This post was originally published on this site

On the heels of last week’s losing-streak breaking rally, investors look headed for the sidelines on Monday.

Apart from an underwhelming growth forecast from China over the weekend that’s knocking oil prices, we’ve got a sparse, but meaty lineup for the week that includes remarks from Fed Chairman Jerome Powell and a jobs update.

Read: Stock market faces crucial test this week: 3 questions that could decide rally’s fate

Here’s Deutsche Bank, summing up what’s at stake for the latter: “It’s fairly uncontroversial to say that the last payrolls report published on Feb. 3 was a huge moment, and one that started a series of events that has meant that the last month has been a struggle for most financial assets, especially bonds. As such if you thought the relatively random number generator that is payrolls is usually overhyped, you’ve seen nothing yet as we approach Friday’s big number,” wrote a team of strategists led by Jim Reid.

However, recent momentum for market does appear to have nudged one of Wall Street’s most bearish strategists to ease up a little on the gloom. Our call of the day returns to Mike Wilson, the Morgan Stanley strategist who two weeks ago warned that investors had pushed stocks into a death zone.

In a new note, the strategist points out how the S&P 500

SPX,

“survived a crucial test of support” last week by staying above the widely-watched 200-day moving average. Stocks could see some further gains in the short term if the dollar and interest rates continue to pull back, he said.

Wilson has targeted 4,150 as the next resistance area for the S&P 500, though he still doesn’t seem to be ready to give up on that death-zone prediction.

“While this is an unequivocal positive in the short term, we believe it does not refute the very poor risk reward currently offered by many stocks given valuations and earnings forecasts that remain way too high, in our view,” he said.

Wilson, who expects the S&P 500 will finish the year at 3,900 — the more bearish end of Wall Street’s wide-ranging forecasts — warned in late February that investors had been following stock prices to “dizzying heights once again,” driven by liquidity and greed. He said pricey valuations meant investors weren’t being compensated for risk.

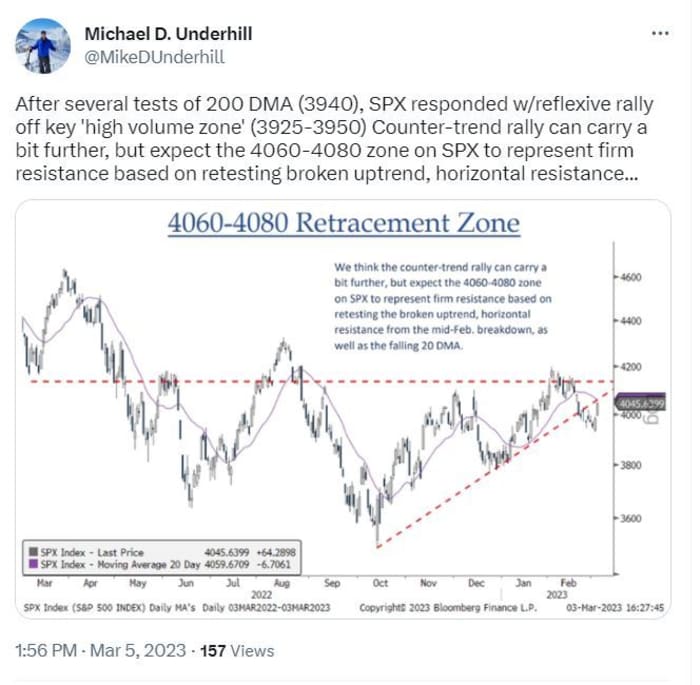

Others are looking at bit past the 200-DMA, such as this fund manager who notes how tough the road will be beyond that line in the sand:

@MikeDUnderhill

Our last word goes to Bill Blain, market strategist at Shard Capital, who has come to the conclusion that we are facing “directionless markets” and “a most dangerous moment.”

“There is no particular trend or belief driving prices. The equity bounce has gone. Bonds look tired. All the major themes are out there, clearly in play; inflationary expectations, interest rates, company valuations, the sustainability of national debt loads, geopolitics and global threats, but there is no particular momentum behind any of them. That will change in a flash – but how or when we simply don’t know,” Blain says in a blog post.

