This post was originally published on this site

Nvidia Corp. shares ticked higher in the extended session Wednesday after the chip maker’s expected exposure to a U.S. ban on certain tech sales to China did not prevent it from topping Wall Street revenue estimates.

Nvidia

NVDA,

shares rose 2% after hours, following a 4.5% decline in the regular session to close at $159.10.

Nvidia reported third-quarter net income of $680 million, or 27 cents a share, compared with $2.46 billion, or 97 cents a share, in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were 58 cents a share, compared with $1.17 a share in the year-ago period.

Revenue fell to $5.93 billion from $7.1 billion in the year-ago quarter as gaming sales slumped. Analysts had forecast 71 cents a share on revenue of $5.78 billion.

Data-center sales rose 31% to $3.83 billion, while gaming sales dropped 51% to $1.57 billion from a year ago. Analysts had forecast $1.42 billion in gaming sales and $3.72 billion in data-center sales.

“We are quickly adapting to the macro environment, correcting inventory levels and paving the way for new products,” said Jensen Huang, Nvidia’s founder and chief executive, in a statement. Last quarter, the company announced it took a $1.32 billion inventory charge.

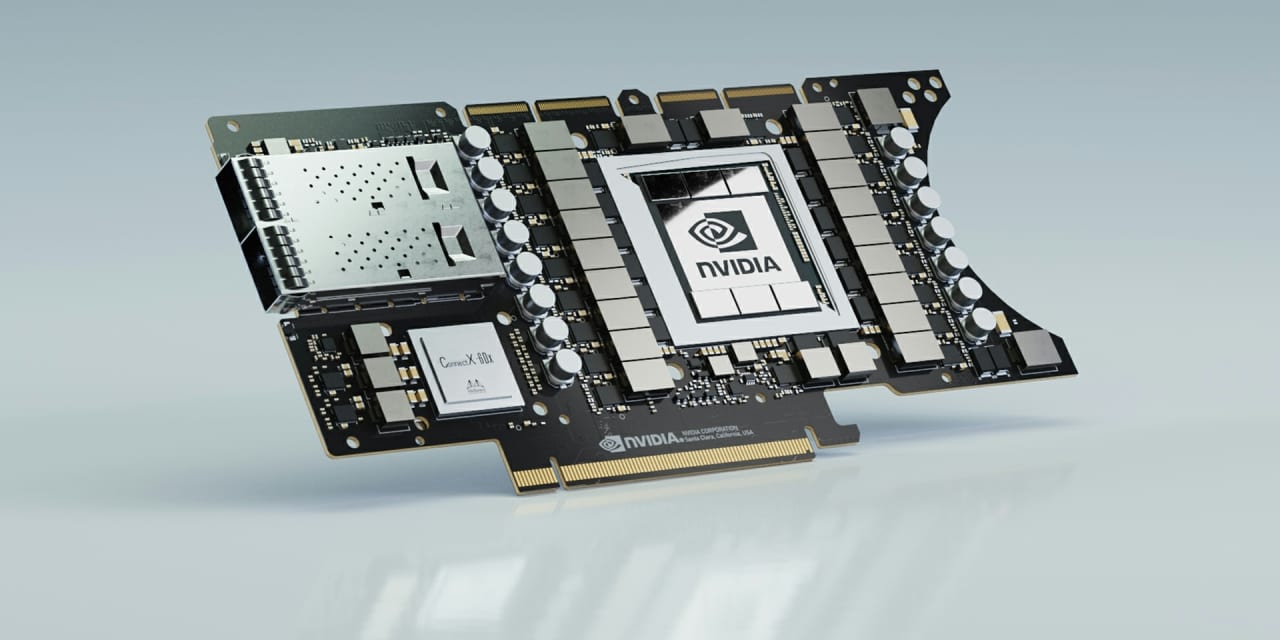

In late August, Nvidia had forecast third-quarter sales between $5.78 billion and $6.02 billion, which fell about $1 billion below what the Street was expecting at the time. That was before it estimated a possible $400 million in lost China sales, that Nvidia hopes to correct by selling a version of its A100 data-center chip called the A800 to China, which inhibits AI and supercomputing use and thus meets U.S. restrictions for sale.

“These restrictions impacted third-quarter revenue, with the decline largely offset by sales of alternative products into China,” said Colette Kress, Nvidia’s chief financial officer, in a statement.

For the fourth quarter, Nvidia forecast revenue of $5.88 billion to $6.12 billion, while analysts surveyed by FactSet, on average, have forecast earnings of 76 cents a share on revenue of $6.07 billion.

PC sales are seeing their steepest decline since data started being collected in the 1990s after a two-year surge, and spending on videogames and gear for them has also come back to earth. At the same time, drops in cryptocurrency prices have made crypto mining less profitable; Nvidia cards have been used extensively to mine for Ethereum

ETHUSD,

and other digital assets.

Nvidia has been slashing its outlook al year, sometimes twice with a quarter.

Earlier in August, Nvidia warned of a $1.4 billion revenue shortfall because of weak gaming sales. That was on top of the $500 million Nvidia pulled from its second-quarter revenue forecast because of the COVID lockdowns in China and the war in Ukraine.

Following that, analysts readjusted their estimates, settling on a consensus of $5.78 billion for the quarter, coming very close to the $5.57 billion Advanced Micro Devices Inc.

AMD,

reported for its third quarter. The last time AMD topped Nvidia in quarterly revenue was the third quarter of 2014, when AMD reported sales of $1.43 billion and Nvidia reported $1.23 billion, according to FactSet data.

Over the year, Nvidia shares have dropped 46%. In comparison, the PHLX Semiconductor Index

SOX,

is down 32% year to date, the S&P 500 index

SPX,

is down 17%, and the Nasdaq Composite Index

COMP,

is off 29%.