This post was originally published on this site

U.S. stocks held on to gains in the final hour of trading on Monday, attempting a bounce after shifting rate expectations triggered Wall Street’s worst week of 2023.

How stocks are trading

-

The Dow Jones Industrial Average

DJIA,

+0.22%

was up 42 points, or 0.1%, at 32,858. -

The S&P 500

SPX,

+0.31%

advanced 9 points, or 0.2%, to 3,979. -

The Nasdaq

COMP,

+0.63%

gained 63 points, or 0.6%, to trade at 11,458.

Stock indexes booked their biggest losses of 2023 last week. The Dow dropped 3% for its biggest weekly decline since the week that ended Sept. 23. The S&P 500 retreated 2.7% for its third straight weekly fall and the Nasdaq fell 3.3%. The S&P 500 and Nasdaq saw their biggest weekly declines since the week ending Dec. 9.

What’s driving markets

U.S. stocks were attempting to gain back some of the ground lost last week, when equities fell on further signs that relatively robust economic activity is helping keep inflation stubbornly high.

The PCE inflation measure released on Friday showed price pressures remain elevated, reducing the chances that the Federal Reserve will consider easing monetary policy anytime soon and thus forcing bond yields higher.

Despite such data, some investors were brushing aside the report. Jay Hatfield, chief executive of Infrastructure Capital Advisors in New York and portfolio manager of the InfraCap Equity Income ETF

ICAP,

said he thinks the PCE and U.S. consumer-price index are “overstating inflation.” In particular, he said, PCE contains a number of volatile components such as transportation services “which can reverse month to month and show significant declines.”

“We do not believe that the Fed will double down on rate hikes and do 50bp [basis points] at the next meeting,” Hatfield wrote in an email to MarketWatch. “We continue to believe that the Fed is far too bearish about inflation.”

Fed Gov. Philip Jefferson said on Monday that he doesn’t support raising the central bank’s 2% inflation target because it “would damage the central bank’s credibility.”

In other developments on Monday, U.S. durable-goods orders fell 4.5% in January. Excluding transportation, sales were up 0.7%.

A modest pullback in Treasury yields following that data was “all stocks needed to break the strong downtrend they had been in,” according to Louis Navellier, founder of Navellier & Associates.

Meanwhile, U.S. pending home sales rose 8.1% in January, based on the monthly index released on Monday by the National Association of Realtors, with sales rising for the second month in a row. The last time pending home sales rose by this much in June 2020, fueled by pandemic buying. Analysts polled by The Wall Street Journal had forecast the pending home sales index would rise by 0.9%.

The S&P 500 has lost 4% over the past three weeks as the monetary-policy-sensitive 2-year Treasury yield

TMUBMUSD02Y,

moved above 4.8% to the highest level since July 2007. However, yields were a touch softer on Monday, helping to improvement sentiment toward stocks as the week begins.

Still, economists at JPMorgan Chase & Co. are warning about the rising risk of “a more wrathful Old-Testament style” reaction to rate hikes from developed-market central banks, following a “gentle and forgiving path” to rein in inflation. And Jonathan Krinsky, chief technical strategist at BTIG, is wary of further downside for stocks.

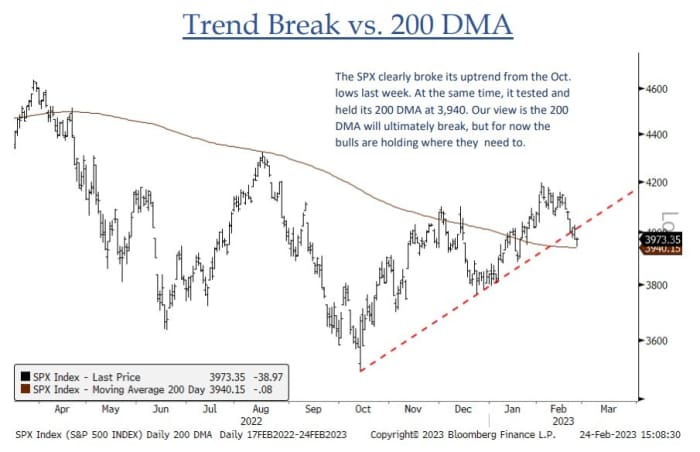

Source: BTIG

“While it was holiday shortened, the [S&P 500] suffered its worst decline of the year last week (-2.67%) as momentum continues to rollover. As a result, it essentially tested its 200 day moving average (3940) and got down to the high volume zone (3925-3950) of the last few years. While these areas are likely to provide some support in the near-term, we expect an eventual breakdown below which would open the door to Dec. lows (3775),” Krinsky wrote in a note to clients.

Major European stock indexes all finished higher on Monday. Gold for April delivery

GCJ23,

settled at $1,824.90 an ounce, up 0.4%, on Comex while the ICE U.S. Dollar Index

DXY,

was off 0.5%. Oil prices declined after posting back-to-back session gains, with U.S. benchmark West Texas Intermediate crude for April delivery

CLJ23,

falling 64 cents, or 0.8%, to settle at $75.68 a barrel on the New York Mercantile Exchange.

Companies in focus

-

Shares of Seagen Inc.

SGEN,

+10.40%

rose 10.2% after The Wall Street Journal reported Pfizer Inc.

PFE,

-2.32%

was in talks to buy the cancer-therapies biotech for a premium to its $30 billion market cap. Pfizer’s stock fell 1.9%. -

Union Pacific Corp.

UNP,

+10.09%

shares were up 9.5% after the railroad agreed to oust its chief executive just hours after a New York hedge fund urged it to do so.

Movers & Shakers: Seagen’s stock soars on reported Pfizer buyout interest; Union Pacific shares rally after CEO ouster

— Jamie Chisholm contributed to this article.