This post was originally published on this site

Wall Street often gets it wrong when it comes to anticipating where stocks might be trading one-year out. But in 2022, its forecasters were set to miss the mark by the widest margin in nearly 15 years, according to data compiled by FactSet.

Wall Street equity analysts were on pace to overestimate the performance of the S&P 500 index in 2022 by nearly 40% as of Tuesday, according to the average bottom-up forecast compiled by FactSet’s senior earnings analyst John Butters. That would mark their biggest miss since 2008 when analysts overshot by 92%.

A year ago, equity analysts were penciling in the S&P 500

SPX,

finishing 2022 at 5,264.51, according to FactSet data. That’s turned out to be way off base: the large-cap index was trading just north of 3,800 as of Tuesday’s close.

This year, however, Wall Street’s top strategists have been more cautious, spending much of the time slashing their year-end stock-market targets as the Federal Reserve kept raising rates to fight stubbornly high inflation and causing volatility across markets, including stocks, bonds, currencies and commodities, to explode.

The damage felt across financial markets has the S&P 500 down about 20%, on pace for its worst year since 2008 when it plunged nearly 40%, according to Dow Jones Market Data.

S&P 500 estimates

A recent survey of top Wall Street forecasters by MarketWatch put the average S&P 500 estimate at 4,031 for the end of 2023, an advance of only about 6% from Tuesday’s close of 3,821.62. To get to that average (see chart), MarketWatch collected estimates from 18 investment banks and brokers.

| Firm | Strategist | S&P 500 Target |

| Deutsche Bank | Binky Chadha | 4,500 |

| Oppenheimer | John Stoltzfus | 4,400 |

| BMO | Brian Belski | 4,300 |

| Scotiabank | Hugo Ste-Marie | 4,225 |

| Jefferies | Sean Darby | 4,200 |

| JPMorgan | Marko Kolanovic | 4,200 |

| Cantor Fitzgerald | Eric Johnson | 4,100 |

| RBC Capital Markets | Lori Calvasina | 4,100 |

| Credit Suisse | Jonathan Golub | 4,050 |

| Bank of America | Brian Hartnett | 4,000 |

| Goldman Sachs | David Kostin | 4,000 |

| HSBC | Max Kettner | 4,000 |

| Citigroup | Scott Chronert | 3,900 |

| Morgan Stanley | Mike Wilson | 3,900 |

| UBS | Keith Parker | 3,900 |

| Barclays | Venu Krishna | 3,725 |

| Societe Generale | Manish Kabra | 3,650 |

| BNP Paribas | Greg Boutle | 3,400 |

| Average | 4,031 |

A few estimates, including those of top equity and macro strategists at Barclays PLC

BCS,

Morgan Stanley

MS,

Citigroup Inc.

C,

and UBS Group AG

UBS,

have told clients they expect the S&P 500 to finish next year below 4,000.

Forecasts, however, from the group were spread over an unusually wide range, market strategists told MarketWatch.

On the low end, BNP Paribas’ Greg Boutle expects a continued slide in stocks next year, with the S&P 500 finishing 2023 at 3,400. Deutsche Bank’s Binky Chadha, who has the highest year-end target of the group, expects the index to finish next year at 4,500.

Furthermore, a FactSet survey of equity analysts produced a bottom-up forecast for the S&P 500 of 4,500 by the end of 2023. That would represent an advance of roughly 18% based on the index’s closing level on Tuesday.

What about a recession?

Many macro strategists said in their 2023 outlooks that they expect the U.S. economy to slide into a recession by midyear, further undermining equity valuations as corporate profits slump and unemployment climbs.

Notably, Goldman Sachs’

GS,

Chief Economist Jan Hatzius expects economic growth in the U.S. to slow, but avoid a recession.

One of the main pillars supporting equity valuations has been an expectation that stocks will bottom out in the first half of next year, before rebounding in the latter half of 2023, as inflation recedes and unemployment rises, allowing the Fed to start slashing interest-rates without risking hyperinflation.

While even Fed Chairman Jerome Powell has said there are no guarantees about where monetary policy will need to bring inflation down concretely, lingering expectations have been for the Fed eventually to “pivot” eventually away from its aggressive stance on rates at some point next year, which has helped buttress stocks, market strategists told MarketWatch.

Movements in fed-funds futures, which are used by traders for the purposes of hedging and speculation, appear to confirm this view, according to data from the CME Group’s FedWatch tool.

