This post was originally published on this site

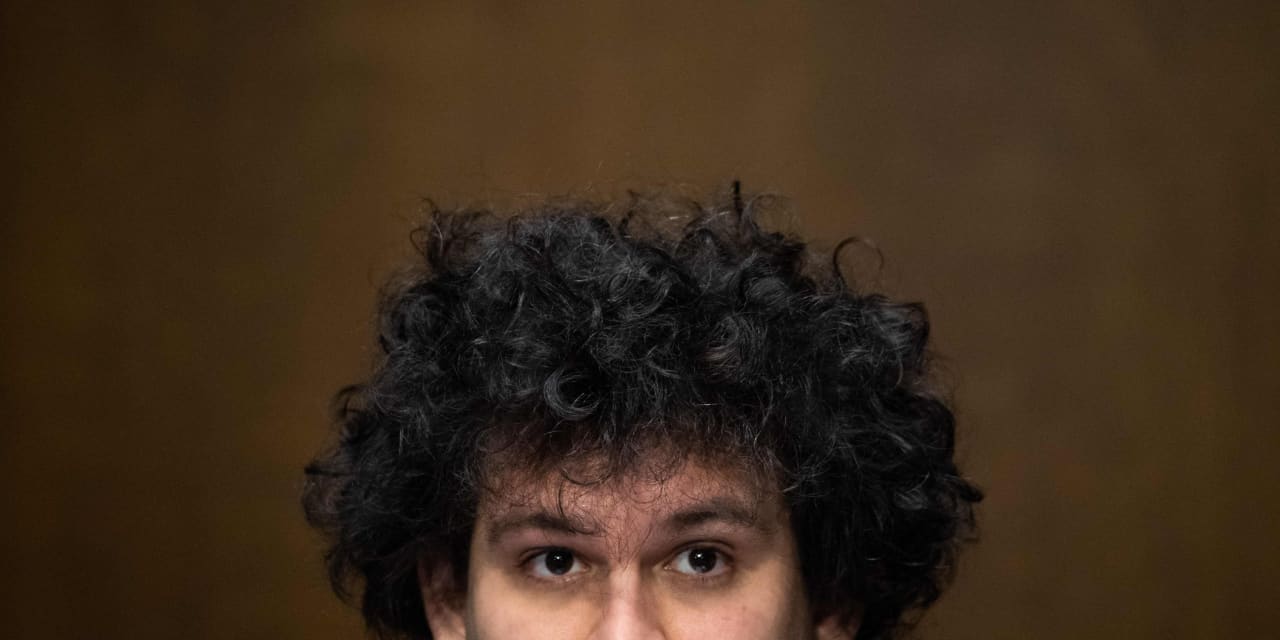

Sam Bankman-Fried, crypto billionaire and chief executive at digital asset exchange FTX, could see his net worth shrink by more than $13.6 billion if Binance’s proposed acquisition of FTX is completed, according to an estimate by Bloomberg.

Bankman-Fried was estimated to be worth $15.6 billion before the Binance takeover, according to Bloomberg Billionaires Index.

On Tuesday, Changpeng Zhao, co-founder and chief executive of Binance, said the exchange signed a letter of intent to acquire the non-U.S. assets of FTX, after the latter “asked for help” amid a liquidity crunch.

Read: Bitcoin falls to two-year low after crypto exchange Binance proposed to buy rival FTX

Terms of the deal were not disclosed, and representatives from Binance and FTX did not respond to MarketWatch’s request for comment on this story.

Bankman-Fried, a 30-year-old graduate from the Massachusetts Institute of Technology, amassed his fortune of billions quickly within just five years in crypto, through his digital asset trading house Alameda Research and exchange FTX. He has been referred by some industry participants as the crypto version of J.P. Morgan

JPM,

after his companies offered lines of credit or equity to some struggling firms like BlockFi and Voyager at various times this year.

Also read: Mark Zuckerberg says he’s accountable for missteps as Meta prepares for mass layoffs

Of Bankman-Fried’s more than $15.6 billion in wealth, $6.22 billion comes from FTX, the company that may soon be sold to Binance, according to Bloomberg Billionaires Index. His stake in Alameda was valued at around $7.4 billion, according to Bloomberg.

All existing FTX investors, including Bankman-Fried, Softbank Vision Fund and Temasek, among others, could be wiped out by Binance’s takeover, according to Bloomberg. Meanwhile, as FTX’s liquidity problems stemmed from its connection with Alameda research, Bankman-Fried’s stake in the latter might be worthless as well, Bloomberg noted.

Also see: The 5 most influential crypto market players in the year when $2 trillion was wiped out

Bankman-Fried also has about $1.99 billion of his wealth tied to FTX’s U.S. arm, but that branch of FTX is not part of this most recent deal with Binance. It is unclear how much impact the Binance deal would has on the valuation of FTX.US.

Bankman-Fried is also one of the biggest stakeholders in financial services company Robinhood Markets Inc.

HOOD,

accounting for more than $677 million of his net worth. He has roughly $650 million liabilities, Bloomberg noted.

FTX’s native token FTT went down more than 75% over the past 24 hours to around $5.42, according to CoinMarketCap data.

Zhao — a Chinese-Canadian executive commonly identified as “CZ” — founded Binance in 2017. The company has grown into the world’s largest crypto exchange by 24-hour trading volume, compared with FTX, which ranks third, according to CoinMarketCap.

“Clearly FTX did not go into this deal with Binance from a position of strength,” according to Ryan Shea, crypto economist at Trakx.

The news around FTX comes amid a prolonged crypto winter. Bitcoin

BTCUSD,

price briefly dropped its lowest level in two years on Tuesday. The price for ether

ETHUSD,

was down 15% on Tuesday, and is down 60% over the past year.