This post was originally published on this site

U.S. stocks face pressure from the emerging risk of deterioration in companies’ profit margins, according to research from Citigroup.

“We think we will have to be prepared for broader earnings pressure as we move toward the back half of 2023 and begin to look ahead to 2024,” equity strategists led by Scott Chronert warned in a Citi Research note dated Feb. 24. They “suspect” margin risk is not priced into the S&P 500 index, despite the trend of analysts “aggressively right-sizing 2023 estimates since mid-2022.”

Even after a pattern of revisions, “out-year expectations for margins appear unrealistically aggressive,” the Citi strategists said. In evaluating sectors, they identified “burgeoning cracks in the margin set up,” saying the “consumer” part of the S&P 500 already is showing signs of margin pressure, while healthcare and technology “may not prove as margin-resilient as often expected.”

“Economic-sensitive sectors, including industrials and energy, are the most stable, for now,” the strategists said. “We remain most positive on the economic sensitive side of U.S. equities.”

Still, the report says that margins in the industrial sector, as well as in healthcare and tech, appear to be “plateauing.” Meanwhile, consumer discretionary, consumer staples and communication services are “showing signs of peaking margins.”

At this point, Citi is keeping its earnings-per-share estimates for the S&P 500 at $216, according to the note. “But, margin degradation from here poses a downside risk that is hard to ignore,” the strategists said.

Heading into 2023, they had expected that companies’ fourth–quarter results would be “better than feared, but with C-suites inclined to lower 2023 guidance to acknowledge the uncertain macro environment,” according to their note.

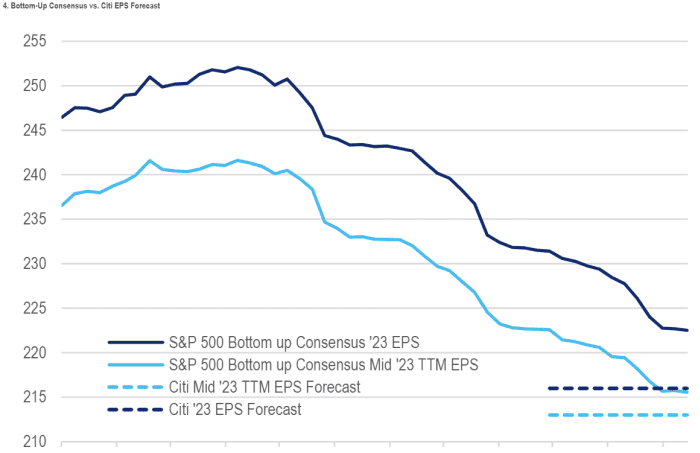

“This has largely held true per a mild aggregate beat on EPS and sales for the quarter, but with full-year consensus estimates falling roughly 3%,” the Citi strategists said. “The result is that bottom-up consensus estimates have followed the trend in guidance, right-sizing closer to our top-down earnings forecast” for a year-over-year drop of 3% in 2023, they wrote.

The chart below shows Citi’s forecast for the S&P 500’s earnings per share, or EPS, versus the bottom-up consensus.

CITI RESEARCH NOTE DATED FEB. 24, 2023

Meanwhile, stock-market investors have been navigating “crosscurrents” from interest rates, the Citi strategists said, with the Federal Reserve continuing to hike its benchmark rate in an effort to bring down still high inflation. Investors have worried that the Fed’s rate hikes, if too aggressive, could trigger a recession.

“A higher-for-longer Fed funds regime now implies risk of more significant macro pressure on fundamentals,” the analysts wrote, referring to the Fed’s benchmark rate. The central bank has been trying to curb cool consumer demand for goods and services, and with that inflation, while at the same time aiming for a so-called soft landing for the U.S. economy.

“Irrespective of a soft landing or recession outcome for the broader economy, we suspect that EBIT margins for the S&P 500 are poised to correct from here,” the Citi strategists said. EBIT is an abbreviation for earnings before interest and taxes, a measure of a company’s profitability.

“Counterintuitively, there may be a negative incremental margin fall-out as the past year’s rising inflation backdrop gradually reverses,” the strategists cautioned.

“We believe that rising inflation over the past year or longer has provided a tailwind for each of revenues and, as a result, margins,” they said. Companies’ ability “to pass through rising input costs, including labor, has been a feature of last year’s earnings resilience even as the Fed turned down an increasingly hawkish path.”

But the situation is now more “complicated” in terms of pricing power, according to the note.

For the short term, “the economic sensitive side of U.S. equities” is showing relative “margin resilience,” they said. “Longer term, we look for a gradual shift away from the past decade’s mega cap growth leadership and toward a revitalized industrial focus.”

The Citi strategists also pointed to a need “to be prepared for an intermediate-term set-up where disinflation this year may eventually support a bottoming in the consumer sectors as expectations are reset.” They said, “no doubt, an eventual dovish turn by the Fed would catalyze this part of the market.”

Citi maintained its year-end target for the S&P 500 at 4,000.

“Given the starting point of stretched relative valuations on a cross-asset basis, it is difficult for us to see multiple expansion leading the market higher from here, unless 10yr yields were to break through their recent lows,” the strategists wrote.

Ten-year Treasury yields

TMUBMUSD10Y,

were slightly lower Monday afternoon near 3.92%, according to FactSet data, at last check. The U.S. stock market was rising modestly, as investors assessed a report from the Department of Commerce showing a drop in durable-goods orders in January, but an increase in business investment.

The S&P 500

SPX,

was trading up 0.3% at around 3,983, with gains of almost 4% so far this year, according to FactSet data, at last check.