The markets

Stock futures

ES00,

NQ00,

are struggling for traction, while the 10-year Treasury yield

TMUBMUSD10Y,

is lower, at 3.919% after briefly topping 4% last week. Oil prices

CL.1,

are falling after China set a conservative growth target of “around 5%.” The dollar

DXY,

is slightly higher.

Also read: Here’s what analysts are saying about China’s new growth target.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Tobacco maker Altria

MO,

announced a $2.75 billion deal for e-vapor product maker NJOY.

Tesla

TSLA,

late Sunday cut the prices of its Model S and Model X cars to help boost sales as the first quarter draws to a close. Shares aren’t doing much in premarket trading.

As part of a cost-cutting move, Amazon

AMZN,

will close eight of its cashierless convenience stores in San Francisco, New York City and Seattle.

A handful of U.S.-listed Chinese stocks are lower on the heels of that modest growth target. Alibaba

BABA,

Nio

NIO,

and Baidu

BIDU,

are all down 1% or more.

Fastenal

FAST,

and Ciena

CIEN,

will report results this morning, followed by WW International (Weight Watchers)

WW,

after the close.

Incyte

INCY,

will discontinue a study for the treatment of myelofibrosis, and shares are lower in premarket.

Factory orders are due at 10 a.m., in a week that will end with nonfarm payroll data, in which we’ll see if January’s surge was a blip. And biannual Congressional testimony from Fed’s Powell is scheduled for Tuesday and Wednesday.

Read: Powell to talk to Congress about the possibility of more interest-rate hikes, not fewer

Best of the web

Is the U.S. housing market headed for a crash? ‘It all depends on how high rates go,’ mortgage veteran says.

Billionaire investor Mark Mobius says he can’t get his money out of China.

The cold reality of trench warfare on Ukraine’s front lines.

The chart

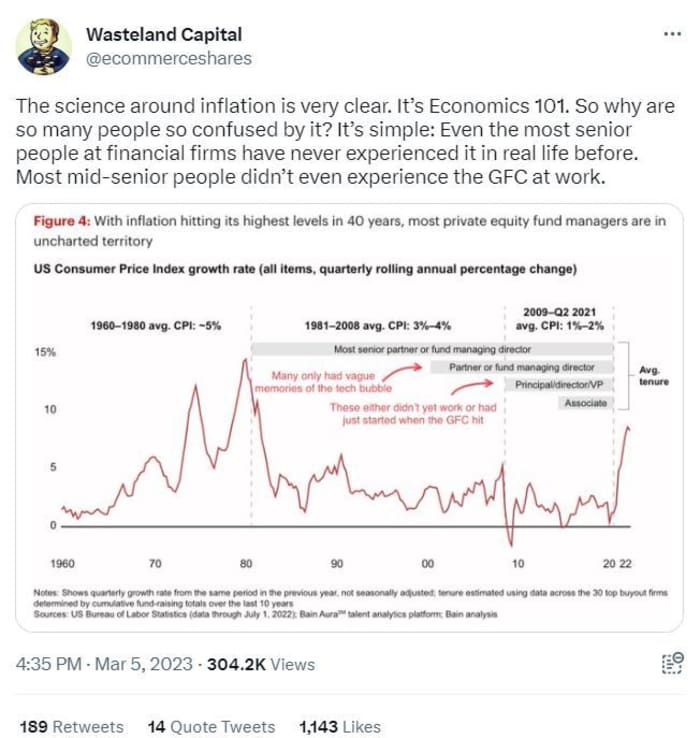

Why are most investors befuddled by inflation these days? The Twitter account behind Wasteland Capital has an idea. You just haven’t lived it yet, baby.

@ecommerceshares

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

TRKA, |

Troika Media |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

XELA, |

Exela Technologies |

Random reads

A symbol of old, rustic Paris is about to be transformed.

Toblerone is losing its Alpine mountain image.

A cheesy U.S. victory over Europe.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton