This post was originally published on this site

Nikola Inc. shares closed at an all-time low Thursday, and the maker of electric and fuel-cell vehicles expects to sell stock at a 20% discount to that price.

Nikola announced Thursday afternoon that it intended to sell $100 million in shares to the public and another $100 million to an unnamed investor in a direct offering. Later Thursday, however, the company said that it would instead raise $100 million total, splitting the shares between the public and the unnamed investor, and charging $1.12 per share.

Nikola’s stock

NKLA,

closed Thursday at an all-time low of $1.40, and moved to $1.30 a share in after-hours trading, following the announcement of the initial version of the deal. Nikola announced the price of the deal and the changed terms after the extended session ended.

Nikola reported that it expects to sell about 29.9 million shares to the public at the offering price, and about 59.4 million shares in the private offering, totaling roughly $100 million. The company could offer about 4.5 million more shares through its underwriter, Citigroup Inc.

C,

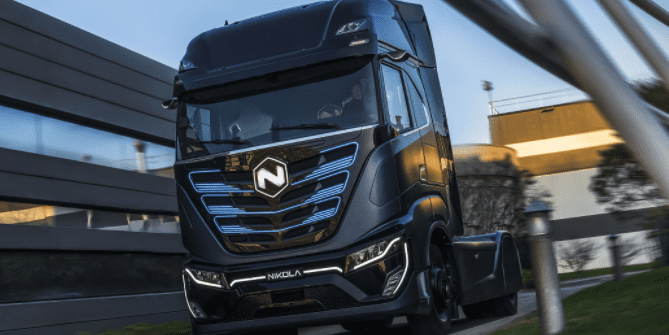

Nikola began producing an electric freight vehicle in 2022, producing 133 of the vehicles in the fourth quarter, when its revenue disappointed investors. The company intends to deliver another 250 to 350 of those trucks in 2023, executive projected in February, and begin producing its hydrogen fuel-powered version in the fourth quarter, when executives intend to deliver 125 to 150 of those trucks.

The company reported a net loss of $784 million for the year, and cash and short-term investments of about $244 million when 2022 ended. Analysts on average expect the company to report a net loss of about $155 million for the first quarter, which ends this week.

Nikola’s founder, Trevor Milton, was convicted of securities fraud last year for promises he made about the company’s work on hydrogen-fueled heavy trucks. Milton’s replacement as CEO lasted about three years before leaving the company at the beginning 0f 2023. Nikola’s chief financial officer announced her departure earlier this week, and was replaced by the company’s controller.

Shares have plunged 87.4% in the past 12 months and 35.2% so far this year, as the S&P 500 index

SPX,

has declined 12.5% and gained 4.9% in those periods respectively.