This post was originally published on this site

Wall Street stocks are poised for a bounce to start a new week, with politics one spotlight as U.S. midterm elections are set to get under way.

Many expect a split Congress and political deadlock for two years, which isn’t necessarily bad for markets, which tend to prefer a divided government. Neil Wilson, chief strategist at Markets.com, said markets have done better 17 out of 19 times postwar in the half-year after than half-year before.

Read: For EVs, solar tax breaks and climate change, here are the midterm elections that matter

China is another focus, and Wall Street got a little boost late last week on rumors of a loosening of the country’s COVID-zero policy, though officials denied that was happening over the weekend. Citing sources, The Wall Street Journal reported Monday that Chinese leaders are mulling reopening steps, but slowly and with no time frame.

China’s no-tolerance COVID rules have been tough on the country’s markets and Wall Street at times. Markets remain hopeful that Beijing will bend eventually, that’s as we see those COVID policies interfering with Apple’s ability to sell more big dollar phones in time for Christmas (see The Buzz).

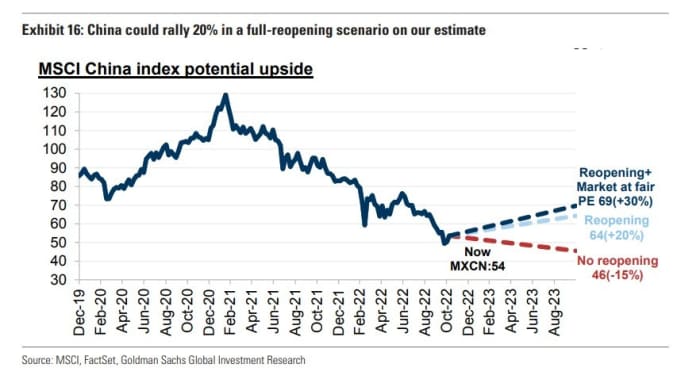

Start your engines now for the big China reopening, says our call of the day from Goldman Sachs, which sees the country’s stock markets rising as much as 20% once the big reopening comes. “Cross-country empirical analysis shows that equity markets tend to pre-trade reopening about a month in advance and the positive momentum typically lasts for 2-3 months,” said a team of strategists led by Kinger Lau.

The note was written with the MSCI China index at 54 — so it includes the 11% gain last week.

They see steep economic costs whittling away at the government’s resolve, with fresh data showing a surprise fall in October exports for China.

“Reported cases are rising but more signs of COVID policy relaxation have been made available post the Party Congress, and our economists expect China could start to reopen in 2Q23 on political and public health considerations,” they said.

Like the rest of the world, the Omicron variant has been tough on President Xi Jinping’s government, with cities making up 50% of the country’s economy under some restrictions as of Nov. 4, points out Goldman. They estimate containment moves have knocked China GDP some 4% to 5% from trend levels.

And while U.S. markets are stuck in worries about Fed tightening, China may be eager to keep stimulating to recover from its COVID problems. The Hang Seng

HSI,

has lost 29% so far this year, versus a 20% drop for the S&P 500

SPX,

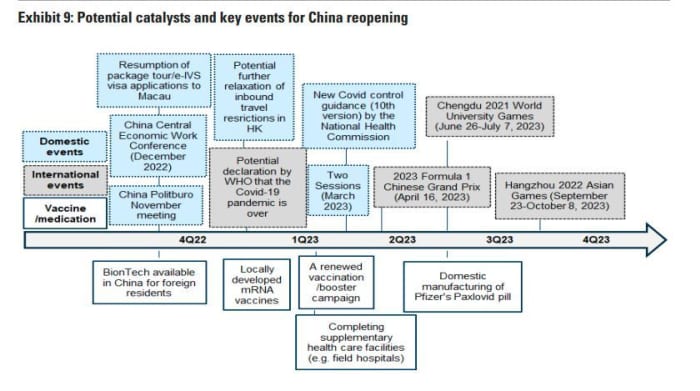

Goldman is encouraged as well by the planned rollout of CanSino’s inhalable vaccine that boosted China stocks a few days ago, and BioNTech’s

BNTX,

vaccine that has been okayed for foreign residents and could see further rollout.

