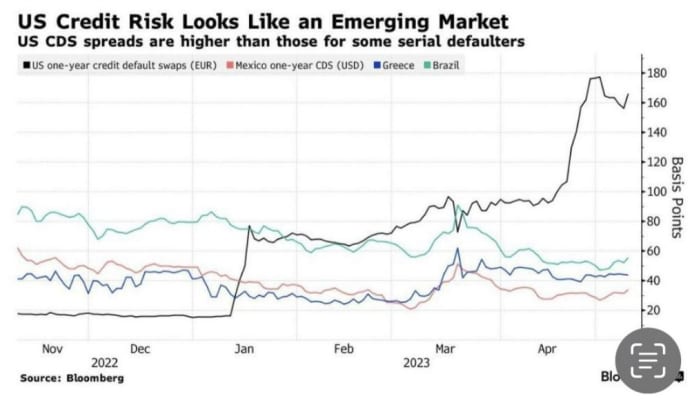

The chart

The chart below was Tweeted Friday morning by Mohamed El-Erian, president of Queens’ College, Cambridge University, and an advisor to Allianz and Gramercy. He’s also a New York Jets fan, but on economics and market matters his judgement is sound. It shows the cost of insuring government debt for one year.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

BUD, |

Anheuser-Busch InBev ADR |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

BABA, |

Alibaba ADR |

|

NVDA, |

Nvidia |

Random reads

Astronomers capture largest cosmic explosion ever witnessed.

On the beat: Police drummer rocks Coronation party.

Hollywood’s Tasmanian Devil trademarks annoy actual Tasmanians.

I was not Meghan in disguise at coronation, says 79-year-old composer.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton