This post was originally published on this site

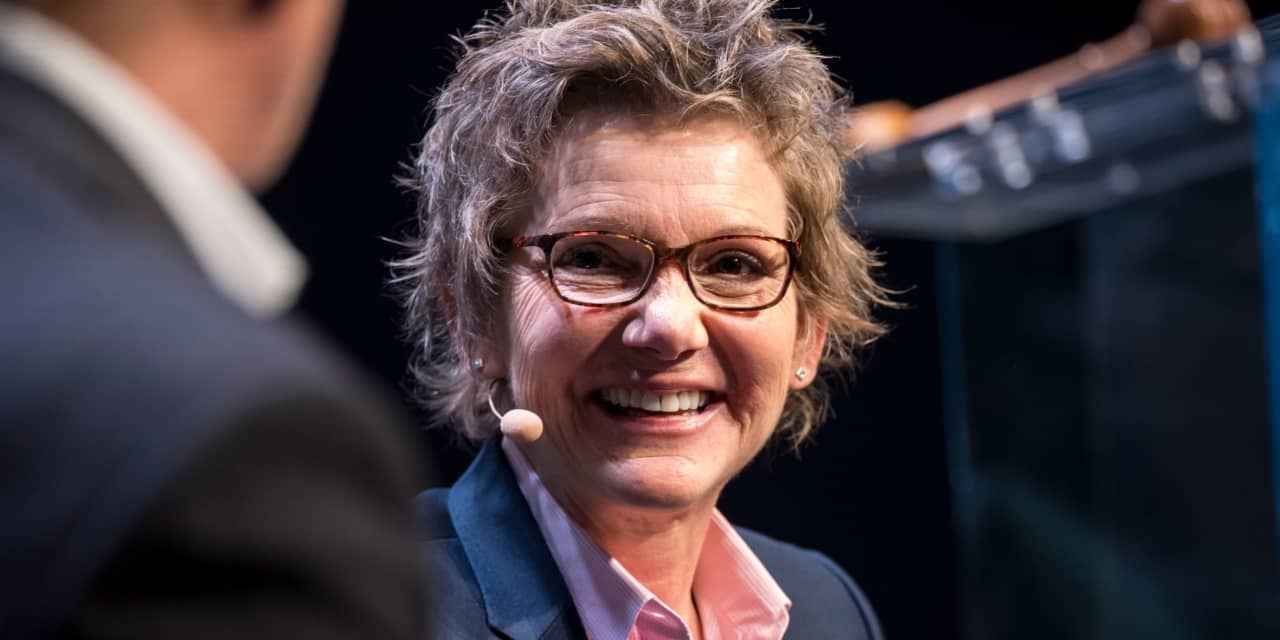

Financial market conditions seem much tighter than suggested by the actual level of the Federal Reserve’s benchmark interest rate, said San Francisco Fed President Mary Daly.

Citing new research from the her regional bank, Daly said Monday that tightness in markets is more akin to having a benchmark rate of around 6%. That is well above the actual level of 3.75%-4% that Daly said should only be “modestly” slowing the economy down.

Markets appear to be feeling an impact from the shrinking of the Fed’s balance sheet, or quantitative tightening. In addition, the market is paying attention to the central bank’s forward guidance about the need for higher rates, Daly said. She spoke to the Orange County Business Council and took questions from reporters afterward.

The Fed said earlier this month that it will keep raising rates until the level is “sufficiently” slowing the economy, in order to lower the high inflation rate.

Fed officials are debating what that level may be. Daly has said her most recent estimate would put the Fed’s benchmark rate around 5%.

The rate could go higher if incoming data on inflation stayed hot, she added.

St. Louis Fed President James Bullard said the rate could be in the range of 5%-7%.

Opinion: What Bullard got wrong about a 7% fed funds rate?

Daly said ignoring the actual impact of Fed rate policy on the economy would raise the chances of overtightening — leading to a recession.

“As we make decisions about further rate adjustments, it will be important to remain conscious of this gap between the federal funds rate and the tightening in financial markets. Ignoring it raises the chances of tightening too much,” Daly said.

The Fed could also overtighten if it doesn’t take into account “lags” from all the rate hikes so far this year.

The Fed has raised its benchmark rate to 3.75%-4% range. Rates were close to zero in March.

“We have to account for the fact that while financial markets react quickly to policy changes, the real economy takes longer to adjust. Overlooking this lag can make us think we have further to go when, in reality, we just have to wait for earlier actions to work their way through the economy,” Daly said.

Investors cheered when U.S. inflation slipped to 7.7% in October from 8.2% in the prior month. But Daly said it was “far too early to call this a turning point.”

Daly said she was looking at “core services and core goods” as the indicators for future inflation. Core rates strip out food and energy prices.

Overall, Daly said she was on the “hawkish” end of the spectrum of opinion among top Fed officials.

“I really want to make sure the job is well and fully done. Inflation is a regressive tax. It injures most the people least able to bear it. Ending early in hope that it will go away and we’ve done enough is not at all satisfying to me,” she said.

In a separate interview on CNBC, Cleveland Fed President Loretta Mester said the Fed has raised rates high enough that it can now slow down after four straight 0.75-percentage-point rate hikes.

“I think we can slow down from the 75 at the next meeting,” Mester said. But she added that the central bank was not thinking about pausing or stopping rate hikes.

“I don’t think we’re anywhere near stopping though,” she said.

Stocks

DJIA,

SPX,

closed lower on Monday. The yield on the 10-year Treasury note

TMUBMUSD10Y,

slipped to 3.83%.