This post was originally published on this site

Crypto hedge fund Galois Capital will close its flagship $200 million fund with half of its assets still stuck on the fallen crypto exchange FTX.

The firm confirmed the shutdown on Twitter on Monday after the Financial Times reported the fund was closing.

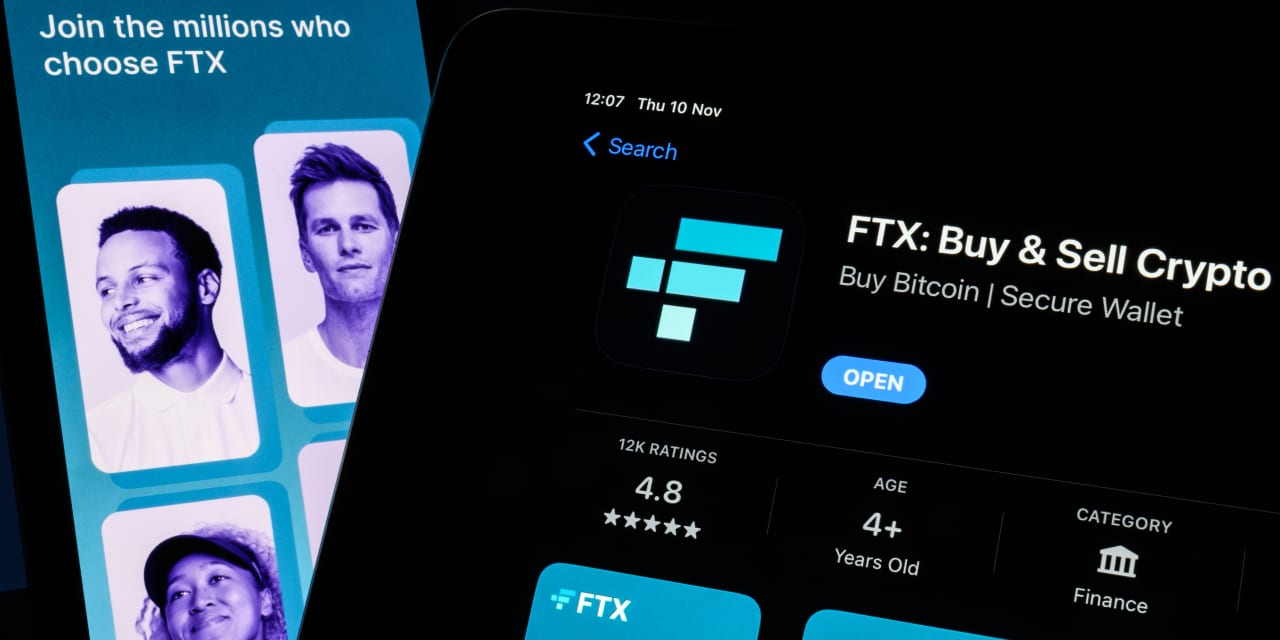

The fund suffered from the FTX blow-up last November, admitting that it had a significant portion of funds stuck on the crypto exchange after its collapse.

In the wake of the FTX collapse, founder Sam Bankman-Fried is facing a trial this October on fraud charges, to which he had pleaded not guilty. Around 1 million creditors have been identified in the bankruptcy filing.

In a letter to investors, seen by the Financial Times, co-founder Kevin Zhou wrote that it would return 90% of the remaining money in the fund, and 10% was still to be finalized by administrators.

“I am proud to say that although we lost almost half our assets to the FTX disaster and then sold the claim for cents on the dollar, we are among the few who are closing shop with an inception-to-date performance which is still positive,” tweeted the Galois Capital account.

The Financial Times reported that Galois sold the claim for around 16 cents to the dollar.

Earlier last year, Zhou foresaw and shorted the collapse of Terra/Luna. But he still remains hopeful about the crypto industry, saying it will “endure” the current setbacks it faces.