Investors have continued to cling to hopes for a late-year 2023 rate cut from the Fed, futures show, even as the Fed’s latest “dot plot,” released earlier this month, suggest senior central bankers don’t expect to cut rates until 2024.

Many investors expect stocks to bottom during the first half of 2023 as the Fed’s aggressive interest-rate hikes finally take their toll on the economy.

JPMorgan Chase & Co.’s

JPM,

Marko Kolanovic, who was one of the most bullish strategists on Wall Street heading into 2022, holds this view, as he confirmed to MarketWatch via email.

Morgan Stanley’s Michael Wilson, one of the few Wall Street equity strategists who anticipated this year’s crash, endorsed a similar view when he described 2023 as a “tale of two halves” in a research note dated Dec. 19. Wilson thinks the S&P 500 will find a bottom in the first quarter of 2023, creating a “terrific buying opportunity.”

Bulls and bears: wildly different outlooks

A look outside of major investment banks shows bulls and bears with dramatically different visions of how they expect next year to play out.

Tom Lee, head of research at Fundstrat Global Advisors, sees the S&P 500 advancing to 4,750 next year based on his expectation that inflation will continue to recede. Lee has burnished his reputation as a stock-market bull, even standing by his calls for stocks to continue to climb in frequent appearances on business television networks, like CNBC.

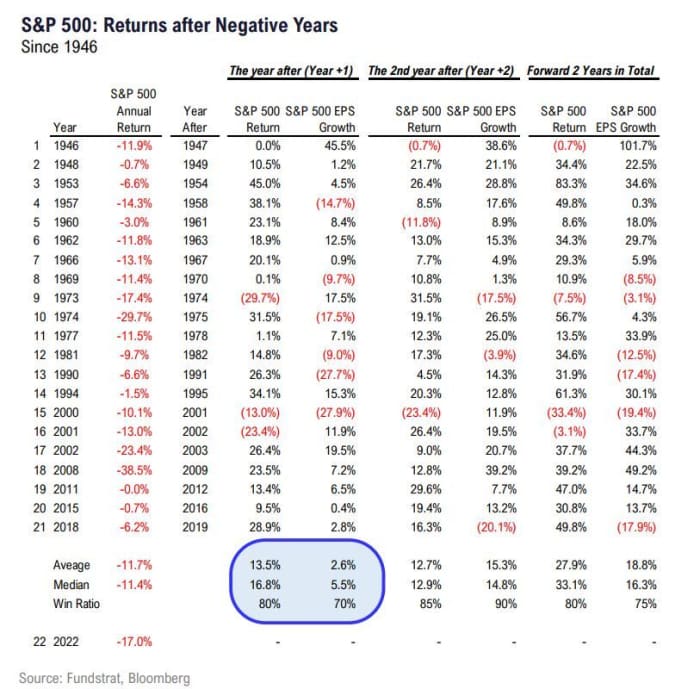

In a recent elaboration of his 2023 outlook, Lee noted that instances where U.S. stocks fall for two consecutive years have been rare since World War II.

What’s more, double-digit pullbacks, which look likely this year, often have been followed by particularly torrid rebounds, as the historical data show.

The S&P 500 has advanced 13.5%, on average, in the years following a pullback, according to Lee’s analysis of historical data going back to 1946.

FUNDSTRAT

On the other hand, stock-market bears like Chris Senyek, chief investment strategist at Wolfe Research, expect the pain in equities to persist next year. In a recent report, Senyek explained why he thinks the U.S. economy will crater next year, while inflation will remain stubbornly persistent, leading to “stagflation.”

A 35% pullback?

As a result, Senyek expects the S&P 500 to potentially fall by as much as 35% next year. A decline of that magnitude from Tuesday’s close would drive the S&P 500 to around 2,500, a level last touched in the wake of the March 2020 crash, according to FactSet.

“We believe that the amount of [monetary] tightening that’s already taken place is enough to push in the U.S. economy into a recession, and that U.S. real GDP growth will hit -2% to -3% on a [year-over-year] basis at some point in 2023,” Senyek said, in a note about his outlook.

The S&P 500 has fallen roughly 20% this year through Tuesday, while the Dow Jones Industrial Average

DJIA,

was down 10% and the Nasdaq Composite

COMP,

was off nearly 33%.