This post was originally published on this site

Midterm elections are great for the stock market, regardless of who wins. But the divided government that came out of this year’s is even more bullish.

Compelling seasonal factors are also telling us this is a good time to buy stocks. Here’s more detail, and eight companies to consider.

1. The midterm-election effect, part 1

It’s no secret there’s a low-key battle between the financial world and political sphere over who matters more. In a swipe at Washington, D.C., in this contest, Wall Street loves it when the Capitol is neutralized by divided power. When one party controls part of Congress and the other has the White House, the implied gridlock means politicians can do less damage, according to this logic.

“A Democratic president with a Republican Congress is the best setup that appears over the last 90 years,” says Patrick Nielsen, deputy general manager of MAPFRE AM, an investment group.

The market risk is that, given heightened political polarization, we get market-damaging battles over matters such as raising the debt ceiling or the use of fiscal stimulus during a recession, says Nielsen.

2. The midterm-election effect, part 2

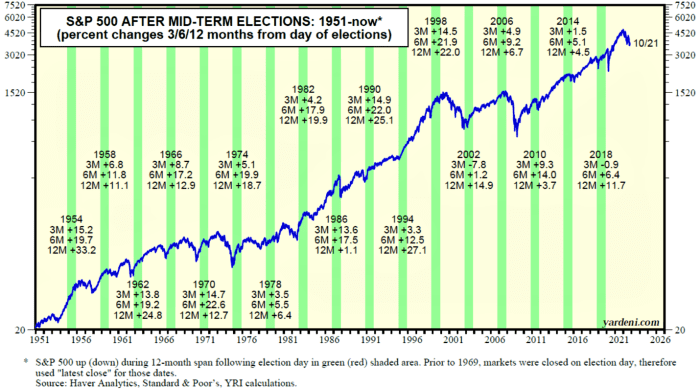

Historically, midterm elections set up nice rallies with phenomenal consistency. Since 1942, after midterm elections the S&P 500

SPX,

went up 7.6%, 14.1%, and 14.9% over the next three, six and 12 months, notes Ed Yardeni of Yardeni Research. That’s irrespective of the election outcome.

The two charts below show the history. The green- and red-shaded areas represent the 12 months following an election. The percentage market move during the three-, six- and 12-month time frames are written below the election year.

“In midterm election years, you normally see a major bottom in the fourth quarter,” says Paul Schatz, the founder and president of Heritage Capital. “The market is in a bottoming process now. It is hard to deny that. It could lead to a significant market rally.”

Here is more evidence of this bullish election-year effect. During the past 10 years, the CBOE Volatility Index

VIX,

declined 5% to 45% in November for an average drop of 20.4%, points out Lawrence McDonald of the Bear Traps Report. A declining VIX means investors are calming down, a mood shift that correlates with rising stock values. So far this November, the VIX is down 7%, so the effect may already be under way.

3. October is a bear market killer

“October has a reputation as being the biggest killer of bear markets,” says Schatz, at Heritage Capital. Twelve of the post-WWII bears died in October.

Why is this?

One reason might be that October is the tax-loss-selling deadline for institutional investors. My own theory, backed by some research conducted in both hemispheres, is that cold weather brings out a “prepare for harder times” mentality that has investors harvesting cash, just as humans have harvested food during autumn for eons.

Whatever the reason, the seasonal selloff creates bargains.

“There are more opportunities today than I have seen since the fourth quarter of 2008,” says Schatz.

I’m not a huge fan of technical analysis, but it’s interesting to note there was a bullish engulfing pattern on Oct. 13, which was the recent market low. In this pattern, a day’s trading range “engulfs” the prior day’s trading range, and it is bullish when it closes near the high of the range. Think of it as a final battle between the bulls and the bears in which the bulls win and the bears concede victory.

“The odds certainly favor a major low in the fourth quarter,” says Schatz, who also noticed this technical signal.

4. Santa Claus is real

The period of November to January is seasonally strong for the market. Since 1936, the S&P 500 has advanced 4.5% vs. an overall average three-month performance of 2.9%, the quantitative analysts at Bank of America tell us. What’s more, this timeframe has had negative returns only 24% of the time, the lowest of any three-month period other than October-December (19% of the time).

