This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXNPEB610LQ_M.jpg

Investing.com — Stocks rallied to break a losing streak on Wednesday, as consumer confidence is strong and earnings beat expectations.

Investors have been wondering if a Santa rally would materialize after the markets headed into the holiday season on a down note. Fears about inflation and the Federal Reserve’s aggressive moves to stop it by raising interest rates have stoked concerns about a recession next year.

The Fed has signaled it intends to keep interest rates higher for longer, rather than a pause or pivot as many investors would have liked to see. But the pace of the rate increases softened this month to a half-percentage point and could soften further next year. The Fed has said its benchmark rate could rise above 5% before it’s finished, higher than some expected just a few months ago.

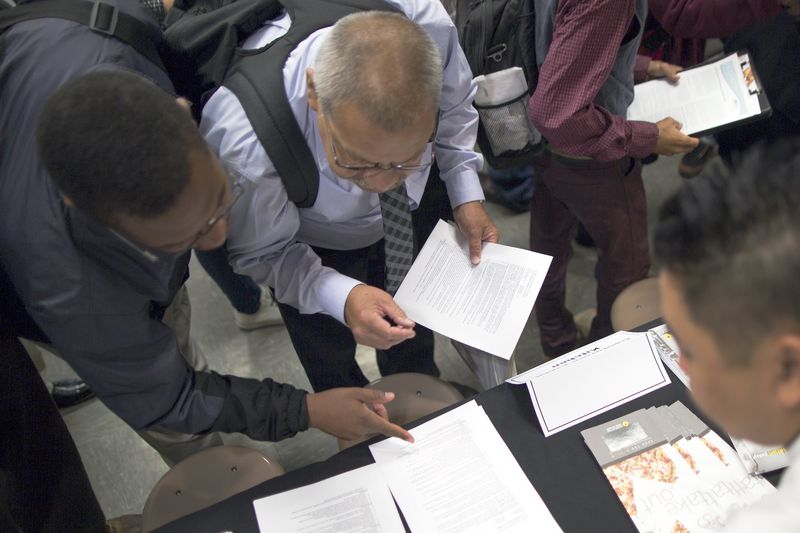

The central bank is also expecting gross domestic product growth to slow next year and unemployment to increase, though the labor market continues to remain tight.

Additional labor data is due out tomorrow, with the weekly unemployment claims, which are expected to rise slightly from the prior week.

Here are three things that could affect markets tomorrow:

1. GDP reading

Another print of third quarter gross domestic product is due out at 8:30 ET (13:30 GMT). Analysts expect it to remain the same as the last reading, at 2.9%.

2. Jobless claims

Initial jobless claims, due out around the same time, are expected to rise to 222,000 from 211,000 the prior week. Continuing claims are expected to rise to 1.68 million from 1.67 million.

3. CarMax earnings

The rental car market has softened considerably since the pandemic-fueled buying spree. CarMax Inc (NYSE:KMX) is expected to report earnings of 73 cents on revenue of $7.34 billion, and analysts will be listening for the outlook on sales and margins.