This post was originally published on this site

Wolfspeed Inc. shares declined 8% in after-hours trading Wednesday, as the silicon-carbide chip maker projected disappointing revenue figures for the fiscal fourth quarter and next year.

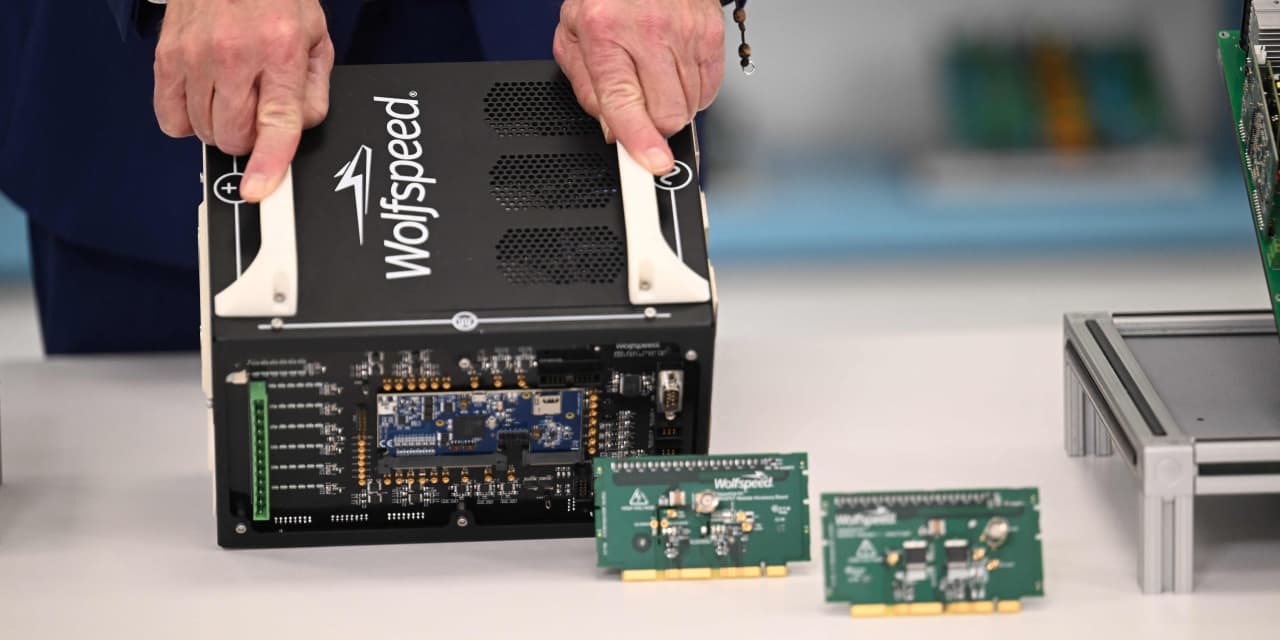

Executives for Wolfspeed

WOLF,

which was formerly known as Cree, projected a fiscal fourth-quarter adjusted loss of 17 to 25 cents a share on sales of $212 million to $232 million, while analysts on average were projecting an adjusted loss of 12 cents a share on revenue of $233 million, according to FactSet. For fiscal 2024, Wolfspeed executives predicted revenue of $1 billion to $1.1 billion, while analysts on average were forecasting $1.29 billion, according to FactSet.

“We are adjusting our fiscal 2024 revenue forecast to reflect the projected growth of our materials production as it relates to supplying Mohawk Valley,” a chip-fabrication plant that began shipping product in the quarter, Wolfspeed Chief Executive Gregg Lowe said in a statement.

Wolfspeed’s focus on silicon-carbide chips — which are used in electric vehicles, chargers and other products that seek less power usage in their semiconductors — boosted the stock late last year, but recent issues have taken away those gains. Shares are down 40.4% in the past year, as the S&P 500 index

SPX,

has declined 2.5%.

“While we expect some inefficiency in WOLF’s Mohawk Valley ramp, the company should work through any yield issues in an expedited manner, resulting in steady margin improvement,” Oppenheimer analysts wrote in a preview of the report earlier this month. They have an outperform rating and $115 price target on the stock.

Wolfspeed reported a fiscal third-quarter loss of $99.5 million, or 80 cents a share, on revenue of $228.7 million, up from $188 million a year ago. After adjusting for stock compensation, factory startup costs and other factors, Wolfspeed reported a loss of 13 cents a share, after recording an adjusted loss of 12 cents a share a year ago.

Analysts on average expected an adjusted loss of 15 cents a share on sales of $220.2 million, after Wolfspeed disappointed the Street with its forecast three months ago. Shares sank toward $54 in the extended session Tuesday, after closing with a 1.9% gain at $57.40.