This post was originally published on this site

The S&P 500

SPX,

is about to wrap up its best month since November, up more than 4% in January, while the Nasdaq Composite

COMP,

is eyeing its strongest month since July, up more than 8%.

But here comes February, with a Fed decision, big earnings and data right off the bat. And concerns that a recent rally is over already seems to be spreading across Wall Street and among investors.

Read: Investors who aren’t nervous right now should be, says Standard Chartered,

Our contrarian call of the day from founder and editor-in-chief of The Kobeissi Letter, Adam Kobeissi is not buying any of that.

“We have been bullish of equities, gold, crude oil, and bonds since the new year. Our view is that peak inflation is behind us, the Fed will begin cutting interest rates by the end of 2023, despite their previous statements that they won’t, and earnings expectations have come down significantly,” said Kobeissi, in emailed comments.

Kobeissi thinks the Fed will indeed deliver on that interest-rate pivot in the second quarter. “This is why we have been bullish of the S&P 500 from 3900 and have a 4150 target, and we expect more strength in earnings over the next couple of weeks to lead higher,” he said.

Despite recession worries and “many reasons to fall,” the uptrend is there for markets such as crude, while stocks are in the same basket, he said. But don’t expect a straight line, rather more volatility ahead and a general uptrend over the next few weeks or so.

“The reality is that markets are looking for a reason to rally. When markets are looking for reasons to rally, they usually find them,” he said, adding that sentiment swung too far in the direction of the bears, which explains that “explosive” year-to-date move for stocks.

He’s had a bullish view on tech stocks recently, but generally just plays the S&P 500. “The reason we saw such a steep drop in the tech sector was on the back of higher rates. If markets can begin looking beyond the current tightening cycle, tech can make a comeback,” said Kobessi.

Last year he said he benefited from a mix of long and short S&P 500 setups, being mostly long crude oil, and a mix of longs and shorts on natural gas.

His main takeaway from 2022 is that the market is extremely technical, so “avoiding a bias is key to being profitable.”

“For 2023, it’s important to begin looking past current headwinds and thinking about where we will be in one year from now. Markets are clearly beginning to look ahead,” said Kobeissi.

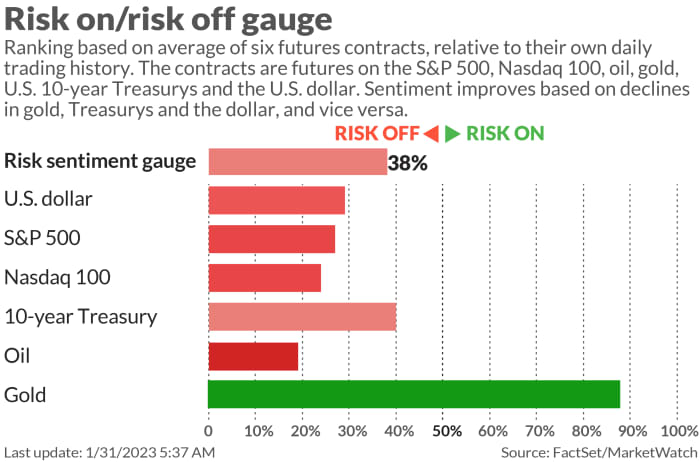

The markets

Stock futures

ES00,

YM00,

are dropping, again led by tech

NQ00,

with bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

mixed and oil

CL.1,

down. The dollar

DXY,

is higher and gold

GC00,

is under pressure. Fresh data shows the precious metal saw its strongest demand in a decade in 2022. Asian markets were a sea of red, with the Hang Seng

HSI,

dropping another 1%.

Read: What the Eagles-Chiefs Super Bowl matchup can tell us about the stock market

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily. Also check out MarketWatch’s Live blog for up-to-the-minute markets updates.

The buzz

Caterpillar shares

CAT,

are dropping on a profit miss, while revenue disappointment is weighing on shares of Exxon

XOM,

and UPS

UPS,

while Pfizer

PFE,

is falling on a downbeat outlook as COVID sales drop.

On the upside, GM stock

GM,

is climbing after better-than-expected earnings, McDonald’s

MCD,

shares are higher after an earnings beat and strong sales. Spotify

SPOT,

is also gaining as user growth breezed past expectations.

After the close we’ll hear from Advanced Micro Devices

AMD,

Amgen

AMGN,

Snap

SNAP,

and Electronics Arts

EA,

Read: Why McDonald’s earnings probably haven’t been hit by higher prices

DoorDash shares

DASH,

are down after the delivery group said its three co-founders will sell millions of shares starting in February.

U.S. and global economies are set to slow in 2023, but the forecast is “less gloomy,” said the IMF. The only major economy expected to see a recession is the U.K., which on Tuesday marked three years since its Brexit separation from Europe.

The employment cost index for the fourth quarter is out at 8:30 a.m., followed by a pair of house-price indexes, the consumer confidence and the rental vacancy rate. The two-day Fed meeting kicks off Tuesday.

Best of the web

Here’s why a record-setting lack of snow in New York City is pretty chilling.

Yale honors efforts of 9-year old girl, a victim of racial profiling, for her efforts in battling damaging insect

The U.S. consumer is freaking out.

The chart

Crude prices have been pushing lower this week ahead of central bank meetings, where hawkish outcomes could weigh on the commodity, as an OPEC gathering also looms. Here’s one view:

@RaoulGMI

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

GNS, |

Genius Group |

|

NIO, |

NIO |

|

LCID, |

Lucid Group |

|

AAPL, |

Apple |

|

CVNA, |

Carvana |

Random reads

How a Kansas City Chiefs superfan in a wolf mask ended up in jail.

A vast Maya kingdom is revealed in Guatemalan jungle.

A sad farewell to Cindy Williams of “Laverne & Shirley” fame

@RealRonHoward

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton