This post was originally published on this site

The U.S. Justice Department on Thursday said it has reached an agreement with Los Angeles-based City National Bank in what prosecutors described as the largest-ever payment to settle alleged discriminatory lending practices by a bank.

The agreement will include more than $31 million in relief for affected people and communities and represents “the largest redlining settlement” in its history, the Justice Department said.

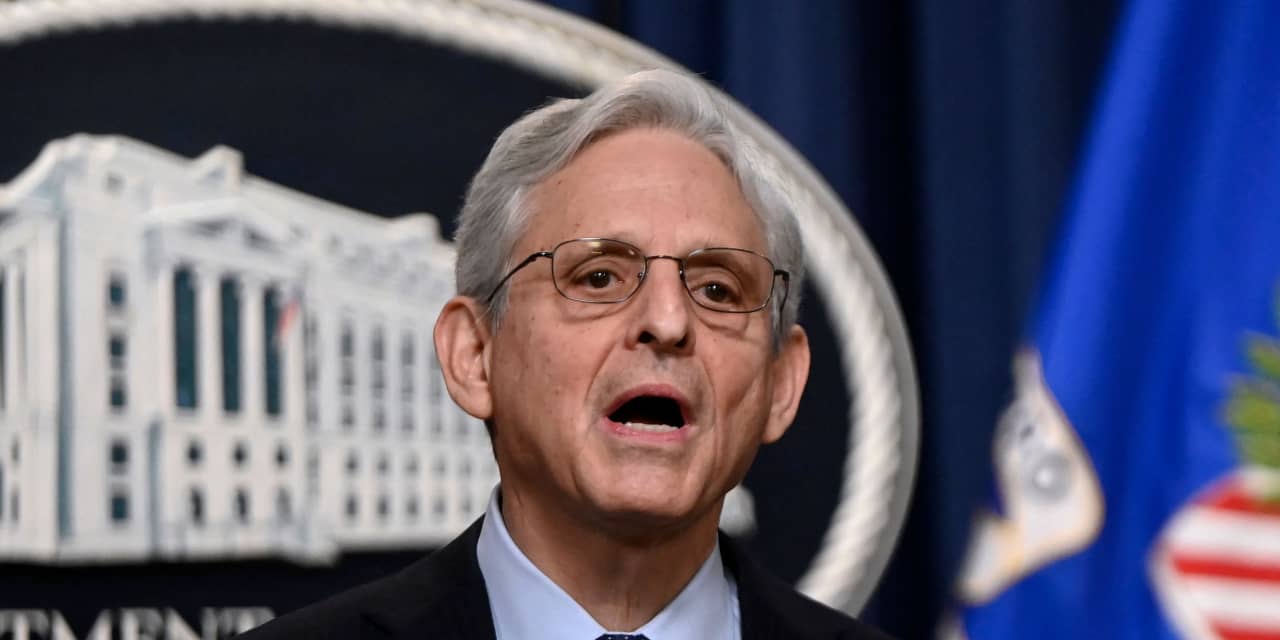

The move comes as part of Attorney General Merrick Garland’s anti-redlining initiative, which has drawn more than $75 million in relief for communities affected by discrimination in lending.

“The Justice Department will continue to build on our efforts to vigorously enforce federal fair-lending laws and work to ensure that financial institutions provide equal opportunity for every American to obtain credit,” Garland said in a statement. “In advance of what would have been Dr. Martin Luther King Jr.’s 94th birthday, it is a fitting time to reaffirm our commitment to that work.”

The annual federal holiday honoring King falls on Monday, Jan. 16, this year.

The complaint in federal court alleges that from 2017 through at least 2020, City National avoided providing mortgage-lending services to majority-Black and majority-Hispanic neighborhoods in Los Angeles County, the government said.

City National has only opened one branch in a majority-Black or majority-Hispanic neighborhood since 2003, even as it opened or acquired 11 branches during that time period.

Under the proposed consent order filed in the U.S. District Court for the Central District of California, City National Bank has agreed to invest at least $29.5 million in a loan subsidy fund for residents of majority-Black and majority-Hispanic neighborhoods in Los Angeles County.

It must also open one new branch in a majority-Black or majority-Hispanic neighborhood and evaluate future opportunities for expansion within Los Angeles County; in addition, at least four mortgage-loan officers must be dedicated to serving Black and Hispanic neighborhoods.

City National Bank said in a statement that it disagrees with the allegations by the Justice Department but supports the effort by the government to ensure equal access to credit for all consumers, regardless of race.

“In addition to the work we currently do to ensure equal access to credit, we will further strengthen that commitment through a robust community lending program that reaches beyond the terms of the settlement,” the bank said.

The bank said it has been focused more on commercial loans than on residential mortgages but that it will devote increased resources to home lending in all the areas it serves, including California, Georgia, New York, Nevada and Washington, D.C.

The bank also said it created a new community lending team in 2022 to increase mortgage lending to historically underserved borrowers.

As the biggest bank in Los Angeles, City National Bank ranks as one of the 50 overall largest banks in the U.S. The bank manages about $95 billion in assets through 67 branches, including 22 regional centers. City National Bank is a unit of Royal Bank of Canada

RY,

Related: Can an effort to revamp anti-redlining lending laws survive the swamp?