This post was originally published on this site

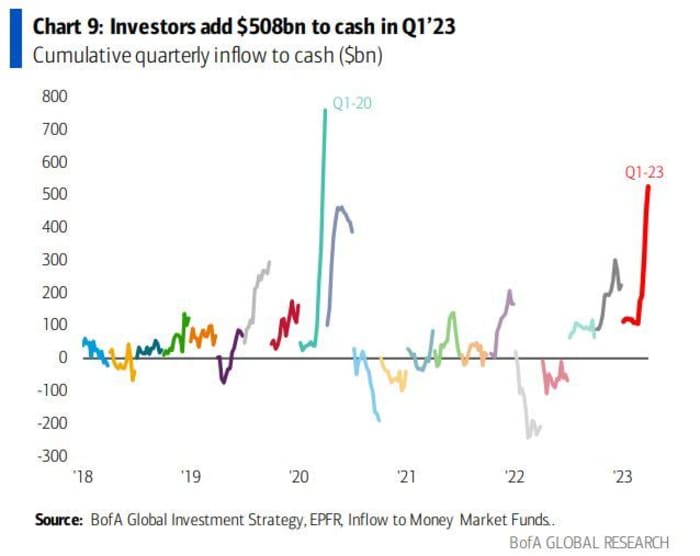

Inflation and recession worries, followed by a banking crisis, drove billions of investor money into cash in the first quarter of 2023 — the most since the pandemic’s outbreak.

That’s according to the latest “Flow Show” survey from Bank of America released Friday that reported $508 billion flowing into the perceived safer haven of cash in the first three months of the year. That marked the biggest quarterly inflow since the first quarter of 2020, as investors reeled from the global outbreak of a deadly pandemic. Cash often refers to Treasury bills with a duration of six months or less.

Uncredited

The bank’s analysts said over the week to March 29, that some $60.1 billion was converted to cash, and more than $100 billion over the past two weeks. For the week, $2.3 billion went to bonds and $500 million to gold, while $5.2 billion was yanked from equities.

Recent data from Crane showed that assets held by money-market funds that invest in short-maturity debt securities with low credit risk last week soared to a record high of $5.4 billion.

The quarter is set to end with a roughly 5.5% gain for the S&P 500

SPX,

after a 19% drop last year, but a 14% surge for the Nasdaq Composite

COMP,

rebounding from a 33% slump in 2022.

Read: 2023 has been bad for the bears. Here are five reasons why it’s going to get even worse.

“Conventional wisdom in Jan. was China reopening so long energy, commodities & EM, a Fed pivot was imminent so consensus was long yield curve steepeners, and avoid stocks as Q1 would see EPS recession,” said a team led by Michael Hartnett, Bank of America’s chief investment strategist. A steepener makes money when the bond yield differential increases or widens out.

Here’s what BofA’s had to say about their “conventional wisdom” prediction for the second quarter: “Fed cutting 160 basis points after May, so long Big Tech; recession a slam dunk, so short small caps and banks (…and sell commodities as China troughing not surging), and long gold as U.S. dollar in bear market; pain trade is recession once again delayed by stimulus, labor market doesn’t crack, inflation stays high, market reprices lower but cyclicals outperform.”

The fallout from the crisis that collapsed three U.S. banks and one overseas lender, has continued to dent on investor appetite for financials, even amid hopes it could be abating, with $600 million in outflows in the latest week, the most in 10 weeks. Technology stocks, meanwhile, are getting some safe-haven bids and riding hopes that the Federal Reserve will be done with interest rate hikes soon, and so saw a sixth straight week of inflows, the longest such streak since April 2022.

Read: Are tech stocks becoming a haven again? ‘It’s a mistake,’ say market analysts.

Consumer-themed equities saw the biggest inflow in eleven weeks of $700 million. Investment-grade bond four-week flows, meanwhile, have turned positive for the first time since November 2022, the bank’s data showed. Inflows to emerging market equities have reached $37.4 billion year to date, around $152.3 billion annualized, which would be the biggest amount ever if inflows continue in this pace.

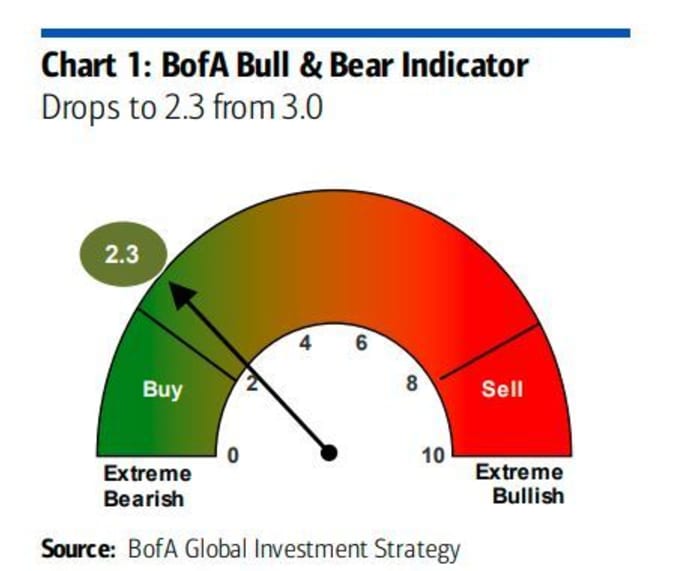

Hartnett and the team, also hinted though that some dip-buying opportunities could be around the corner. Their Bull & Bear Indicator dropped to 2.3 from 3.0 in the latest week, pushing further into “contrarian buy” territory.

Uncredited

A buy signal for riskier assets is triggered when the Bull & Bear Indicator drops under 2.0. And average three-month moves after nine “buy” signals since 2013 have seen bond yields rise 43% and global stocks up 7.6%, the bank said.

Read: Michael Burry of ‘Big Short’ fame says he was ‘wrong’ to tell investors to ‘sell’