This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

The firm sees a recovery of LME aluminum prices within the coming year due to an increase in global demand cycles. China/EU supply remains limited by energy constraints, and the market’s tendency to grant higher scarcity premiums for catalysts after China reaches its capacity cap breach and experiences carbon tax implications.

The company’s shares have a strong correlation to LME aluminum prices and in periods of weaker S/D fundamentals, cost curve shifts matter greatly to price formation. According to Credit Suisse, recent downtrends in pricing have been more functional around energy price weakness, lower inflation breakevens, and bearish trader positioning pivot on weaker China data/U.S. bank fears as S/D has been roughly balanced.

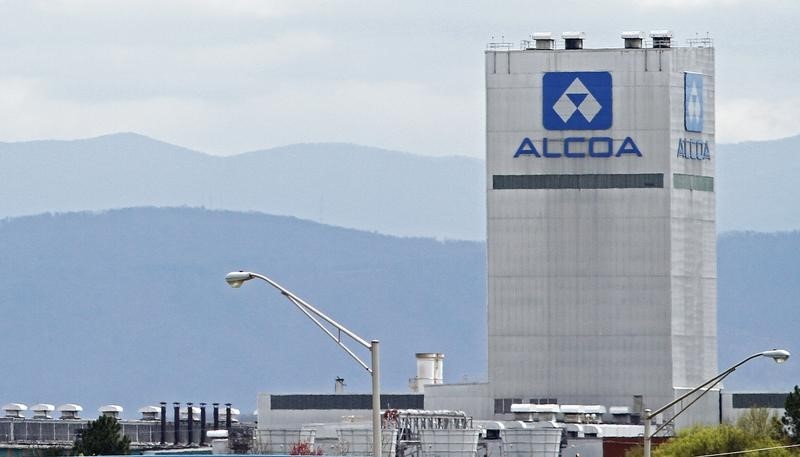

The firm expects Alcoa to move past internal challenges, noting that for 2024 it is poised for operational catalysts with San Ciprian restart, Huntly mine permit approvals, lower input costs, and Elysis milestones.