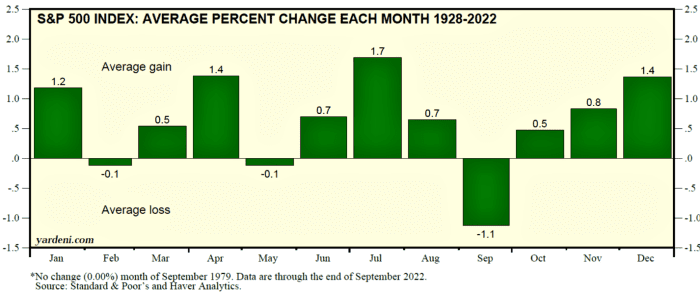

Yardeni finds that, since 1928, the S&P 500 was up 0.5%, 0.6% and 1.4% on average during October, November and December. “Yes, Virginia, there really is a Santa Claus rally,” he concludes.

This chart shows performance by month, since 1928, but it is more pronounced during midterm election years.

November is best month of the year for the Nasdaq

COMP,

during midterm election years, returning 3.5% since 1971. The six months from November through April have generated an average return of 7.5% on the Dow Jones Industrial Average

DJIA,

versus a 0.8% average gain from May through October.

What might prompt a rally

A rally isn’t farfetched, for three reasons.

1. Sentiment got extremely dark, as I wrote here. It’s usually better to buy when things look bleak, not when everything is rosy. That’s because the market is a forward-looking discounting mechanism. “The majority is almost always wrong at extremes, and we are at an extreme now,” says Schatz. “If people wait until they feel really good, the markets will be 20%-30% higher from here.”

2. Inflation will fall soon because upstream price gauges are all declining. This will have the Federal Reserve signaling it might back off on raising interest rates. You can see hints of this already, if you squint. While Fed Chairman Jerome Powell remains hawkish, Fed Vice Chair Lael Brainard has struck a more accommodating tone in speeches. “Brainard believes that the Fed may have done enough, or soon will do so, to bring inflation down, considering that the impact of cumulative tightening on the economy operates with lags,” says Yardeni. We will learn more about prices on Thursday when the consumer price index (CPI) comes out.

3. We may get a soft landing of the economy. While many people remain convinced we will go into a recession that could compress stock indices even more, that might not be the case. Goldman Sachs economist Jan Hatzius says there is still a “very plausible” chance that we avoid a recession despite the Fed’s aggressive tightening campaign. He puts the odds of recession over the next 12 months at 35%. Similarly, Yardeni puts the odds of a recession at 40%, and a soft landing at 60%.

Go long and wide

One of the simplest ways to invest, which is probably the most appropriate for a lot of people, is to dollar-cost-average into long-term positions in a broad basket of stocks. You can do this with far-reaching exchange traded funds (EFTs), such as the Schwab U.S. Broad Market ETF

SCHB,

iShares Core S&P Total U.S. Stock Market ETF

ITOT,

and SPDR Portfolio S&P 1500 Composite Stock Market ETF

SPTM,

If this is your strategy, step up your buying at times like this when sentiment is so dark.

Favor damaged goods

You might think that in troubled times like this, it’s best to buy companies with fortress balance sheets and excellent free cash flow. But this might be one of the worst things to do, says Schatz. Instead, the best performers are often found among the stocks hit the hardest. “What goes down the most rallies the most coming out of the bottom,” says Schatz.

Indeed, stocks destroyed by October tax-loss selling historically outperform, as you can see in this column.

Here’s an added twist to this theme, which I did not put in that column: The ones beaten down the most do the best. They post 3.6 percentage points of outperformance November-January vs. 1.8 percentage points for tax-loss selling candidates overall, says Bank of America.

Four names beaten down the most are two Bank of America “buy”-rated stocks: Match Group

MTCH,

and Caesars Entertainment

CZR,

; and chip leaders Nvidia

NVDA,

and Advanced Micro Devices

AMD,

Find the sidewinders

Schatz likes stocks that get hit hard but then at some point stop declining whenever the market overall plunges again. They resist subsequent waves of selling and instead trade sideways.

“It shows the sellers have been exhausted,” he says.

Stocks that he owns from this category include web-development platform Wix.Com

WIX,

and AbbVie

ABBV,

and Moderna

MRNA,

in biopharma.

Otherwise, avoid the leadership names from the prior bull market, meaning the FAANGs. One exception Schatz makes is Netflix

NFLX,

which has also resisted declines in market selloffs.

“I always love best-of-breed stocks that fall on hard times,” he says.

Otherwise, the rule is that when new bull markets emerge, so does new leadership. What might be the new leadership groups?

“Given where rates are and the fact that the yield curve will steepen, financials will qualify as a leadership group,” says Schatz.

They benefit from rising rates and a steepening yield curve. Materials stocks are another potential leadership group in the early stages of the next bull market because they are economically sensitive.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned CZR, NVDA and NFLX. Brush has suggested CZR, NVDA AMD and NFLX in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.