Goldman is also encouraged by more international flights to China, and some high-profile global events scheduled for the second half of next year onward. If China meets a few conditions, such as higher elderly vaccinations and more access to affordable and effective COVID pills, next spring could be when we see the big exit from zero COVID rules.

Goldman Sachs

As for what to invest in, Goldman sees reopening benefits for more for the offshore market, than A shares, notably hotels, catering and entertainment sectors. Sands China

1928,

Yum China

9987,

YUMC,

Trip.com

9961,

TCOM,

Galaxy Entertainment

27,

and China Tourism Group Duty Free

601888,

are among a few names they like.

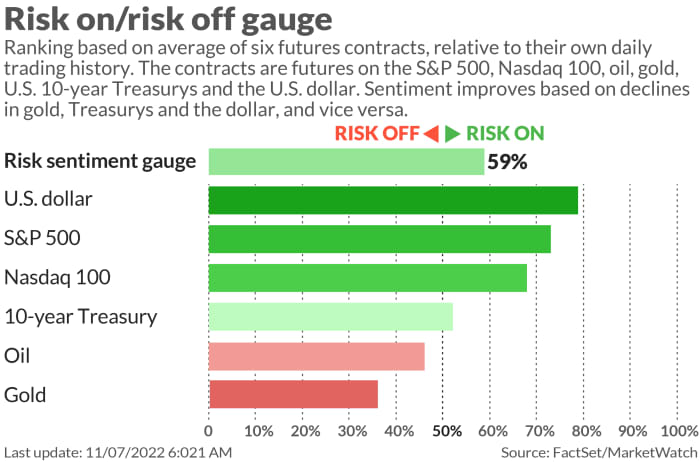

The markets

MarketWatch

Stock futures

ES00,

NQ00,

are higher, with bond yields

TY00,

TMUBMUSD02Y,

easing off along with the dollar

DXY,

Oil prices

CL.1,

are softer, while natural-gas prices

NG00,

are sharply higher. In Asia, Hong Kong stocks

HSI,

led gains across the broader region.

The buzz

The bulk of earnings news will come after the close of markets, when Take-Two

TTWO,

ActivisionBlizzard

ATVI,

Lyft

LYFT,

TripAdvisor

TRIP,

and a few others will report.

Apple

AAPL,

said it expects lower shipments of its iPhone 14 Pro and iPhone 14 Pro Max devices, as COVID-19 issues hamper China production. Softer demand will also lead to 3 million fewer iPhones produced, Bloomberg reports.

Thousands of workers at Facebook parent Meta

META,

could be laid off as soon as Wednesday.

CPI inflation and consumer sentiment are in the data spotlight this week. For Monday, we’ll get consumer credit and an appearance by Richmond Fed President Tom Barkin, who will speak on inflation at 6 p.m. Eastern.

Read: Why a big labor shortage is adding to high inflation in the U.S.

Best of the web

Billions in capital calls are threatening havoc for global stocks and bonds

COP27? Key issues for markets to watch as U.N. climate talks kick off in Egypt

Ukrainians get ready for the harshest winter in decades, without power.

The chart

Watch out for new highs in the enegy sector, says Larry Tentarelli, editor and publisher of the Blue Chip Daily Trend Report. Specifically, he’s looking at the SPDR S&P Oil & Gas Exploration & Production ETF

XOP,

which he notes broke out to a 20-week closing high on Friday.

“(XOP) is trending higher, above rising weekly moving averages, and could be setting up for a test of new highs. This can be a volatile sector, as well as crude oil itself, so near-term consolidation wouldn’t be unexpected. On any major pullbacks, I’d want to see the 125-130 level hold,” Tentarelli told clients on his blog.

Blue Chip Daily Trend Report

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

META, |

Meta Platforms |

|

AMZN, |

Amazon.com |

|

MULN, |

Mullen Automotive |

|

BBBY, |

Bed Bath & Beyond |

|

DWAC, |

Digital World Acquisition |

Random reads

World Cup-bound referee hands out a record 10 red cards in heated Brazil final

Cobra dies after being bitten by 8-year old boy.

A record number of Americans are moving to Mexico.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton