This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

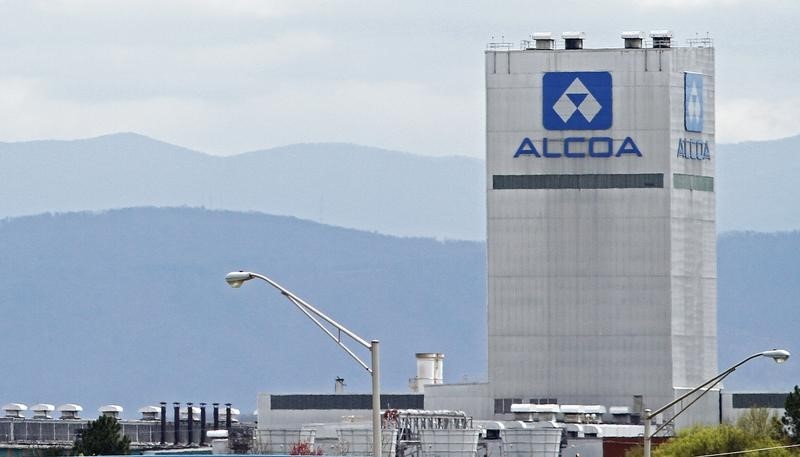

Alcoa (NYSE:AA) shares were trading more than 4% lower after-hours following the company’s reported Q4 results, with EPS of ($0.70) coming in worse than the consensus estimate of ($0.67). Revenue fell by 7% sequentially to $2.7 billion (vs. consensus of $2.66B) primarily due to lower prices for both alumina and aluminum. The average realized third-party price of alumina/aluminum decreased by 8%/10% sequentially.

“We will address current challenges while maintaining our future focus, as the long-term outlook for our industry remains strong. Aluminum is rising in importance as a material of choice, and we are excited about the development of our transformative technologies that have the potential to reinvent the industry,” said Alcoa President and CEO Roy Harvey.

In 2023, the company expects total alumina shipments, including externally sourced alumina, to be in the range of 12.7-12.9 million metric tons, a decrease of 0.5M metric tons from 2022 due to the partial curtailment of the San Ciprián refinery and lower bauxite quality at the Australian refineries. The Aluminum segment is expected to ship between 2.5 and 2.6M metric tons, consistent with 2022 as additional shipments from the restart of the Alumar and Portland smelters are offset by lower anticipated trading volume.